UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013 |

OR |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number: 000-50067

CROSSTEX ENERGY, L.P.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State of organization) | | 16-1616605 (I.R.S. Employer Identification No.) |

2501 CEDAR SPRINGS DALLAS, TEXAS (Address of principal executive offices) | | 75201 (Zip Code) |

(Registrant's telephone number, including area code)

(214) 953-9500

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: |

| | |

Title of Each Class | | Name of Exchange on which Registered |

Common Units Representing Limited Partnership Interests | | The NASDAQ Global Select Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None.

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the Common Units representing limited partner interests held by non-affiliates of the registrant was approximately $1,263,121,436 on June 30, 2013, based on $20.32 per unit, the closing price of the Common Units as reported on The NASDAQ Global Select Market on such date.

At February 14, 2014, there were 91,534,187 common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

TABLE OF CONTENTS

CROSSTEX ENERGY, L.P.

PART I

Item 1. Business

General

Crosstex Energy, L.P. is a publicly traded Delaware limited partnership formed in 2002. Our common units are traded on The NASDAQ Global Select Market under the symbol "XTEX". Our business activities are conducted through our subsidiary, Crosstex Energy Services, L.P., a Delaware limited partnership (the "Operating Partnership"), and the subsidiaries of the Operating Partnership. Our executive offices are located at 2501 Cedar Springs, Dallas, Texas 75201, and our telephone number is (214) 953-9500. Our Internet address is www.crosstexenergy.com. We post the following filings in the "Investors" section of our website as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission: our annual report on Form 10-K; our quarterly reports on Form 10-Q; our current reports on Form 8-K; and any amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings on our website are available free of charge. In this report, the terms "Partnership" and "Registrant," as well as the terms "our," "we," "us" and "its," are sometimes used as abbreviated references to Crosstex Energy, L.P. itself or Crosstex Energy, L.P. together with its consolidated subsidiaries, including the Operating Partnership.

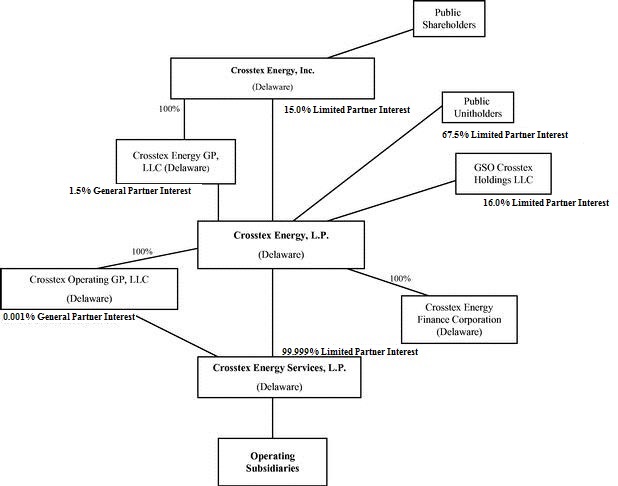

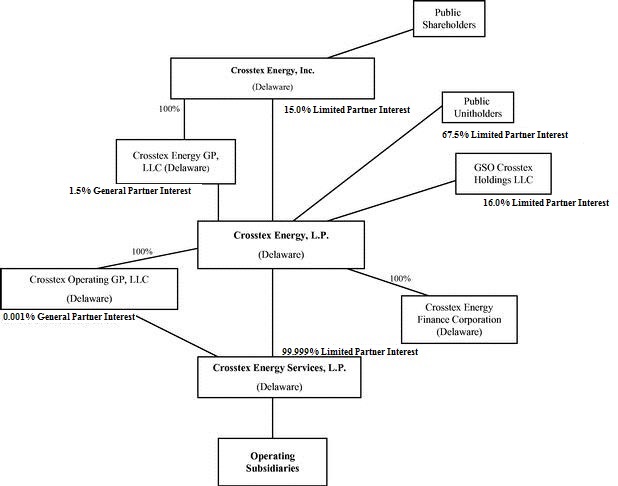

Crosstex Energy GP, LLC, a Delaware limited liability company, is our general partner. Crosstex Energy GP, LLC manages our operations and activities. Crosstex Energy GP, LLC is a wholly owned subsidiary of Crosstex Energy, Inc., or CEI. Crosstex Energy, Inc.'s shares are traded on The NASDAQ Global Select Market under the symbol "XTXI."

The following diagram depicts the organization and ownership of the Partnership as of December 31, 2013.

