UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

For the fiscal year ended December 31, 2019

OR

For the transition period from to

Commission file number: 001-36336

(Exact name of registrant as specified in its charter)

(State of organization) | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices) | (Zip Code) | |

(214 ) 953-9500

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Trading Symbol | Name of Exchange on which Registered | ||

Liability Company Interests | ||||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act. (Check one):

Large accelerated filer | ☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company | ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common units representing limited liability company interests held by non-affiliates of the registrant was approximately $2.7 billion on June 30, 2019, based on $10.09 per unit, the closing price of the common units as reported on the New York Stock Exchange on such date.

At February 19, 2020, there were 488,445,794 common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

TABLE OF CONTENTS

Item | Description | Page | ||

PART I | ||||

1. | ||||

1A. | ||||

1B. | ||||

2. | ||||

3. | ||||

4. | ||||

PART II | ||||

5. | ||||

6. | ||||

7. | ||||

7A. | ||||

8. | ||||

9. | ||||

9A. | ||||

9B. | ||||

PART III | ||||

10. | ||||

11. | ||||

12. | ||||

13. | ||||

14. | ||||

PART IV | ||||

15. | ||||

2

DEFINITIONS

The following terms as defined are used in this document:

Defined Term | Definition | |

/d | Per day. | |

2014 EDA | Equity Distribution Agreement entered into by ENLK in November 2014 with BMO Capital Markets Corp., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Citigroup Global Markets Inc., Jefferies LLC, Raymond James & Associates, Inc. and RBC Capital Markets, LLC to sell up to $350.0 million in aggregate gross sales of ENLK’s common units from time to time through an “at the market” equity offering program. | |

2014 Plan | ENLC’s 2014 Long-Term Incentive Plan. | |

2017 EDA | Equity Distribution Agreement entered into by ENLK in August 2017 with UBS Securities LLC, Barclays Capital Inc., BMO Capital Markets Corp., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Citigroup Global Markets Inc., Jefferies LLC, Mizuho Securities USA LLC, RBC Capital Markets, LLC, SunTrust Robinson Humphrey, Inc., and Wells Fargo Securities, LLC (collectively, the “ENLK Sales Agents”) to sell up to $600.0 million in aggregate gross sales of ENLK’s common units from time to time through an “at the market” equity offering program. | |

AMZ | Alerian MLP Index for Master Limited Partnerships. | |

ASC | The FASB Accounting Standards Codification. | |

ASC 606 | ASC 606, Revenue from Contracts with Customers. | |

ASC 842 | ASC 842, Leases. | |

Ascension JV | Ascension Pipeline Company, LLC, a joint venture between a subsidiary of ENLK and a subsidiary of Marathon Petroleum Corporation in which ENLK owns a 50% interest and Marathon Petroleum Corporation owns a 50% interest. The Ascension JV, which began operations in April 2017, owns an NGL pipeline that connects ENLK’s Riverside fractionator to Marathon Petroleum Corporation’s Garyville refinery. | |

ASU | The FASB Accounting Standards Update. | |

Avenger | Avenger crude oil gathering system, a crude oil gathering system in the northern Delaware Basin. | |

Bbls | Barrels. | |

Bcf | Billion cubic feet. | |

Black Coyote | Black Coyote crude oil gathering system, a crude oil gathering system in the STACK. | |

BLM | Bureau of Land Management. | |

Cedar Cove JV | Cedar Cove Midstream LLC, a joint venture between a subsidiary of ENLK and a subsidiary of Kinder Morgan, Inc. in which ENLK owns a 30% interest and Kinder Morgan, Inc. owns a 70% interest. The Cedar Cove JV, which was formed in November 2016, owns gathering and compression assets in Blaine County, Oklahoma, located in the STACK play. | |

CFTC | U.S. Commodity Futures Trading Commission. | |

CNOW | Central Northern Oklahoma Woodford Shale. | |

CO2 | Carbon dioxide. | |

Commission | U.S. Securities and Exchange Commission. | |

Consolidated Credit Facility | A $1.75 billion unsecured revolving credit facility entered into by ENLC that matures on January 25, 2024, which includes a $500.0 million letter of credit subfacility. The Consolidated Credit Facility was available upon closing of the Merger and is guaranteed by ENLK. | |

Delaware Basin JV | Delaware G&P LLC, a joint venture between a subsidiary of ENLK and an affiliate of NGP in which ENLK owns a 50.1% interest and NGP owns a 49.9% interest. The Delaware Basin JV, which was formed in August 2016, owns the Lobo processing facilities located in the Delaware Basin in Texas. | |

Devon | Devon Energy Corporation. | |

ECP System | EnLink Crude Purchasing System. The ECP System includes assets that were acquired through the acquisition of LPC Crude Oil Marketing LLC in January 2015. | |

Enfield | Enfield Holdings, L.P. | |

ENLC | EnLink Midstream, LLC. | |

ENLC Class C Common Units | A class of non-economic ENLC common units issued to Enfield immediately prior to the Merger equal to the number of Series B Preferred Units held by Enfield immediately prior to the effective time of the Merger, in order to provide Enfield with certain voting rights with respect to ENLC. | |

ENLC Credit Facility | A $250.0 million secured revolving credit facility entered into by ENLC that would have matured on March 7, 2019, which included a $125.0 million letter of credit subfacility. The ENLC Credit Facility was terminated on January 25, 2019 in connection with the consummation of the Merger. | |

3

ENLC EDA | Equity Distribution Agreement entered into by ENLC in February 2019 with RBC Capital Markets, LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Barclays Capital Inc., BMO Capital Markets Corp., Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, J.P. Morgan Securities LLC, Jefferies LLC, Mizuho Securities USA LLC, MUFG Securities Americas Inc., SunTrust Robinson Humphrey, Inc., and Wells Fargo Securities, LLC (collectively, the “ENLC Sales Agents”) to sell up to $400.0 million in aggregate gross sales of ENLC common units from time to time through an “at the market” equity offering program. | |

ENLK | EnLink Midstream Partners, LP or, when applicable, EnLink Midstream Partners, LP together with its consolidated subsidiaries. Also referred to as the “Partnership.” | |

ENLK Credit Facility | A $1.5 billion unsecured revolving credit facility entered into by ENLK that would have matured on March 6, 2020, which included a $500.0 million letter of credit subfacility. The ENLK Credit Facility was terminated on January 25, 2019 in connection with the consummation of the Merger. | |

EOGP | EnLink Oklahoma Gas Processing, LP or EnLink Oklahoma Gas Processing, LP together with, when applicable, its consolidated subsidiaries. Since January 31, 2019, EOGP has been a wholly-owned subsidiary of the Operating Partnership. | |

FASB | Financial Accounting Standards Board. | |

FERC | Federal Energy Regulatory Commission. | |

GAAP | Generally accepted accounting principles in the United States of America. | |

Gal | Gallons. | |

GCF | Gulf Coast Fractionators, which owns an NGL fractionator in Mont Belvieu, Texas. ENLK owns 38.75% of GCF. | |

General Partner | EnLink Midstream GP, LLC, the general partner of ENLK, which owns a 0.4% general partner interest in ENLK. Prior to the effective time of the Merger, the General Partner also owned all of the incentive distribution rights in ENLK. | |

GHG | Greenhouse gas. | |

GIP | Global Infrastructure Management, LLC, an independent infrastructure fund manager, itself, its affiliates, or managed fund vehicles, including GIP III Stetson I, L.P., GIP III Stetson II, L.P., and their affiliates. | |

GIP Transaction | On July 18, 2018, subsidiaries of Devon closed a transaction to sell all of their equity interests in ENLK, ENLC, and the Managing Member to GIP. | |

Goldman Sachs | Goldman Sachs Group, Inc. | |

GP Plan | The General Partner’s Long-Term Incentive Plan. | |

Greater Chickadee | Crude oil gathering system in Upton and Midland counties, Texas in the Permian Basin. | |

Gross Operating Margin | Revenue less cost of sales. Gross Operating Margin is a non-GAAP financial measure. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for other information. | |

HEP | Howard Energy Partners, LP. ENLK sold its 31% ownership interest in HEP in March 2017. | |

ISDAs | International Swaps and Derivatives Association Agreements. | |

Managing Member | ENLC’s managing member, EnLink Midstream Manager, LLC. | |

Mcf | Thousand cubic feet. | |

MEGA system | Midland Energy Gathering Area system in Midland, Martin, and Glasscock counties, Texas. | |

Merger | On January 25, 2019, NOLA Merger Sub merged with and into ENLK with ENLK continuing as the surviving entity and a subsidiary of ENLC. | |

Merger Agreement | The Agreement and Plan of Merger, dated as of October 21, 2018, by and among ENLK, the General Partner, ENLC, the Managing Member, and NOLA Merger Sub related to the Merger. | |