The following terms as defined generally are used in the energy industry and in this document:

/d = per day

Bbls = barrels

Bcf = billion cubic feet

Btu = British thermal units

CO2= Carbon dioxide

Gal = gallon

Mcf = thousand cubic feet

MMBtu = million British thermal units

MMcf = million cubic feet

NGL = natural gas liquid and natural gas liquids

Capacity volumes for our facilities are measured based on physical volume and stated in cubic feet (Bcf, Mcf or MMcf). Throughput volumes are measured based on energy content and stated in British thermal units (Btu or MMBtu). A volume capacity of 100 MMcf generally correlates to volume capacity of 100,000 MMBtu. Fractionated volumes are measured based on physical volumes and stated in gallons (Gal). Crude oil, condensate and brine services volumes are measured based on physical volume and stated in barrels (Bbls).

Our Operations

We are a Delaware limited partnership formed on July12, 2002. We primarily focus on providing midstream energy services, including gathering, transmission processing, fractionation and marketing, to producers of natural gas, NGLs, crude oil and condensate. We also provide crude oil, condensate and brine services to producers. Our midstream energy asset network includes approximately 3,600 miles of pipelines, nine natural gas processing plants, four fractionators, 3.1 million barrels of NGL cavern storage, rail terminals, barge terminals, truck terminals and a fleet of approximately 100 trucks. We manage and report our activities primarily according to geography. We have five reportable segments: (1) South Louisiana processing, crude and NGL, or PNGL, which includes our processing and NGL assets in south Louisiana; (2) Louisiana, or LIG, which includes our pipelines and processing plants located in Louisiana; (3) North Texas, or NTX, which includes our activities in the Barnett Shale and the Permian Basin; (4) Ohio River Valley, or ORV, which includes our activities in the Utica and Marcellus Shales; and (5) Corporate Segment, or Corporate, which includes our equity investment in Howard Energy Partners, or HEP, in the Eagle Ford Shale and our general partnership property and expenses. See Note 12 to the consolidated financial statements for financial information about these operating segments.

We connect the wells of natural gas producers in our market areas to our gathering systems, process natural gas for the removal of NGLs, fractionate NGLs into purity products and market those products for a fee, transport natural gas and ultimately provide natural gas to a variety of markets. We purchase natural gas from natural gas producers and other supply sources and sell that natural gas to utilities, industrial consumers, other marketers and pipelines. We operate processing plants that process gas transported to the plants by major interstate pipelines or from our own gathering systems under a variety of fee arrangements. We provide a variety of crude oil and condensate services throughout the ORV which include crude oil and condensate gathering via pipelines, barges, rail and trucks and oilfield brine disposal. We also have crude oil and condensate terminal facilities in south Louisiana that provide access for crude oil and condensate producers to the premium markets in this area. Our gas gathering systems consist of networks of pipelines that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission. Our transmission pipelines primarily receive natural gas from our gathering systems and from third party gathering and transmission systems and deliver natural gas to industrial end-users, utilities and other pipelines. We also have NGL transmission lines that transport NGLs from east Texas and our south Louisiana processing plants to our fractionators in south Louisiana. Our crude oil and condensate gathering and transmission systems consist of trucking facilities, pipelines, rail and barges that, in exchange for a fee, transport oil from a producer site to an end user. Our processing plants remove NGLs and CO2 from a natural gas stream and our fractionators separate the NGLs into separate NGL products, including ethane, propane, iso-butane, normal butane and natural gasoline.

Our assets include the following:

| |

• | North Texas Assets (including Permian Basin assets). Our north Texas assets consist of gathering systems with total capacity of approximately 1.1 Bcf/d, processing facilities with a total processing capacity of approximately 315 MMcf/d and a transmission pipeline with a capacity of approximately 375 MMcf/d. |

| |

• | LIG System. Our LIG system is one of the largest intrastate pipeline systems in Louisiana, consisting of approximately 2,000 miles of mainly transmission pipelines extending from the Haynesville Shale in north Louisiana to onshore production in south central and southeast Louisiana which have approximately 2.0 Bcf/d of |

capacity. The LIG system also includes processing facilities with a total processing capacity of 335 MMcf/d and 10,800 Bbls/d of NGL fractionation capcity.

| |

• | South Louisiana Processing and NGL Assets. Our south Louisiana natural gas processing and liquid assets include approximately 1.4 Bcf/d of processing capacity, 83,000 Bbls/d of fractionation capacity, 3.1 million barrels of underground NGL storage, 570 miles of liquids transport lines and a crude oil terminal with a total capacity of 15,600 Bbls/d. |

| |

• | Ohio River Valley Assets. Our Ohio River Valley assets include a 4,500-barrel-per-hour crude oil and condensate barge loading terminal on the Ohio River, a 20-spot operation crude oil and condensate rail loading terminal on the Ohio Central Railroad network and approximately 200 miles of crude oil and condensate pipelines in Ohio and West Virginia. The assets also include 500,000 barrels of above ground storage and a trucking fleet of approximately 100 vehicles comprised of both semi and straight trucks. We have eight existing brine disposal wells with an injection capacity of approximately 10,000 Bbls/d. We currently hold one additional brine well permit in Ohio. |

Our Business Strategy

Our business strategy consists of two overarching objectives, which are to maximize earnings and growth of our existing businesses and enhance the scale and diversification of our assets. As part of enhancing our scale and diversification, we have concentrated on expanding our NGL business, growing a crude oil and condensate business and developing our gas processing and transportation business in rich gas areas. We believe increasing our scale and diversification will strengthen us as a company because we believe it will lead to less reliance on any single geographic area, provide us with a better balance between business driven by crude oil and natural gas, offer us greater opportunities from a broader asset base and provide us with more sustainable fee-based cash flows.

Our strategies include the following:

| |

• | Maximize earnings and growth of our existing businesses. We intend to leverage our franchise position, infrastructure and customer relationships in our existing areas of operation by expanding our existing systems to meet new or increased demand for our gathering, transmission, processing and marketing services. |

| |

• | Enhance the scale and diversification of our assets. We look to grow and diversify our business through acquiring and/or building assets in new areas that will serve as a platform for future growth with a focus on emerging shale plays and other areas with NGL, crude oil and condensate exposure. |

Devon Energy Transaction

On October 21, 2013, the Partnership and the Operating Partnership entered into a Contribution Agreement (the “Contribution Agreement”) with Devon Energy Corporation (“Devon”) and certain of its wholly-owned subsidiaries pursuant to which two of Devon’s subsidiaries would contribute to the Operating Partnership 50% of the outstanding equity interests in EnLink Midstream Holdings, LP (formerly known as Devon Midstream Holdings, L.P.), a wholly-owned subsidiary of Devon referred to herein as “Midstream Holdings,” and all of the outstanding equity interests in EnLink Midstream Holdings GP, LLC (formerly known as Devon Midstream Holdings GP, L.L.C.), the general partner of Midstream Holdings (“Midstream Holdings GP” and, together with Midstream Holdings and their subsidiaries, the “Midstream Group Entities”) in exchange for the issuance by the Partnership of 120,542,441 units representing a new class of limited partnership interests in the Partnership (collectively, the “Contribution”) with a value of approximately $2.4 billion based on the volume weighted average closing prices of our common units for the 20 trading days prior to the announcement of the transaction. Upon completion of the Contribution, Devon and its affiliates will own approximately 53% of the limited partner interests in the Partnership, with approximately 39% of the outstanding limited partner interests held by the Partnership's public unitholders and approximately 7% of the outstanding limited partner interests (and the approximate 1% general partner interest) held indirectly by EnLink Midstream (as defined below).

The Midstream Group Entities own Devon’s midstream assets in the Barnett Shale in North Texas, the Cana and Arkoma Woodford Shales in Oklahoma and Devon’s interest in Gulf Coast Fractionators in Mont Belvieu, Texas. These assets consist of natural gas gathering and transportation systems, natural gas processing facilities and NGL fractionation facilities located in Texas and Oklahoma. Midstream Holdings' primary assets consist of three processing facilities with 1.3 Bcf/d of natural gas processing capacity, approximately 3,685 miles of pipelines with aggregate capacity of 2.9 Bcf/d and fractionation facilities with up to 160 MBbls/d of aggregate NGL fractionation capacity.

In connection with the Contribution Agreement, CEI entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Devon and certain of its wholly-owned subsidiaries, EnLink Midstream, LLC (formerly known as New Public Rangers, L.L.C.), a holding company newly formed by Devon (“EnLink Midstream”), Rangers Merger Sub, Inc., a wholly-owned subsidiary of EnLink Midstream (“Rangers Merger Sub”), and Boomer Merger Sub, Inc., a wholly-owned subsidiary of EnLink Midstream

(“Boomer Merger Sub”), pursuant to which Rangers Merger Sub will merge with and into CEI, and Boomer Merger Sub will merge with and into Acacia Natural Gas Corp I, Inc., a wholly-owned subsidiary of Devon ("New Acacia") (collectively, the “Mergers”), with CEI and New Acacia surviving as wholly-owned subsidiaries of EnLink Midstream. New Acacia owns the remaining 50% limited partner interest in Midstream Holdings. Devon will own the managing member of EnLink Midstream, and EnLink Midstream will indirectly own 100% of our general partner.

The closing of the Contribution is subject to the satisfaction of a number of conditions, including, but not limited to, the closing of the Mergers. The Merger is subject to customary closing conditions, including the approval of the proposal to adopt the merger agreement by the holders of at least 67% of the issued and outstanding shares of CEI's common stock entitled to vote as of the record date for the special meeting. The special meeting is scheduled to take place on March 7, 2014. The Contribution Agreement also contains customary termination provisions and will automatically terminate upon any termination of the Merger Agreement.