MMbbls | Million barrels. | |

MMbtu | Million British thermal units. | |

MMcf | Million cubic feet. | |

MVC | Minimum volume commitment. | |

NGL | Natural gas liquid. | |

NGP | NGP Natural Resources XI, LP. | |

NOLA Merger Sub | NOLA Merger Sub, LLC, previously a wholly-owned subsidiary of ENLC prior to the Merger. | |

NYSE | New York Stock Exchange. | |

Operating Partnership | EnLink Midstream Operating, LP, a Delaware limited partnership and wholly-owned subsidiary of ENLK. | |

ORV | ENLK’s Ohio River Valley crude oil, condensate stabilization, natural gas compression, and brine disposal assets in the Utica and Marcellus shales. | |

OTC | Over-the-counter. | |

Permian Basin | A large sedimentary basin that includes the Midland and Delaware Basins primarily in West Texas and New Mexico. | |

4

POL contracts | Percentage-of-liquids contracts. | |

POP contracts | Percentage-of-proceeds contracts. | |

Redbud | Redbud crude oil gathering system, a crude oil gathering system in the STACK. | |

Series B Preferred Unit | ENLK’s Series B Cumulative Convertible Preferred Unit. | |

Series C Preferred Unit | ENLK’s Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit. | |

STACK | Sooner Trend Anadarko Basin Canadian and Kingfisher Counties in Oklahoma. | |

Term Loan | An $850.0 million term loan entered into by ENLK on December 11, 2018 with Bank of America, N.A., as Administrative Agent, Bank of Montreal and Royal Bank of Canada, as Co-Syndication Agents, Citibank, N.A. and Wells Fargo Bank, National Association, as Co-Documentation Agents, and the lenders party thereto, which ENLC assumed in connection with the Merger and the obligations of which ENLK guarantees. | |

Thunderbird Plant | A gas processing plant in Central Oklahoma. | |

Tiger Plant | A gas processing plant in the Delaware Basin. | |

TPG | TPG Global, LLC. | |

VEX | ENLK’s Victoria Express Pipeline and related truck terminal and storage assets located in the Eagle Ford Shale in South Texas. | |

White Star | White Star Petroleum, LLC. | |

Capacity volumes for our facilities are measured based on physical volume and stated in cubic feet (“Bcf”, “Mcf,” or “MMcf”). Throughput volumes are measured based on energy content and stated in British thermal units (“Btu” or “MMBtu”). A volume of capacity of 100 MMcf correlates to an approximate energy content of 100,000 MMBtu, although this correlation will vary depending on the composition of natural gas and is typically higher for unprocessed gas, which contains a higher concentration of NGLs. Fractionated volumes are measured based on physical volumes and stated in gallons. Crude oil, condensate, and brine services volumes are measured based on physical volume and stated in barrels (“Bbls”).

5

ENLINK MIDSTREAM, LLC

PART I

Item 1. Business

General

ENLC is a Delaware limited liability company formed in October 2013. EnLink Midstream, LLC common units are traded on the NYSE under the symbol “ENLC.” Our executive offices are located at 1722 Routh Street, Suite 1300, Dallas, Texas 75201, and our telephone number is (214) 953-9500. Our Internet address is www.enlink.com. We post the following filings in the “Investors” section of our website as soon as reasonably practicable after they are electronically filed with or furnished to the Commission: our Annual Reports on Form 10-K; our quarterly reports on Form 10-Q; our current reports on Form 8-K; and any amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings on our website are available free of charge. Additionally, filings are available on the Commission’s website (www.sec.gov). In this report, the terms “Company” or “Registrant” as well as the terms “ENLC,” “our,” “we,” and “us” or like terms are sometimes used as references to EnLink Midstream, LLC itself or EnLink Midstream, LLC and its consolidated subsidiaries, including ENLK.

ENLK is a Delaware limited partnership formed in 2002. EnLink Midstream GP, LLC, a Delaware limited liability company and our wholly-owned subsidiary, is ENLK’s general partner. The General Partner manages ENLK’s operations and activities. ENLC owns all of ENLK’s common units and also owns all of the membership interests of the General Partner. References in this report to “EnLink Midstream Partners, LP,” the “Partnership,” “ENLK,” or like terms refer to EnLink Midstream Partners, LP itself or EnLink Midstream Partners, LP together with its consolidated subsidiaries, including EnLink Midstream Operating, LP.

Devon Transaction

In 2014, we completed a series of transactions with Devon pursuant to which Devon contributed certain subsidiaries and assets to us in exchange for a majority interest in us (the “Devon Transaction”).

GIP Transaction

On July 18, 2018, subsidiaries of Devon closed a transaction to sell all of their equity interests in ENLK, ENLC, and the Managing Member to GIP. As a result of the transaction, GIP acquired control of (i) the Managing Member, (ii) ENLC, and (iii) ENLK, as a result of ENLC’s ownership of the General Partner. See “Item 8. Financial Statements and Supplementary Data—Note 1” for more information on the GIP Transaction.

Simplification of the Corporate Structure

On January 25, 2019, we completed the Merger, an internal reorganization pursuant to which ENLC owns all of the outstanding common units of ENLK. As a result of the Merger:

• | Each issued and outstanding ENLK common unit (except for ENLK common units held by ENLC and its subsidiaries) was converted into 1.15 ENLC common units, which resulted in the issuance of 304,822,035 ENLC common units. |

• | The General Partner’s incentive distribution rights in ENLK were eliminated. |

• | Certain terms of the Series B Preferred Units were modified pursuant to an amended partnership agreement of ENLK. See “Item 8. Financial Statements and Supplementary Data—Note 8” for additional information regarding the modified terms of the Series B Preferred Units. |

• | ENLC issued to Enfield, the current holder of the Series B Preferred Units, for no additional consideration, ENLC Class C Common Units equal to the number of Series B Preferred Units held by Enfield immediately prior to the effective time of the Merger, in order to provide Enfield with certain voting rights with respect to ENLC. ENLC also agreed to issue an additional ENLC Class C Common Unit to the applicable holder of each Series B Preferred Unit for |

6

each additional Series B Preferred Unit issued by ENLK in quarterly in-kind distributions. In addition, for each Series B Preferred Unit that is exchanged into an ENLC common unit, an ENLC Class C Common Unit will be canceled.

• | The Series C Preferred Units and all of ENLK’s then-existing senior notes continue to be issued and outstanding following the Merger. |

• | Each unit-based award issued and outstanding immediately prior to the effective time of the Merger under the GP Plan was converted into 1.15 awards with respect to ENLC common units with substantially similar terms as were in effect immediately prior to the effective time. |

• | Each unit-based award with performance-based vesting conditions issued and outstanding immediately prior to the effective time of the Merger under the GP Plan and the 2014 Plan was modified such that the performance metric for any then outstanding performance award relates (on a weighted average basis) to (i) the combined performance of ENLC and ENLK for periods preceding the effective time of the Merger and (ii) the performance of ENLC for periods on and after the effective time of the Merger. |

• | ENLC assumed the outstanding debt under the Term Loan and ENLK became a guarantor thereof. See “Item 8. Financial Statements and Supplementary Data—Note 6” for additional information regarding the Term Loan. |

• | We refinanced our existing revolving credit facilities at ENLK and ENLC. In connection with the Merger, we entered into the Consolidated Credit Facility, with respect to which ENLK is a guarantor. See “Item 8. Financial Statements and Supplementary Data—Note 6” for additional information regarding the Consolidated Credit Facility. |

• | We were required to allocate the goodwill in our Corporate reporting unit previously associated with the incentive distribution rights in ENLK granted to the General Partner which were created in connection with the Devon Transaction, to the Permian, North Texas, Oklahoma, and Louisiana reporting units. See “Item 8. Financial Statements and Supplementary Data—Note 3” for more information on this transaction. |

• | We reduced our deferred tax liability by $399.0 million related to ENLC’s step-up in basis of ENLK’s underlying assets with the offsetting credit in members’ equity. See “Item 8. Financial Statements and Supplementary Data—Note 7” for more information on the deferred tax liabilities. |

7

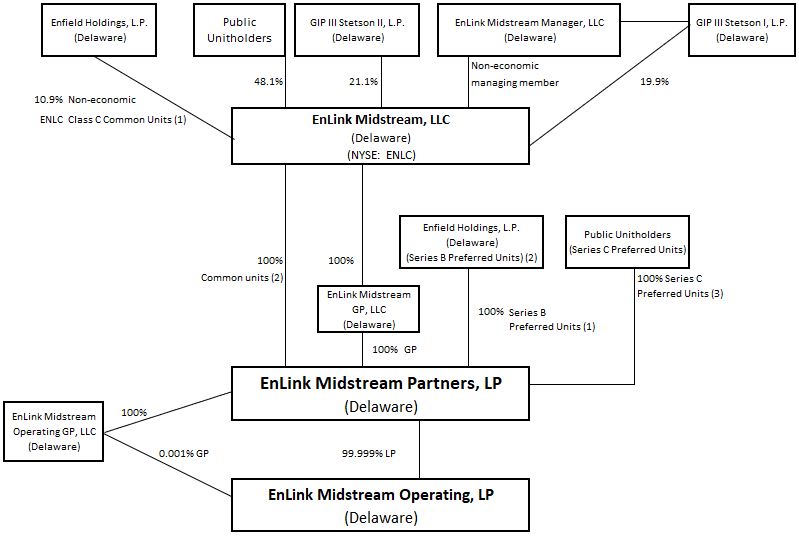

The following diagram depicts our organization and ownership as of December 31, 2019:

____________________________

(1) | Series B Preferred Units are exchangeable into ENLC common units on a 1-for-1.15 basis, subject to certain adjustments. Upon the exchange of any Series B Preferred Units into ENLC common units, an equal number of the ENLC Class C Common Units will be canceled. |

(2) | All ENLK common units are held by ENLC. The Series B Preferred Units are entitled to vote, on a one-for-one basis (subject to certain adjustments) as a single class with ENLC, on all matters that require approval of the ENLK unitholders. |

(3) | Series C Preferred Units are perpetual preferred units that are not convertible into other equity interests, and therefore, are not factored into the ENLK ownership calculations for the limited partner and general partner ownership percentages presented. |

Our Operations

We primarily focus on providing midstream energy services, including:

• | gathering, compressing, treating, processing, transporting, storing, and selling natural gas; |

• | fractionating, transporting, storing, and selling NGLs; and |

• | gathering, transporting, stabilizing, storing, trans-loading, and selling crude oil and condensate, in addition to brine disposal services. |

Our midstream energy asset network includes approximately 12,000 miles of pipelines, 21 natural gas processing plants with approximately 5.3 Bcf/d of processing capacity, seven fractionators with approximately 290,000 Bbls/d of fractionation capacity, barge and rail terminals, product storage facilities, purchasing and marketing capabilities, brine disposal wells, a crude oil trucking fleet, and equity investments in certain joint ventures. Our operations are based in the United States, and our sales are derived primarily from domestic customers.

Our natural gas business includes connecting the wells of producers in our market areas to our gathering systems. Our gathering systems consist of networks of pipelines that collect natural gas from points at or near producing wells and transport it to our processing plants or to larger pipelines for further transmission. We operate processing plants that remove NGLs from the natural gas stream that is transported to the processing plants by our own gathering systems or by third-party pipelines. In

8

conjunction with our gathering and processing business, we may purchase natural gas and NGLs from producers and other supply sources and sell that natural gas or NGLs to utilities, industrial consumers, marketers, and pipelines. Our transmission pipelines receive natural gas from our gathering systems and from third-party gathering and transmission systems and deliver natural gas to industrial end-users, utilities, and other pipelines.

Our fractionators separate NGLs into separate purity products, including ethane, propane, iso-butane, normal butane, and natural gasoline. Our fractionators receive NGLs primarily through our transmission lines that transport NGLs from East Texas and from our South Louisiana processing plants. Our fractionators also have the capability to receive NGLs by truck or rail terminals. We also have agreements pursuant to which third parties transport NGLs from our West Texas and Central Oklahoma operations to our NGL transmission lines that then transport the NGLs to our fractionators. In addition, we have NGL storage capacity to provide storage for customers.

Our crude oil and condensate business includes the gathering and transmission of crude oil and condensate via pipelines, barges, rail, and trucks, in addition to condensate stabilization and brine disposal. We also purchase crude oil and condensate from producers and other supply sources and sell that crude oil and condensate through our terminal facilities to various markets.

Across our businesses, we primarily earn our fees through various fee-based contractual arrangements, which include stated fee-only contract arrangements or arrangements with fee-based components where we purchase and resell commodities in connection with providing the related service and earn a net margin as our fee. We earn our net margin under our purchase and resell contract arrangements primarily as a result of stated service-related fees that are deducted from the price of the commodities purchased. While our transactions vary in form, the essential element of most of our transactions is the use of our assets to transport a product or provide a processed product to an end-user or marketer at the tailgate of the plant, pipeline, barge, truck, or rail terminal.

Effective January 1, 2019, we changed our reportable operating segments to reflect how we currently make financial decisions and allocate resources. Prior to January 1, 2019, our reportable operating segments consisted of the following: (i) natural gas gathering, processing, transmission, and fractionation operations located in North Texas and the Permian Basin, primarily in West Texas, (ii) natural gas pipelines, processing plants, storage facilities, NGL pipelines, and fractionation assets in Louisiana, (iii) natural gas gathering and processing operations located throughout Oklahoma, and (iv) crude rail, truck, pipeline, and barge facilities in West Texas, South Texas, Louisiana, Oklahoma, and ORV. Effective January 1, 2019, we report our financial performance in five segments:

• | Permian Segment. The Permian segment includes our natural gas gathering, processing, and transmission activities and our crude oil operations in the Midland and Delaware Basins in West Texas and Eastern New Mexico and our crude operations in South Texas; |

• | North Texas Segment. The North Texas segment includes our natural gas gathering, processing, and transmission activities in North Texas; |

• | Oklahoma Segment. The Oklahoma segment includes our natural gas gathering, processing, and transmission activities, and our crude oil operations in the Cana-Woodford, Arkoma-Woodford, northern Oklahoma Woodford, STACK, and CNOW shale areas; |

• | Louisiana Segment. The Louisiana segment includes our natural gas pipelines, natural gas processing plants, storage facilities, fractionation facilities, and NGL assets located in Louisiana and our crude oil operations in ORV; and |

• | Corporate Segment. The Corporate segment includes our unconsolidated affiliate investments in the Cedar Cove JV in Oklahoma, our ownership interest in GCF in South Texas, our derivative activity, and our general corporate assets and expenses. |

For more information about our segment reporting, see “Item 8. Financial Statements and Supplementary Data—Note 15.”

9

Our Business Strategies

We operate a differentiated midstream platform that is built for long-term, sustainable value creation. Our integrated assets are strategically located in premier production basins and core demand centers, including the Permian Basin, the Louisiana Gulf Coast, Central Oklahoma, and North Texas. Our primary business objective is to provide cash flow stability in our business while growing prudently and profitably. We intend to accomplish this objective by executing the following strategies:

• | Enhance the Profitability of Existing Business. We are focused on enhancing the profitability of current operations and our strong, integrated base of assets by: |

• | Filling available capacity of our assets and optimizing assets to support increasing demand. |

• | Growing market share in areas across our footprint. |

• | Reducing costs across our assets. |

• | Capitalizing on opportunities to expand and capture business opportunities with customers. |

• | Position to Capture Long-term Opportunities. We believe our assets are positioned in some of the most economically advantageous basins in the U.S., as well as key demand centers with growing end-use customers. We expect to grow certain of our systems organically over time by meeting our customers’ midstream service needs that result from their drilling activity in our areas of operation or growth in supply needs. We continually evaluate economically attractive organic expansion opportunities in our areas of operation that allow us to leverage our existing infrastructure, operating expertise, and customer relationships by constructing and expanding systems to meet new or increased demand for our services. |

• | Optimize Strong Financial Position. We are focused on strengthening our financial position by achieving long-term capital structure priorities, increasing cash flows, and maintaining balance sheet strength. We believe that maintaining a conservative and balanced capital structure, appropriate leverage, and other key financial metrics will afford us better access to the capital markets at a competitive cost of capital. We also believe a strong financial position provides us the opportunity to grow our business in a prudent manner throughout the cycles in our industry. |

• | Drive Organizational Efficiency. We are committed to optimizing costs and efficiencies company-wide, while maintaining a high level of customer service and safety. |

Recent Developments

Simplification of the Corporate Structure. On January 25, 2019, we completed the Merger, an internal reorganization pursuant to which ENLC owns all of the outstanding common units of ENLK. See “Item 8. Financial Statements and Supplementary Data—Note 1” for more information on the Merger and related transactions.

Transfer of EOGP Interest. On January 31, 2019, ENLC transferred its 16.1% limited partner interest in EOGP to the Operating Partnership.

Organic Growth

Riptide Processing Plant. In September 2019, we completed construction of a 65 MMcf/d expansion to our Riptide processing plant in the Midland Basin, bringing the total operational processing capacity at the plant to 165 MMcf/d. We are currently in the process of further expanding our Riptide processing plant and expect an additional 55 MMcf/d of operational capacity to be completed during the fourth quarter of 2020.

Delaware Basin Processing Plant. In August 2019, we commenced construction of our Tiger Plant, which will expand our Delaware Basin processing capacity by an additional 200 MMcf/d. We expect the plant to be operational in the second half of 2020. This processing plant is owned by the Delaware Basin JV.

Central Oklahoma Plants. In June 2019, we commenced operations on our Thunderbird Plant, which expands our Central Oklahoma gas processing capacity by an additional 200 MMcf/d, bringing our total processing capacity at our Central Oklahoma facilities to 1.2 Bcf/d.