Recent Growth Developments

Cajun-Sibon Phases I and II. In Louisiana, we are transforming our business that historically has been focused on processing offshore natural gas to a business that is focused on NGLs with additional opportunities for growth from new onshore supplies of NGLs. The Louisiana petrochemical market historically has relied on liquids from offshore production; however, the decrease in offshore production and increase in onshore rich gas production have changed the market structure. Cajun-Sibon Phases I and II will work to bridge the gap between supply, which aggregates in the Mont Belvieu area, and demand, located in the Mississippi River corridor of Louisiana, thereby building a strategic NGL position in this region.

We began this transformation by restarting our Eunice fractionator during 2011 at a rate of 15,000 Bbls/d of NGLs. We expanded the Eunice fractionator to a rate of 55,000 Bbls/d with Cajun-Sibon Phase I ("Phase I"). Phase I of our pipeline extension project was completed in November 2013 and connects Mont Belvieu supply lines in east Texas to Eunice, providing a direct link to our fractionators in south Louisiana markets. The Phase I Eunice fractionator expansion, which also was completed in early November 2013, has increased our interconnected fractionation capacity in Louisiana to approximately 97,000 Bbls/d of raw-make NGLs.

The Phase I expansion added 130-miles of 12-inch diameter pipeline to our existing 440-mile Cajun-Sibon NGL pipeline system, connecting Mont Belvieu to our Eunice fractionator. The pipeline currently has a capacity of 70,000 Bbls/d for raw make NGLs. The Phase I NGL pipeline extension originates from interconnects with major Mont Belvieu supply pipelines and provides connections for NGLs from the Permian Basin, Barnett Shale, Eagle Ford and other areas to our NGL fractionation facilities and key NGL markets in south Louisiana. Phase I is anchored by a five year ethane sales agreement with Williams Olefins, a subsidiary of the Williams Companies and a five year natural gasoline sales agreement with another company. We have entered into contracts of various lengths for all other purity products.

We have commenced construction of Cajun-Sibon Phase II which will further enhance our Louisiana NGL business with significant additions to the Cajun-Sibon Phase I infrastructure including further fractionation expansion. Phase II will include the addition of four pumping stations, totaling 13,400 horsepower, that will facilitate increasing NGL supply capacity from Phase I's 70,000 Bbls/d to 120,000 Bbls/d; the construction of a new 100,000 Bbls/d fractionator at the Plaquemine gas processing plant site; the conversion of our Riverside fractionator to a butane-and-heavier facility; and the construction of 57 miles of NGL pipeline that will originate at the Eunice fractionator and connect to the new Plaquemine fractionator, which will provide optionality to move purity products around the Louisiana-liquids market. We will also construct a 32-mile, 16-inch diameter extension of LIG's Bayou Jack lateral, which will provide gas services to customers in the Mississippi River corridor, replacing the conversion of supply lines that we currently use for liquid service. We expect Phase II will be in service during the second half of 2014.

Phase II is anchored by10-year sales agreements with Dow Hydrocarbons and Resources, or Dow, to deliver up to 40,000 Bbls/d of ethane and 25,000 Bbls/d of propane produced at our new Plaquemine fractionator into Dow's Louisiana pipeline system. We will also deliver 70,000 MMBtu/d of natural gas to Dow's Plaquemine facility.

We believe the Cajun-Sibon project not only represents a tremendous growth step by leveraging our Louisiana assets, but that it also creates a significant platform for continued growth of our NGL business. We believe this project, along with our existing assets, will provide a number of additional opportunities to grow this business, including expanding market optionality and connectivity, upgrading products, expanding rail imports, exporting NGLs and expanding fractionation and product storage capacity.

Bearkat Natural Gas Gathering and Processing System. In the fourth quarter of 2013, we commenced construction of a new natural gas processing complex and rich gas gathering pipeline system in the Permian Basin. The initial construction included treating, processing and gas takeaway solutions for regional producers. The project, which will be fully owned by us, is supported by a 10-year, fee-based contract.

The new-build processing complex, called Bearkat, will be strategically located near our existing Deadwood joint venture assets in Glasscock County, Texas. The processing plant will have an initial capacity of 60 MMcf/d, increasing the Partnership’s total operated processing capacity in the Permian to approximately 115 MMcf/d. We will also construct a 30-mile high-pressure gathering system upstream of the Bearkat complex to provide additional gathering capacity for producers in Glasscock and Reagan Counties. The entire project is scheduled to be completed in the second half of 2014.