Cajun-Sibon Pipeline. In April 2019, we completed the expansion of our Cajun-Sibon NGL pipeline capacity, which connects the Mont Belvieu NGL hub to our fractionation facilities in Louisiana. This is the third phase of our Cajun-Sibon system referred to as Cajun Sibon III, which increases throughput capacity from 130,000 bbls/d to 185,000 bbls/d.

10

Lobo Natural Gas Gathering and Processing Facilities. In early April 2019, we completed construction of a 100 MMcf/d expansion to our Lobo III cryogenic gas processing plant, bringing the total operational processing capacity at our Lobo facilities to 375 MMcf/d.

Avenger Crude Oil Gathering System. Avenger is a crude oil gathering system in the northern Delaware Basin supported by a long-term contract with Devon on dedicated acreage in their Todd and Potato Basin development areas in Eddy and Lea counties in New Mexico. We commenced initial operations on Avenger during the third quarter of 2018 and began full-service operations during the second quarter of 2019.

11

Our Assets

Our assets consist of gathering systems, transmission pipelines, processing facilities, fractionation facilities, stabilization facilities, storage facilities, and ancillary assets. Except as stated otherwise, the following tables provide information about our assets as of and for the year ended December 31, 2019:

Year Ended | |||||||||||

December 31, 2019 | |||||||||||

Gathering and Transmission Pipelines | Approximate Length (Miles) | Compression (HP) | Estimated Capacity (1) | Average Throughput (2) | |||||||

Gas Pipelines | |||||||||||

Permian assets: | |||||||||||

MEGA System gathering facilities | 765 | 132,500 | 447 | 407,000 | |||||||

Lobo gathering system (3) | 180 | 46,900 | 160 | 316,400 | |||||||

Permian gas assets (3) | 945 | 179,400 | 607 | 723,400 | |||||||

North Texas assets: | |||||||||||

Bridgeport rich and lean gathering systems | 2,800 | 206,700 | 900 | 762,700 | |||||||

Johnson County gathering system | 390 | 49,000 | 400 | 111,700 | |||||||

Silver Creek gathering system | 910 | 53,800 | 260 | 285,800 | |||||||

Acacia transmission system | 130 | 16,000 | 920 | 491,700 | |||||||

North Texas gas assets | 4,230 | 325,500 | 2,480 | 1,651,900 | |||||||

Oklahoma assets: | |||||||||||

Central Oklahoma gathering system | 1,825 | 258,700 | 1,137 | 1,270,200 | |||||||

Northridge gathering system | 140 | 14,000 | 65 | 32,000 | |||||||

Oklahoma gas assets | 1,965 | 272,700 | 1,202 | 1,302,200 | |||||||

Louisiana assets: | |||||||||||

Louisiana gas gathering and transmission system | 3,010 | 97,400 | 3,975 | 2,050,000 | |||||||

Total Gas Pipelines | 10,150 | 875,000 | 8,264 | 5,727,500 | |||||||

NGL, Crude Oil, and Condensate Pipelines | |||||||||||

Permian assets: | |||||||||||

Victoria Express Pipeline | 60 | — | 90,000 | 16,400 | |||||||

Permian Basin gathering (4) | 455 | — | 238,500 | 115,600 | |||||||

Permian Crude Oil and Condensate assets | 515 | — | 328,500 | 132,000 | |||||||

Oklahoma assets: | |||||||||||

Central Oklahoma crude oil gathering systems | 175 | — | 160,000 | 47,300 | |||||||

Louisiana assets: | |||||||||||

Cajun-Sibon NGL pipeline system | 760 | — | 185,000 | 164,200 | |||||||

Ascension NGL pipeline (5) | 35 | — | 50,000 | 21,300 | |||||||

Ohio River Valley (6) | 210 | — | 25,650 | 18,900 | |||||||

Louisiana NGL, Crude Oil, and Condensate assets | 1,005 | — | 260,650 | 204,400 | |||||||

Total NGL, Crude Oil, and Condensate Pipelines | 1,695 | — | 749,150 | 383,700 | |||||||

____________________________

(1) | Estimated capacity for gas pipelines is MMcf/d. Estimated capacity for liquids and crude and condensate pipelines is Bbls/d. |

(2) | Average throughput for gas pipelines is MMBtu/d. Average throughput for NGL, crude, and condensate pipelines is Bbls/d. |

(3) | Includes gross mileage, compression, capacity, and throughput for the Delaware Basin JV, which is owned 50.1% by us. Estimated capacity on our Lobo gathering system includes only the Delaware Basin JV’s compression capacity and does not include gas compressed by third parties on our system. |

(4) | Estimated capacity is comprised of 188,500 Bbls/d of pipeline capacity and 50,000 Bbls/d of trucking capacity. Our Permian Basin gathering crude and condensate assets include the ECP system, Greater Chickadee system, and Avenger system. |

(5) | Includes gross mileage, capacity, and throughput for the Ascension JV, which is owned 50% by us. |

(6) | Estimated capacity is comprised of trucking capacity only. |

12

Year Ended | ||||||

December 31, 2019 | ||||||

Processing Facilities | Processing Capacity (MMcf/d) | Average Throughput (MMBtu/d) | ||||

Permian assets: | ||||||

MEGA system processing facilities | 458 | 467,400 | ||||

Lobo processing facilities | 375 | 304,000 | ||||

Permian assets | 833 | 771,400 | ||||

North Texas assets: | ||||||

Bridgeport processing facility | 800 | 580,000 | ||||

Silver Creek processing system (1) | 480 | 170,500 | ||||

North Texas assets | 1,280 | 750,500 | ||||

Oklahoma assets: | ||||||

Central Oklahoma processing facilities | 1,245 | 1,181,900 | ||||

Northridge processing facility | 200 | 94,800 | ||||

Oklahoma assets | 1,445 | 1,276,700 | ||||

Louisiana assets: | ||||||

Louisiana gas processing facilities (2) | 1,778 | 400,200 | ||||

Total Processing Facilities | 5,336 | 3,198,800 | ||||

____________________________

(1) | The Azle and Goforth processing plants are not operational. These plants represent 50 MMcf/d and 30 MMcf/d, respectively, of the total processing capacity of the Silver Creek processing system. |

(2) | The Blue Water, Eunice, and Sabine processing plants are not operational. These plants represent 193 MMcf/d, 350 MMcf/d, and 300 MMcf/d, respectively, of the total processing capacity of the Louisiana gas processing assets. |

13

Year Ended | ||||||

December 31, 2019 | ||||||

Fractionation Facilities | Estimated NGL Fractionation Capacity (Bbls/d) | Average Throughput (Bbls/d) | ||||

Permian assets: | ||||||

Mesquite terminal (1) | 15,000 | — | ||||

North Texas assets: | ||||||

Bridgeport processing facility (2) | 15,000 | — | ||||

Louisiana assets: | ||||||

Plaquemine fractionation facility (3) | 125,000 | 79,200 | ||||

Plaquemine processing plant | 5,000 | 3,300 | ||||

Eunice fractionation facility | 70,000 | 58,700 | ||||

Riverside fractionation facility (3) | — | 33,600 | ||||

Louisiana assets | 200,000 | 174,800 | ||||

Corporate assets: | ||||||

Gulf Coast Fractionators (4) | 56,000 | 47,600 | ||||

Total Fractionation Facilities | 286,000 | 222,400 | ||||

____________________________

(1) | The Mesquite terminal fractionator is not operational. |

(2) | Our Bridgeport processing plant in North Texas provides operational flexibility for the related processing plants but are not the primary fractionation facilities for the NGLs produced by the processing plants. Under our current contracts, we do not earn fractionation fees for operating these facilities, so throughput volumes through these facilities are not captured on a routine basis and are not significant to our gross operating margins. |

(3) | The Plaquemine fractionation facility produces purity ethane and propane for sale to markets via pipeline, while butane and heavier products are sent to the Riverside fractionation facility for further processing. The Plaquemine fractionation facility and the Riverside fractionation facility have an aggregate fractionation capacity of 125 MBbls/d. |

(4) | Volumes shown reflect our 38.75% ownership in Gulf Coast Fractionators. |

Year Ended | |||||

December 31, 2019 | |||||

Storage Assets | Storage Type | Estimated Storage Capacity (1) | |||

Permian assets: | |||||

Avenger storage | Crude | 0.1 | |||

VEX storage | Crude | 0.2 | |||

Oklahoma assets: | |||||

Central Oklahoma storage | Crude | 0.2 | |||

Louisiana assets: | |||||

Belle Rose gas storage facility | Gas | 11.9 | |||

Sorrento gas storage facility | Gas | 7.3 | |||

Napoleonville NGL storage facility | NGL | 6.0 | |||

ORV storage | Crude | 0.7 | |||

____________________________

(1) | Estimated capacity for gas storage is Bcf and includes linefill capacity necessary to operate storage facilities. Estimated capacity for NGL and crude oil storage is MMbbls. |

14

Permian Segment Assets. Our Permian segment assets include gas gathering systems, crude oil gathering systems and storage, gas processing facilities, and a fractionation facility, which assets are primarily in West Texas and New Mexico.

• | Gas Gathering Systems. Our gas gathering systems are connected to our Permian Basin processing assets and consist of the following: |

• | MEGA system gathering facilities. This gathering system in the Midland Basin serves as an interconnected system of pipelines and compressors to deliver gas from wellheads in the Permian Basin to the MEGA system processing facilities. |

• | Lobo gathering system. This rich natural gas gathering system consists of gathering pipeline and compression assets in the Delaware Basin in Texas and New Mexico. The Lobo gathering system is owned by the Delaware Basin JV. |

• | Crude Oil Gathering Systems. Our crude oil gathering systems consist of crude oil and condensate pipelines and above ground storage, including: |

• | Avenger. During 2018, we constructed a new crude oil gathering system in the northern Delaware Basin called Avenger. Avenger is supported by a long-term contract with Devon on dedicated acreage in their Todd and Potato Basin development areas in Eddy and Lea counties in New Mexico. We commenced initial operations on Avenger during the third quarter of 2018 and full-service operations during the second quarter of 2019. |

• | Greater Chickadee Gathering System. Greater Chickadee was placed into service in March 2017 and delivers crude oil for customers to Enterprise Product Partners L.P.’s crude oil terminal in West Texas. Greater Chickadee also includes multiple central tank batteries with pump, truck injection, and storage stations to maximize shipping and delivery options for producers. |

• | VEX. VEX includes a multi-grade crude oil pipeline with terminals in Cuero and the Port of Victoria and barge docks. The Cuero truck unloading terminal at the origin of the VEX system contains unloading bays and above-ground storage capacity for receipt from, and delivery to, the VEX pipeline. The VEX pipeline terminates at the Port of Victoria Terminal, which has an unloading dock and above-ground storage capacity. The Port of Victoria Terminal delivers to two barge loading docks at the Port of Victoria. |

• | ECP System. The ECP System includes trucking and crude gathering pipelines in the Midland Basin. |

• | Gas Processing Facilities. Our Permian Basin gas processing facilities include six gas processing plants and consist of the following: |

• | MEGA system processing facilities. Our MEGA system natural gas processing facilities are located in Midland, Martin, and Glasscock counties, Texas and operate as a connected system. These assets consist of the Bearkat processing facility with a capacity of 75 MMcf/d, the Deadwood processing facility with a capacity of 58 MMcf/d, the Midmar processing facilities with a capacity of 160 MMcf/d, and the Riptide processing facility with a capacity of 165 MMcf/d. |

• | Lobo processing facilities. Our Lobo natural gas processing facilities are located in Loving County, Texas and include Lobo I, Lobo II, and Lobo III, which account for 35 MMcf/d, 140 MMcf/d, and 200 MMcf/d of processing capacity, respectively. The Lobo processing facilities and the connected gathering system are owned by the Delaware Basin JV. |

• | Fractionation Facility. The Mesquite fractionator has an approximate capacity of 15,000 Bbls/d and is located at our Midland gas processing plant complex. We idled the Mesquite fractionator and only operate the condensate stabilizer in the Mesquite terminal, which has a capacity of 5,000 Bbls/d. |

15

North Texas Segment Assets. Our North Texas segment assets include gas gathering systems, a gas transmission system, gas processing facilities, and a fractionation facility in the Barnett Shale.

• | Gas Gathering Systems. Our gas gathering systems are connected to our processing assets and consist of the following: |

• | Bridgeport rich gas gathering system. A substantial majority of the natural gas gathered on the Bridgeport rich gas gathering system is delivered to the Bridgeport processing facility. Devon is the largest customer on the Bridgeport rich gas gathering system contributing substantially all of the natural gas gathered for the year ended December 31, 2019. As described above, we have extended our fixed-fee gathering agreement with Devon, which was effective after the GIP Transaction, and currently have approximately nine years remaining on a fixed-fee gathering agreement with Devon pursuant to which we provide gathering services on the Bridgeport system. |

• | Bridgeport lean gas gathering system. Natural gas gathered on the Bridgeport lean gas gathering system is primarily attributable to Devon and is delivered to the Acacia transmission system and to intrastate pipelines without processing. As described above, we are party to a fixed-fee gathering and processing agreement with Devon that covers gathering services on the Bridgeport system. |

• | Johnson County gathering system. Natural gas gathered on this system is primarily attributable to one customer with whom we have a fixed-fee processing agreement that currently has approximately four years remaining. |

• | Silver Creek gathering system. Our Silver Creek gathering system is located primarily in Hood, Parker, and Johnson counties, Texas, and connects to the Silver Creek processing system. |

• | Gas Transmission System. The Acacia transmission system is a pipeline that connects production from the Barnett Shale to markets in North Texas accessed by Atmos Energy, Brazos Electric, Enbridge Energy Partners, Energy Transfer Partners, Enterprise Product Partners, and GDF Suez. Devon is the largest customer on the Acacia pipeline with approximately four years remaining on a fixed-fee transportation agreement that covers transmission services and includes annual rate escalators. |

• | Gas Processing Facilities. Our gas processing facilities in North Texas include four gas processing plants and consist of the following: |

• | Bridgeport processing facility. Our Bridgeport natural gas processing facility, located in Wise County, Texas, approximately 40 miles northwest of Fort Worth, Texas, is one of the largest processing plants in the U.S. with seven cryogenic turboexpander plants. Devon is the Bridgeport facility’s largest customer, providing substantially all of the natural gas processed for the year ended December 31, 2019. We have extended our fixed-fee processing agreement with Devon, which was effective after the GIP Transaction, and currently have approximately nine years remaining on our agreement with Devon pursuant to which we provide processing services for natural gas delivered by Devon to the Bridgeport processing facility. |

• | Silver Creek processing system. Our Silver Creek processing system, located in Weatherford, Azle, and Fort Worth, Texas, includes three processing plants: the Azle plant, the Silver Creek plant, and the Goforth plant, which account for 50 MMcf/d, 400 MMcf/d, and 30 MMcf/d of processing capacity, respectively. During 2018, we idled the Azle and Goforth plants due to decreased volumes. Currently, the processing capacity at the Silver Creek plant is sufficient to process all gas on the Silver Creek processing system. |

• | Fractionation Facility. Our Bridgeport processing plant in North Texas also has fractionation capabilities that provide operational flexibility for the related processing plants but is not the primary fractionation facility for the NGLs produced by the processing plants. Under our current contracts, we do not earn fractionation fees for operating this facility, so throughput volumes through this facility are not captured on a routine basis and are not significant to our gross operating margin. |

16

Oklahoma Segment Assets. Our Oklahoma segment assets consist of gas processing facilities, gas gathering systems, and crude oil gathering systems and storage in Southern and Central Oklahoma.

• | Gas Gathering Systems. Our Oklahoma gas gathering systems consist of the following: |

• | Central Oklahoma gathering system. The Central Oklahoma gathering system serves the STACK and CNOW plays. In addition, our contractual arrangement with Devon includes an MVC that will remain in effect until December 2020. For 2020, the MVC dictates that approximately 230 MMcf/d of natural gas will be delivered through the Chisholm gathering system. |

• | Northridge gathering system. Our Northridge gathering system is located in the Arkoma-Woodford Shale in Southeastern Oklahoma. |

• | Gas Processing Facilities. Our gas processing facilities consist of the following: |

• | Central Oklahoma processing facilities. The Central Oklahoma processing facilities include the Thunderbird Plant, the Chisholm plants, the Battle Ridge plant, and the Cana processing facilities (collectively, the “Central Oklahoma processing system”), which account for 200 MMcf/d, 560 MMcf/d, 85 MMcf/d, and 400 MMcf/d of processing capacity, respectively. The residue natural gas from the Cana processing facility is delivered to Enable Midstream Partners, LP and an affiliate of ONEOK, Inc. (“ONEOK”). The unprocessed NGLs from the Chisholm facilities are transported by ONEOK to NGL transmission lines, which then transport the NGLs to our fractionators in Louisiana. Devon is the primary customer of the Cana processing facilities. We have extended our fixed-fee processing agreement with Devon, which was effective after the GIP Transaction, and currently have approximately nine years remaining on a fixed-fee gathering and processing agreement with us pursuant to which we provide processing services for natural gas delivered by Devon to the Cana processing facility. Additionally, we have a contractual arrangement with Devon on the Chisholm plants that includes an MVC that will remain in effect until December 2020. For 2020, the MVC dictates that approximately 230 MMcf/d of natural gas will be delivered to the Chisholm plant processing facility. |

• | Northridge processing facility. Our Northridge processing plant is located in Hughes County in the Arkoma-Woodford Shale in Southeastern Oklahoma. The residue natural gas from the Northridge processing facility is delivered to CenterPoint Energy, Inc., Enable Midstream Partners, LP, and MPLX LP. |

• | Crude Oil Gathering Systems. Our Oklahoma crude and condensate assets have crude oil and condensate pipelines and above ground storage in Central Oklahoma. These assets consist of the following: |

• | Central Oklahoma Crude Oil Gathering Systems. Our Central Oklahoma crude oil gathering systems include Black Coyote and Redbud. Black Coyote operates in the core of the STACK play in Central Oklahoma and was built primarily to service acreage dedicated from Devon, which is the anchor customer on the system. Redbud also operates in the core of the STACK play and is supported by a contract with Marathon Oil Company. |

Louisiana Segment Assets. Our Louisiana segment assets consist of gas and NGL gathering and transmission pipelines, gas processing facilities, gas and NGL storage, and our ORV crude logistics assets.