Permian Pipeline Extension Project. In February 2014, the Partnership entered into an agreement to construct a new 35-mile, 12-inch diameter high-pressure pipeline that will provide critical gathering capacity for the aforementioned Bearkat natural gas processing complex. The pipeline will have a capacity of approximately 100 MMcf/d and will provide gas takeaway solutions for constrained producer customers in Howard, Martin and Glasscock counties. Right-of-way acquisition is underway and the pipeline is expected to be operational in the second half of 2014.

Riverside Crude Facility Expansion. In June 2013, we completed the Phase II expansion of our Riverside facility located on the Mississippi River in southern Louisiana. The Riverside facility’s capacity to transload crude oil and condensate from railcars to our barge facility increased to approximately 15,000 Bbls/d of crude oil and condensate. Phase II additions to the Riverside facility include a 100,000 barrel above-ground crude oil and condensate storage tank, a rail spur with a 26-spot crude railcar unloading rack and a crude oil and condensate offloading facility with pumps and metering as well as a truck unloading bay. As part of the Phase II expansion, the Riverside facility was modified so that sour crude can be unloaded in addition to sweet crude.

Our Assets

North Texas Assets (including Permian Basin assets). Our gathering systems in north Texas, or NTG, consist of approximately 715 miles of gathering lines that had an average throughput of approximately 700,000 MMBtu/d for the year ended December 31, 2013. Our processing facilities in north Texas include three gas processing plants with total processing throughput that averaged 382,000 MMBtu/d for the year ended December 31, 2013. Our transmission asset, referred to as the North Texas Pipeline, or NTPL, is a 140-mile pipeline from an area near Fort Worth, Texas to a point near Paris, Texas and related facilities. The NTPL connects production from the Barnett Shale to markets in north Texas accessed by the Natural Gas Pipeline Company of America, LLC, Kinder Morgan, Inc., Houston Pipeline Company, L.P., Atmos Energy Corporation and Gulf Crossing Pipeline Company, LLC. For the year ended December 31, 2013, the average throughput on the NTPL was approximately 342,000 MMBtu/d.

Our north Texas segment also includes our Deadwood natural gas processing plant and our Mesquite Terminal and fractionator that comprise our Permian Basin assets. We have a 50% undivided working interest in the Deadwood processing facility which is located in Glasscock County, Texas. The Deadwood plant is supported by acreage dedication from a major producer in the Permian Basin. The Deadwood processing facility has a total capacity of 58 MMcf/d and total processing throughput that averaged 66,000 MMBtu/d for the year ended December 31, 2013. The Mesquite Terminal is located in Midland County and serves as a terminal for third party raw-make NGLs. We are also transloading crude oil at this facility.

LIG Assets. The LIG gathering and transmission pipeline system is comprised of a north and south system and had an average throughput of approximately 473,000 MMbtu/d for the year ended December 31, 2013. The southern part of our LIG system has a capacity in excess of 1.5 Bcf/d and approximately 1,125 miles of pipeline. The south system also includes two operating, on-system processing plants, our Plaquemine and Gibson plants, with an average throughput of 255,000 MMBtu/d for the year ended December 31, 2013. The Plaquemine plant also has a fractionation capacity of 10,800 Bbls/d of raw-make NGL products, and total volume for fractionated liquids at Plaquemine averaged approximately 4,800 Bbls/d for the year ended December 31, 2013. The south system has access to both rich and lean gas supplies from onshore production in south central and southeast Louisiana. LIG has a variety of transportation and industrial sales customers in the south, with the majority of its sales being made into the industrial Mississippi River corridor between Baton Rouge and New Orleans.

Our LIG system in the north, comprised of approximately 800 miles of pipeline, serves the natural gas fields south of Shreveport, Louisiana and extends into the Haynesville Shale gas play in north Louisiana. The north Louisiana system has a capacity of 465 MMcf/d and interconnects with interstate pipelines of ANR Pipeline, Columbia Gulf Transmission, Texas Gas Transmission, Trunkline Gas and Tennessee Gas Pipeline. We have a substantial number of firm transportation agreements on the north system with weighted average lives of approximately 4.3 years. Our north Louisiana system is connected to our south Louisiana system and has the capacity to move approximately 145 MMcf/d of gas to our markets in the south.

In August 2012, a slurry-filled sinkhole developed in Assumption Parish near Bayou Corne, Louisiana and in the vicinity of certain of our pipelines and our underground storage reservoir located in Napoleonville, Louisiana. The cause of the slurry is currently under investigation by Louisiana state and local officials. Consequently, we took a section of our 36-inch-diameter natural gas pipeline located near the sinkhole out of service. Service to certain markets, primarily in the Mississippi River area, has been curtailed or interrupted, and we have worked with our customers to secure alternative natural gas supplies so that

disruptions are minimized. We are currently in the initial phase of constructing the replacement pipeline in our rerouted location and anticipate the re-route to be completed during the first half of 2014. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Changes in Operations During 2013 and 2012" for further information about this matter.

PNGL Assets. Our south Louisiana natural gas processing and liquids assets include processing and fractionation capabilities, underground storage and approximately 570 miles of liquids transport lines. Total processing throughput averaged 399,000 MMBtu/d and fractionated barrels averaged 27,300 Bbls/d for the year ended December 31, 2013.

| |

• | NGL Assets. Our NGL assets include our Eunice fractionation facility, our Riverside fractionation plant, our Cajun-Sibon pipeline system and our Napoleonville storage facility. |

| |

• | Eunice Fractionation Facility. The Eunice fractionation facility is located in south central Louisiana and was restarted in 2011 to take advantage of the activity around liquids rich shale-plays, including the Eagle Ford, Permian, Granite Wash, Marcellus and Utica plays. The Eunice fractionation facility has a capacity of 55,000 Bbls/d of liquid products, including ethane, propane, iso-butane, normal butane and natural gasoline, and is directly connected to the southeast propane market and pipelines to the Anse La Butte storage facility. The plant fractionated 5,100 Bbls/d of liquids during 2013. Our Plaquemine facility is connected to the PNGL system, which gives us operational flexibility, increased fractionation capacity and the ability to capture new NGL-related business. See "Recent Growth Developments" for a discussion of the Eunice expansion in conjunction with the Cajun-Sibon project. |

| |

• | Riverside Fractionation Plant. The Riverside fractionator and loading facility is located on the Mississippi River upriver from Geismar, Louisiana. The Riverside plant has a fractionation capacity of approximately 28,000 Bbls/d of liquids delivered by the Cajun-Sibon pipeline system from the Eunice, Pelican and Blue Water processing plants or by truck and rail. The Riverside facility has above-ground storage capacity of approximately 233,000 Bbls. The loading/unloading facility has the capacity to transload 15,000 Bbls/d of crude oil and condensate from rail cars to barges. Total volumes for fractionated liquids at Riverside averaged 22,200 Bbls/d for the year ended December 31, 2013. See "Recent Growth Developments" for discussion of the expansion at Riverside in conjunction with the Cajun-Sibon project. |

| |

• | Cajun-Sibon Pipeline System. Currently, the Cajun-Sibon pipeline system consists of approximately 570 miles of raw make NGL pipelines ranging in size from 4" to 12" with a current system capacity of approximately 70,000 Bbls/d. The pipelines transport unfractionated NGLs, referred to as raw make, from areas such as the Liberty, Texas interconnects near Mont Belvieu and from our Eunice and Pelican processing plants in south Louisiana to either the Riverside or Eunice fractionators or to third party fractionators when necessary. See "Recent Growth Developments" for information regarding the expansion of this pipeline system. |

| |

• | Napoleonville Storage Facility. The Napoleonville NGL storage facility is connected to the Riverside facility and has a total capacity of 3.1 million barrels of underground storage comprised of two existing caverns. The caverns are currently operated in propane and butane service, and space is leased to customers for a fee. |

| |

• | Processing Assets. Our processing assets include our Pelican processing plant, our Eunice processing plant and our Blue Water gas processing plant. |

| |

• | Pelican Processing Plant. The Pelican processing plant complex is located in Patterson, Louisiana and has a designed capacity of 600 MMcf/d of natural gas. For the year ended December 31, 2013, the plant processed approximately 334,000 MMBtu/d. The Pelican plant is connected with continental shelf and deepwater production and has downstream connections to the ANR Pipeline. This plant has an interconnection with the LIG pipeline so we can process natural gas from the LIG system at our Pelican plant when markets are favorable. |

| |

• | Eunice Processing Plant. The Eunice processing plant is located in south central Louisiana, has a capacity of 475 MMcf/d and processed approximately 31,000 MMBtu/d for the year ended December 31, 2013. The plant is connected to onshore gas supply as well as continental shelf and deepwater gas production and has downstream connections to the ANR Pipeline, Florida Gas Transmission and Texas Gas Transmission. In August 2013, we shut down the Eunice processing plant |

due to adverse economics driven by low NGL prices and low processing volumes, which we do not see improving in the near future based on forecasted price curves.

| |

• | Blue Water Gas Processing Plant. We own a 64.29% interest in the Blue Water gas processing plant and operate the plant. The Blue Water plant is located in Crowley, Louisiana and is connected to the Blue Water pipeline system. The plant has a net capacity to our interest of approximately 300 MMcf/d. The plant is not expected to operate in the future unless fractionation spreads are favorable and volumes are sufficient to run the plant. |