• | Transmission and Gathering Systems. The Louisiana gas pipeline system includes gathering and transmission systems, processing facilities, and underground gas storage. |

• | Gas Transmission and Gathering Systems. Our transmission system consists of a portfolio of large capacity interconnections with the Gulf Coast pipeline grid that provides customers with supply access to multiple domestic production basins for redelivery to major industrial market consumption located primarily in the Mississippi River Corridor between Baton Rouge, Louisiana and New Orleans, Louisiana. Our natural gas transmission services are supplemented by fully integrated, high deliverability salt dome storage capacity strategically located in the natural gas consumption corridor. In combination with our transmission system, our gathering systems provide a fully integrated wellhead to burner tip value chain that includes local gathering, processing, and treating services to Louisiana producers. |

17

• | Gas Processing and Storage Facilities. Our processing facilities in Louisiana include six gas processing plants, of which three are currently operational, and two storage facilities. These assets consist of the following: |

• | Plaquemine Processing Plant. The Plaquemine processing plant has 225 MMcf/d of processing capacity and is connected to the Plaquemine fractionation facility. |

• | Gibson Processing Plant. The Gibson processing plant has 110 MMcf/d of processing capacity and is located in Gibson, Louisiana. The Gibson processing plant is connected to our Louisiana gathering system. |

• | Pelican Processing Plant. The Pelican processing plant complex is located in Patterson, Louisiana and has a designed capacity of 600 MMcf/d of natural gas. The Pelican processing plant is connected with continental shelf and deepwater production and has downstream connections to the ANR Pipeline. This plant has an interconnection with the Louisiana gas pipeline system allowing us to process natural gas from this system at our Pelican processing plant when markets are favorable. |

• | Belle Rose Gas Storage Facility. The Belle Rose storage facility is located in Assumption Parish, Louisiana. This facility is designed for injecting pipeline quality gas into storage or withdrawing stored gas for delivery by pipeline. |

• | Sorrento Gas Storage Facility. The Sorrento gas storage facility is located in Assumption Parish, Louisiana. This facility is designed for injecting pipeline quality gas into storage or withdrawing stored gas for delivery by pipeline. |

• | Idled Processing Plants: |

• | Blue Water Gas Processing Plant. We operate and own a 64.29% interest in the Blue Water gas processing plant. The Blue Water gas processing plant is located in Crowley, Louisiana and is connected to the Blue Water pipeline system. Our share of the plant’s capacity is approximately 193 MMcf/d. We have shut down the Blue Water gas processing plant and we do not expect to operate it in the near future unless volumes are sufficient to run the plant. |

• | Eunice Processing Plant. The Eunice processing plant is located in South Central Louisiana and has a capacity of 350 MMcf/d of natural gas. We have shut down the Eunice processing plant. The plant is not expected to operate in the near future unless volumes are sufficient to run the plant. |

• | Sabine Pass Processing Plant. The Sabine Pass processing plant is located east of the Sabine River in Johnson's Bayou, Louisiana and has a processing capacity of 300 MMcf/d of natural gas. We have shut down the Sabine Pass processing plant and do not anticipate reopening the plant based on current market conditions. |

• | NGL and Crude Oil Pipeline Systems. Our NGL and crude oil pipeline systems consist of NGL pipelines, crude oil and condensate pipelines, underground NGL storage, and our ORV crude logistics assets. |

• | Cajun-Sibon Pipeline System. The Cajun-Sibon pipeline system transports unfractionated NGLs from areas such as the Liberty, Texas interconnects near Mont Belvieu, Texas, and, from time to time, our Gibson and Pelican processing plants in South Louisiana to either the Plaquemine or Eunice fractionators or to third-party fractionators when necessary. |

• | Ascension Pipeline. The Ascension JV is an NGL pipeline that connects our Riverside fractionator to Marathon Petroleum Corporation’s Garyville refinery and is owned 50% by Marathon Petroleum Corporation. |

• | Ohio River Valley. Our ORV operations are an integrated network of assets comprised of a 5,000-barrel-per-hour crude oil and condensate barge loading terminal on the Ohio River, a 20-spot crude oil and condensate rail loading terminal on the Ohio Central Railroad network, crude oil and condensate pipelines in Ohio and West Virginia, above ground crude oil storage, a trucking fleet comprised of both semi and straight trucks, trailers for hauling NGL volumes, and seven existing brine disposal wells. Additionally, our ORV operations |

18

include eight condensate stabilization and natural gas compression stations that are supported by long-term, fee-based contracts with multiple producers.

• | Napoleonville Storage Facility. The Napoleonville NGL storage facility is connected to the Riverside facility and is comprised of two existing caverns. The caverns currently provide butane storage. |

• | Fractionation Facilities. There are four fractionation facilities located in Louisiana that are connected to our processing facilities and to Mont Belvieu, Texas and other hubs through our Cajun-Sibon pipeline system. |

• | Plaquemine Fractionation Facility. The Plaquemine fractionator is located at our Plaquemine gas processing plant complex and is connected to our Cajun-Sibon pipeline. The Plaquemine fractionation facility produces purity ethane and propane for sale to markets via pipeline, while butane and heavier products are sent to our Riverside facility for further processing. The Plaquemine fractionator, collectively with the Riverside Fractionation Facility, has an approximate capacity of 125,000 Bbls/d of raw-make NGL products. |

• | Plaquemine Gas Processing Plant. In addition to the Plaquemine fractionation facility, the adjacent Plaquemine gas processing plant also has an on-site fractionator. |

• | Eunice Fractionation Facility. The Eunice fractionation facility is located in South Central Louisiana. Liquids are delivered to the Eunice fractionation facility by the Cajun-Sibon pipeline system. The Eunice fractionation facility fractionates butane and heavier products from our Riverside facility and is directly connected to NGL markets and to a third-party storage facility. |

• | Riverside Fractionation Facility. The Riverside fractionator and loading facility are located on the Mississippi River upriver from Geismar, Louisiana. Liquids are delivered to the Riverside fractionator by pipeline from the Pelican processing plants or by third-party truck and rail assets. The loading/unloading facility has the capacity to transload 15,000 Bbls/d of crude oil and condensate from rail cars to barges. |

Corporate Segment Assets. Our Corporate segment assets primarily consist of our 38.75% ownership interest in GCF and 30% ownership interest in the Cedar Cove JV.

• | GCF. We own a 38.75% interest in GCF, with the remaining interests owned 22.5% by Phillips 66, and 38.75% by Targa Resources Partners, LP. GCF owns an NGL fractionator located on the Gulf Coast at Mont Belvieu, Texas. Phillips 66 is the operator of the fractionator. GCF receives raw mix NGLs from customers, fractionates the raw mix, and redelivers the finished products to customers for a fee. |

• | Cedar Cove JV. We own a 30% interest in the Cedar Cove JV, which operates gathering and compression assets in Blaine County, Oklahoma that tie into our existing Oklahoma assets. Kinder Morgan, Inc. owns a 70% interest in, and is the operator of, the Cedar Cove JV. All gas gathered by the Cedar Cove JV is processed by our Central Oklahoma processing facilities. |