Ohio River Valley Assets. Our Ohio River Valley assets include a 4,500-barrel-per-hour crude oil and condensate barge loading terminal on the Ohio River, a 20-spot crude oil and condensate rail loading terminal on the Ohio Central Railroad network and approximately 200 miles of crude oil and condensate pipelines in Ohio and West Virginia. The assets also include 500,000 barrels of above ground storage and a trucking fleet of approximately 100 vehicles comprised of both semi and straight trucks with a current capacity of 25,000 Bbls/d. Total crude oil and condensate handled averaged approximately 11,000 Bbls/d for the year ended December 31, 2013. We have eight existing brine disposal wells with an injection capacity of approximately 10,000 Bbls/d and an average disposal rate of 7,000 Bbls/d for the year ended December 31, 2013. We currently hold one additional well permit in Ohio.

Investment in Limited Liability Company. In 2011 and 2012, we made capital contributions totaling $87.3 million to HEP in exchange for an individual ownership interest in HEP. HEP owns midstream assets and provides midstream and construction services to Eagle Ford Shale producers and is continuing to expand its midstream assets in the area. As of December 31, 2013, we owned a 30.6% interest in HEP and accounted for this investment under the equity method of accounting. In December 2013, Alinda Capital Partners acquired a 59 percent capital interest in HEP from Quanta Capital Solutions and GE Energy Financial Services. We contributed an additional $30.6 million to HEP during the year ended December 31, 2013 to fund our 30.6% share of HEP’s expansion costs. We also received cash distributions totaling $17.5 million from HEP during the year ended December 31, 2013. Our investment in HEP is included in our Corporate segment.

Industry Overview

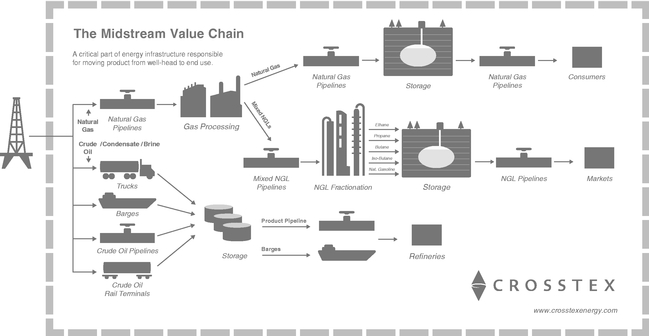

The following diagram illustrates the gathering, processing, fractionation and transmission process.

The midstream industry is the link between the exploration and production of natural gas, crude oil and condensate and the delivery of its components to end-user markets. The midstream industry is generally characterized by regional competition based on the proximity of gathering systems and processing plants to natural gas, crude oil and condensate producing wells.

Natural gas gathering. The natural gas gathering process follows the drilling of wells into gas-bearing rock formations. After a well has been completed, it is connected to a gathering system. Gathering systems typically consist of a network of small diameter pipelines and, if necessary, compression and treating systems that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission.

Compression. Gathering systems are operated at pressures that will maximize the total natural gas throughput from all connected wells. Because wells produce gas at progressively lower field pressures as they age, it becomes increasingly difficult to deliver the remaining production in the ground against the higher pressure that exists in the connected gathering system. Natural gas compression is a mechanical process in which a volume of gas at an existing pressure is compressed to a desired higher pressure, allowing gas that no longer naturally flows into a higher-pressure downstream pipeline to be brought to market. Field compression is typically used to allow a gathering system to operate at a lower pressure or provide sufficient discharge pressure to deliver gas into a higher-pressure downstream pipeline. The remaining natural gas in the ground will not be produced if field compression is not installed because the gas will be unable to overcome the higher gathering system pressure. In contrast, a declining well can continue delivering natural gas if the field compression is installed.

Natural gas processing. The principal components of natural gas are methane and ethane, but most natural gas also contains varying amounts of heavier NGLs and contaminants, such as water and CO2, sulfur compounds, nitrogen or helium. Natural gas produced by a well may not be suitable for long-haul pipeline transportation or commercial use and may need to be processed to remove the heavier hydrocarbon components and contaminants. Natural gas in commercial distribution systems mostly consists of methane and ethane, and moisture and other contaminants have been removed so there are negligible amounts of them in the gas stream. Natural gas is processed to remove unwanted contaminants that would interfere with pipeline transportation or use of the natural gas and to separate those hydrocarbon liquids from the gas that have higher value as NGLs. The removal and separation of individual hydrocarbons through processing is possible due to differences in weight, boiling point, vapor pressure and other physical characteristics. Natural gas processing involves the separation of natural gas into pipeline-quality natural gas and a mixed NGL stream and the removal of contaminants.