19

Industry Overview

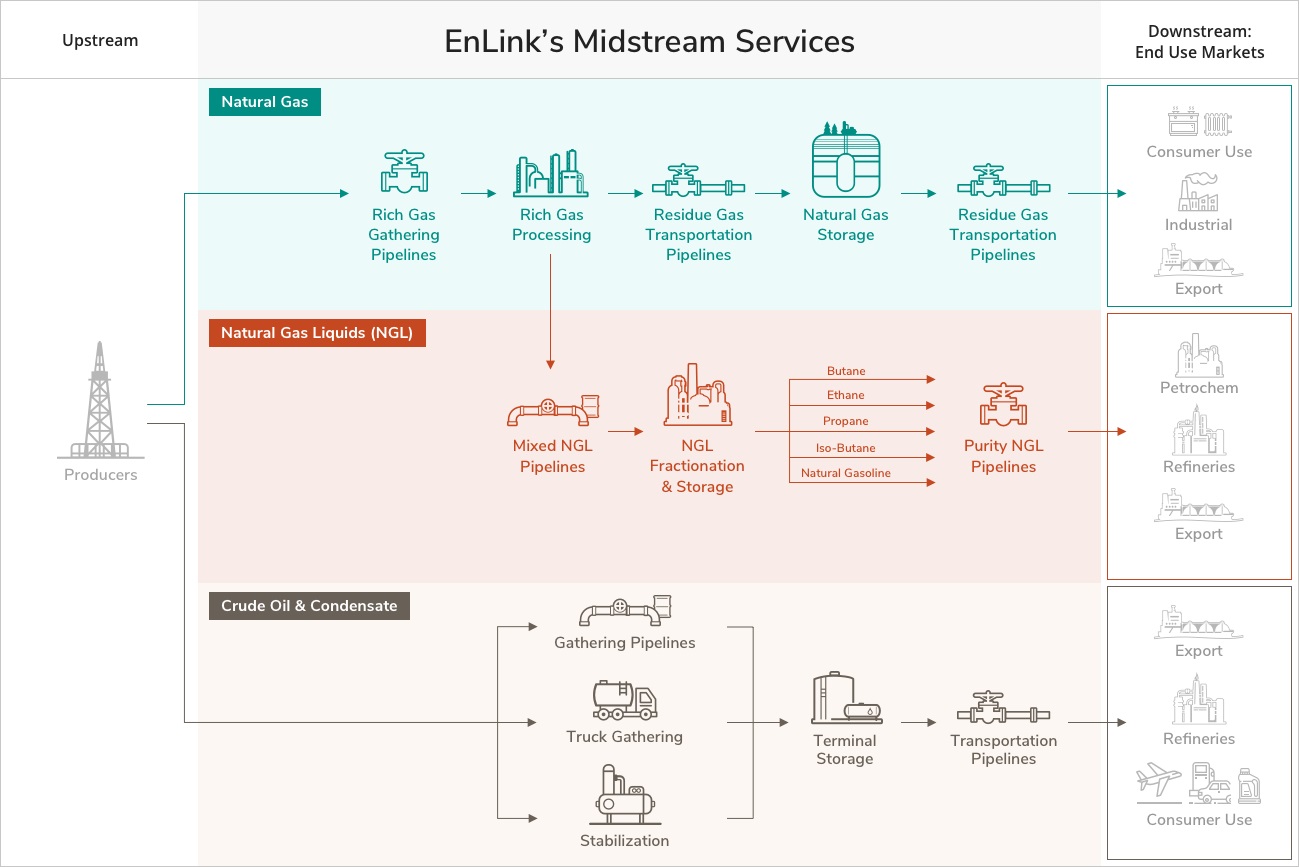

The following diagram illustrates the gathering, processing, fractionation, stabilization, and transmission process.

The midstream industry is the link between the exploration and production of natural gas and crude oil and condensate and the delivery of its components to end-user markets. The midstream industry is generally characterized by regional competition based on the proximity of gathering systems and processing plants to natural gas and crude oil and condensate producing wells.

Natural gas gathering. The natural gas gathering process follows the drilling of wells into gas-bearing rock formations. After a well has been completed, it is connected to a gathering system. Gathering systems typically consist of a network of small diameter pipelines and, if necessary, compression and treating systems that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission.

Compression. Gathering systems are operated at pressures that will maximize the total natural gas throughput from all connected wells. Because wells produce gas at progressively lower field pressures as they age, it becomes increasingly difficult to deliver the remaining production in the ground against the higher pressure that exists in the connected gathering system. Natural gas compression is a mechanical process in which a volume of gas at an existing pressure is compressed to a desired higher pressure, allowing gas that no longer naturally flows into a higher-pressure downstream pipeline to be brought to market. Field compression is typically used to allow a gathering system to operate at a lower pressure or provide sufficient discharge pressure to deliver gas into a higher-pressure downstream pipeline. The remaining natural gas in the ground will not be produced if field compression is not installed because the gas will be unable to overcome the higher gathering system pressure. A declining well can continue delivering natural gas if field compression is installed.

Natural gas processing. The principal components of natural gas are methane and ethane, but most natural gas also contains varying amounts of heavier NGLs and contaminants, such as water and CO2, sulfur compounds, nitrogen, or helium. Natural gas produced by a well may not be suitable for long-haul pipeline transportation or commercial use and may need to be processed to remove the heavier hydrocarbon components and contaminants. Natural gas in commercial distribution systems mostly consists of methane and ethane, and moisture and other contaminants have been removed, so there are negligible

20

amounts of them in the gas stream. Natural gas is processed to remove unwanted contaminants that would interfere with pipeline transportation or use of the natural gas and to separate those hydrocarbon liquids from the gas that have higher value as NGLs. The removal and separation of individual hydrocarbons through processing is possible due to differences in weight, boiling point, vapor pressure, and other physical characteristics. Natural gas processing involves the separation of natural gas into pipeline-quality natural gas and a mixed NGL stream and the removal of contaminants.

NGL fractionation. NGLs are separated into individual, more valuable components during the fractionation process. NGL fractionation facilities separate mixed NGL streams into discrete NGL products: ethane, propane, isobutane, normal butane, natural gasoline, and stabilized crude oil and condensate. Ethane is primarily used in the petrochemical industry as feedstock for ethylene, one of the basic building blocks for a wide range of plastics and other chemical products. Propane is used as a petrochemical feedstock in the production of ethylene and propylene and as a heating fuel, an engine fuel, and industrial fuel. Isobutane is used principally to enhance the octane content of motor gasoline. Normal butane is used as a petrochemical feedstock in the production of ethylene and butylene (a key ingredient in synthetic rubber), as a blend stock for motor gasoline, and to derive isobutene through isomerization. Natural gasoline, a mixture of pentanes and heavier hydrocarbons, is used primarily as motor gasoline blend stock or petrochemical feedstock.

Natural gas transmission. Natural gas transmission pipelines receive natural gas from mainline transmission pipelines, processing plants, and gathering systems and deliver it to industrial end-users, utilities, and to other pipelines.

Crude oil and condensate transmission. Crude oil and condensate are transported by pipelines, barges, rail cars, and tank trucks. The method of transportation used depends on, among other things, the resources of the transporter, the locations of the production points and the delivery points, cost-efficiency, and the quantity of product being transported.

Condensate Stabilization. Condensate stabilization is the distillation of the condensate product to remove the lighter end components, which ultimately creates a higher quality condensate product that is then delivered via truck, rail, or pipeline to local markets.

Brine gathering and disposal services. Typically, shale wells produce significant amounts of water that, in most cases, require disposal. Produced water and frac-flowback is hauled via truck transport or is pumped through pipelines from its origin at the oilfield tank battery or drilling pad to the disposal location. Once the water reaches the delivery disposal location, water is processed and filtered to remove impurities, and injection wells place fluids underground for storage and disposal.

Storage. Demand for natural gas, NGLs, and crude oil fluctuate daily and seasonally, while production and pipeline deliveries are relatively constant in the short term. Storage of products during periods of low demand helps to ensure that sufficient supplies are available during periods of high demand. Natural gas and NGLs are stored in large volumes in underground facilities and in smaller volumes in tanks above and below ground, while crude oil is typically stored in tanks above ground.

Crude oil and condensate terminals. Crude oil and condensate rail terminals are an integral part of ensuring the movement of new crude oil and condensate production from the developing shale plays in the United States and Canada. In general, the crude oil and condensate rail loading terminals are used to load rail cars and transport the commodity out of developing basins into market rich areas of the country where crude oil and condensate rail unloading terminals are used to unload rail cars and store crude oil and condensate volumes for third parties until the crude oil and condensate is redelivered to premium market delivery points via pipelines, trucks, or rail.

Balancing Supply and Demand

When we purchase natural gas, NGLs, crude oil, and condensate, we establish a margin normally by selling it for physical delivery to third-party users. We can also use over-the-counter derivative instruments or enter into future delivery obligations under futures contracts on the New York Mercantile Exchange (“NYMEX”) related to our natural gas purchases to balance our margin position. Through these transactions, we seek to maintain a position that is balanced between (1) purchases and (2) sales or future delivery obligations. Our policy is not to acquire and hold natural gas, NGL, or crude oil futures contracts or derivative products for the purpose of speculating on price changes.

Competition

The business of providing gathering, transmission, processing, and marketing services for natural gas, NGLs, crude oil, and condensate is highly competitive. We face strong competition in obtaining natural gas, NGLs, crude oil, and condensate

21

supplies and in the marketing, transportation, and processing of natural gas, NGLs, crude oil, and condensate. Our competitors include major integrated and independent exploration and production companies, natural gas producers, interstate and intrastate pipelines, other natural gas, NGLs, and crude oil and condensate gatherers, and natural gas processors. Competition for natural gas and crude oil and condensate supplies is primarily based on geographic location of facilities in relation to production or markets, the reputation, efficiency, and reliability of the gatherer, and the pricing arrangements offered by the gatherer. For areas where acreage is not dedicated to us, we compete with similar enterprises in providing additional gathering and processing services in its respective areas of operation. Many of our competitors may offer more services or have stronger financial resources and access to larger natural gas, NGLs, crude oil, and condensate supplies than we do. Our competition varies in different geographic areas.

In marketing natural gas, NGLs, crude oil, and condensate, we have numerous competitors, including marketing affiliates of interstate pipelines, major integrated oil and gas companies, and local and national natural gas producers, gatherers, brokers, and marketers of widely varying sizes, financial resources, and experience. Local utilities and distributors of natural gas are, in some cases, engaged directly and through affiliates in marketing activities that compete with our marketing operations.

We face strong competition for acquisitions and development of new projects from both established and start-up companies. Competition increases the cost to acquire existing facilities or businesses and results in fewer commitments and lower returns for new pipelines or other development projects. Our competitors may have greater financial resources than we possess or may be willing to accept lower returns or greater risks. Our competition differs by region and by the nature of the business or the project involved.

Natural Gas, NGL, Crude Oil, and Condensate Supply

Our gathering and transmission pipelines have connections with major intrastate and interstate pipelines, which we believe have ample natural gas and NGL supplies in excess of the volumes required for the operation of these systems. We evaluate well and reservoir data that is either publicly available or furnished by producers or other service providers in connection with the construction and acquisition of our gathering systems and assets to determine the availability of natural gas, NGLs, crude oil, and condensate supply for our systems and assets and/or obtain an MVC from the producer that results in a rate of return on investment. We do not routinely obtain independent evaluations of reserves dedicated to our systems and assets due to the cost and relatively limited benefit of such evaluations. Accordingly, we do not have estimates of total reserves dedicated to our systems and assets or the anticipated life of such producing reserves.

Credit Risk and Significant Customers

We are subject to risk of loss resulting from nonpayment or nonperformance by our customers and other counterparties, such as our lenders and hedging counterparties. We diligently attempt to ensure that we issue credit to only credit-worthy customers. However, our purchase and resale of crude oil, condensate, NGLs, and natural gas exposes us to significant credit risk, as the margin on any sale is generally a very small percentage of the total sales price. Therefore, a credit loss can be very large relative to our overall profitability. A substantial portion of our throughput volumes come from customers that have investment-grade ratings. However, lower commodity prices in future periods may result in a reduction in our customers’ liquidity and ability to make payments or perform on their obligations to us. Some of our customers have filed for bankruptcy protection, and their debts and payments to us are subject to laws governing bankruptcy.

The following customers individually represented greater than 10% of our consolidated revenues. These customers represent a significant percentage of revenues, and the loss of the customer would have a material adverse impact on our results of operations because the revenues and gross operating margin received from transactions with these customers is material to us. No other customers represented greater than 10% of our consolidated revenues.

Year Ended December 31, | ||||||||

2019 | 2018 | 2017 | ||||||

Devon | 10.5 | % | 10.4 | % | 14.4 | % | ||

Dow Hydrocarbons and Resources LLC | 10.0 | % | 11.1 | % | 11.2 | % | ||

Marathon Petroleum Corporation | 13.8 | % | 11.5 | % | (1) | |||

____________________________

(1) | Consolidated revenues for Marathon Petroleum Corporation did not exceed 10% of our consolidated revenues for the year ended December 31, 2017. |

22

Regulation

Natural Gas Pipeline Regulation. We own an interstate natural gas pipeline that is subject to regulation as a natural gas company by the FERC under the Natural Gas Act (“NGA”). FERC regulates the rates and terms and conditions of service on interstate natural gas pipelines, as well as the certification, construction, modification, expansion, and abandonment of facilities.

The rates and terms and conditions of service for our interstate pipeline services regulated by FERC must be just and reasonable and not unduly preferential or unduly discriminatory, although negotiated rates may be accepted in certain circumstances. Such rates and terms and conditions of service are set forth in FERC-approved tariffs. Proposed rate increases and changes to our tariff are subject to FERC approval. Pursuant to FERC’s jurisdiction over rates, existing rates may be challenged by complaint or by FERC on its own initiative, and proposed new or changed rates may be challenged by protest. If protested, a rate increase may be suspended for up to five months and collected, subject to refund. If, upon completion of an investigation, FERC finds that the new or changed rate is unlawful, it is authorized to require the pipeline to refund revenues collected in excess of the just and reasonable rate during the term of the investigation.

The cost-of-service rates charged by our FERC regulated natural gas pipeline may also be affected by FERC’s income tax allowance policy, although we do not currently expect to experience any impact to financial results as a result of this policy. In July 2016, the United States Court of Appeals for the District of Columbia Circuit issued its opinion in United Airlines, Inc., et al.v. FERC, finding that FERC had acted arbitrarily and capriciously when it failed to demonstrate that permitting SFPP, L.P., then an interstate petroleum products pipeline organized as a master limited partnership, to include an income tax allowance in the cost of service underlying its rates in addition to the discounted cash flow return on equity would not result in the pipeline double-recovering its investors’ income taxes. The court vacated FERC’s order and remanded to FERC. In March 2018, FERC issued an Order on Remand to SFPP, L.P. and simultaneously issued a revised policy statement disallowing master limited partnerships from recovering both an income tax allowance for the partners’ tax costs and a discounted cash flow return on equity in their cost-of-service rates. The revised policy statement further provides that FERC will address the application of this policy to partnerships and pass-through entities that are not organized as master limited partnerships in subsequent proceedings on a case-by-case basis as the issue arises. In July 2018, FERC dismissed the requests for rehearing of the revised policy statement and provided guidance that if a pipeline organized as a master limited partnership or other pass-through entity eliminates its income tax allowance from its cost of service, FERC anticipates that such pipeline will also remove accumulated deferred income taxes from its cost of service. FERC further required all interstate natural gas pipelines to file a one-time informational filing in 2018 on a new form in order to collect information to evaluate the impact of the 2017 Tax Cuts and Jobs Act and the revised policy statement on such pipelines.

In addition to policies regarding rate setting, interstate natural gas pipelines regulated by FERC are required to comply with numerous regulations related to standards of conduct, market transparency, and market manipulation. FERC’s standards of conduct regulate the manner in which interstate natural gas pipelines may interact with their marketing affiliates if such marketing affiliates are shippers on their interstate natural gas pipelines. FERC’s market oversight and transparency regulations require regulated entities to submit annual reports of threshold purchases or sales of natural gas and publicly post certain information on scheduled volumes. FERC’s market manipulation regulations, promulgated pursuant to the Energy Policy Act of 2005 (the “EPAct 2005”), make it unlawful for any entity, directly or indirectly in connection with the purchase or sale of natural gas subject to the jurisdiction of FERC, or the purchase or sale of transportation services subject to the jurisdiction of FERC, to (1) use or employ any device, scheme, or artifice to defraud; (2) make any untrue statement of material fact or omit to state a material fact necessary to make the statements made not misleading (in light of the circumstances under which the statements were made); or (3) engage in any act, practice, or course of business that operates (or would operate) as a fraud or deceit upon any person. The EPAct 2005 also amends the NGA and the Natural Gas Policy Act of 1978 (“NGPA”) to give FERC authority to impose civil penalties for violations of these statutes up to $1.0 million per day per violation for violations occurring after August 8, 2005. The maximum penalty authority established by the statute has been adjusted to approximately $1.3 million per day per violation and will continue to be adjusted periodically for inflation. Should we fail to comply with all applicable FERC-administered statutes, rules, regulations, and orders, we could be subject to substantial penalties and fines.

Certain of our intrastate natural gas pipelines also transport gas in interstate commerce and, thus, the rates, terms and conditions of such services are subject to FERC jurisdiction under Section 311 of the NGPA (“Section 311”). Pipelines providing transportation service under Section 311 are required to provide services on an open and nondiscriminatory basis, and the maximum rates for interstate transportation services provided by such pipelines must be “fair and equitable.” Such rates are generally subject to review every five years by FERC or by an appropriate state agency.

In addition to Section 311 regulation, our intrastate natural gas pipeline operations are subject to regulation by various state agencies. Most state agencies possess the authority to review and authorize natural gas transportation transactions and the

23

construction, acquisition, abandonment, and interconnection of physical facilities for intrastate pipelines. State agencies also may regulate transportation rates, service terms, and conditions and contract pricing.

Liquids Pipeline Regulation. We own certain liquids and crude oil pipelines that are regulated by FERC as common carrier interstate pipelines under the Interstate Commerce Act (“ICA”), the Energy Policy Act of 1992, and related rules and orders.