NGL fractionation. NGLs are separated into individual, more valuable components during the fractionation process. NGL fractionation facilities separate mixed NGL streams into discrete NGL products: ethane, propane, isobutane, normal butane, natural gasoline and stabilized crude oil and condensate. Ethane is primarily used in the petrochemical industry as feedstock for ethylene, one of the basic building blocks for a wide range of plastics and other chemical products. Propane is used as a petrochemical feedstock in the production of ethylene and propylene and as a heating fuel, an engine fuel and industrial fuel. Isobutane is used principally to enhance the octane content of motor gasoline. Normal butane is used as a petrochemical feedstock in the production of ethylene and butylene (a key ingredient in synthetic rubber), as a blend stock for motor gasoline and to derive isobutene through isomerization. Natural gasoline, a mixture of pentanes and heavier hydrocarbons, is used primarily as motor gasoline blend stock or petrochemical feedstock.

Natural gas transmission. Natural gas transmission pipelines receive natural gas from mainline transmission pipelines, processing plants and gathering systems and deliver it to industrial end-users, utilities and to other pipelines.

Crude oil and condensate transmission. Crude oil and condensate are transported by pipelines, barges, rail cars and tank trucks. The method of transportation used depends on, among other things, the resources of the transporter, the locations of the production points and the delivery points, cost-efficiency and the quantity of product being transported.

Brine gathering and disposal services. Typically, shale wells produce significant amounts of water that, in most cases, require disposal. Produced water and frac-flowback is hauled via truck transport or is pumped through pipelines from its origin at the oilfield tank battery or drilling pad to the disposal location. Once the water reaches the delivery disposal location, water is processed and filtered to remove impurities and injection wells place fluids underground for storage and disposal.

Crude oil and condensate terminals. Crude oil and condensate rail terminals are an integral part of ensuring the movement of new crude oil and condensate production from the developing shale plays in the United States and Canada. In general, the crude oil and condensate rail loading terminals are used to load rail cars and transport the commodity out of developing basins into market rich areas of the country where crude oil and condensate rail unloading terminals are used to unload rail cars and store crude oil and condensate volumes for third parties until the crude oil and condensate is redelivered to premium markets via pipelines, trucks or rail to delivery points.

Balancing Supply and Demand

When we purchase natural gas, crude oil and condensate, we establish a margin normally by selling it for physical delivery to third-party users. We can also use over-the-counter derivative instruments or enter into future delivery obligations under futures contracts on the New York Mercantile Exchange (the "NYMEX") related to our natural gas purchases. Through these transactions, we seek to maintain a position that is balanced between purchases, on the one hand, and sales or future

delivery obligations, on the other hand. Our policy is not to acquire and hold natural gas futures contracts or derivative products for the purpose of speculating on price changes.

Competition

The business of providing gathering, transmission, processing and marketing services for natural gas, NGLs, crude oil and condensate is highly competitive. We face strong competition in obtaining natural gas, NGLs, crude oil and condensate supplies and in the marketing and transportation of natural gas, NGLs, crude oil and condensate. Our competitors include major integrated and independent exploration and production crude oil and condensate companies, natural gas producers, interstate and intrastate pipelines, other natural gas and crude oil and condensate gatherers and natural gas processors. Competition for natural gas and crude oil supplies is primarily based on geographic location of facilities in relation to production or markets, the reputation, efficiency and reliability of the gatherer and the pricing arrangements offered by the gatherer. Many of our competitors offer more services or have greater financial resources and access to larger natural gas, NGLs, crude oil and condensate supplies than we do. Our competition varies in different geographic areas.

In marketing natural gas and NGLs, we have numerous competitors, including marketing affiliates of interstate pipelines, major integrated oil and gas companies, and local and national natural gas producers, gatherers, brokers and marketers of widely varying sizes, financial resources and experience. Local utilities and distributors of natural gas are, in some cases, engaged directly and through affiliates in marketing activities that compete with our marketing operations.

We face strong competition for acquisitions and development of new projects from both established and start-up companies. Competition increases the cost to acquire existing facilities or businesses and results in fewer commitments and lower returns for new pipelines or other development projects. Many of our competitors have greater financial resources or lower cost of capital or are willing to accept lower returns or greater risks. Our competition differs by region and by the nature of the business or the project involved.

Natural Gas, NGL, Crude Oil and Condensate Supply

Our gathering and transmission pipelines have connections with major intrastate and interstate pipelines, which we believe have ample natural gas and NGLs supplies in excess of the volumes required for the operation of these systems. Our Ohio River Valley pipeline, terminals, trucks and storage facilities are strategically located in oil and condensate producing regions. We evaluate well and reservoir data that is either publicly available or furnished by producers or other service providers in connection with the construction and acquisition of our gathering systems and assets to determine the availability of natural gas, NGL, crude oil and condensate supply for our systems and assets and/or obtain a minimum volume commitment from the producer that results in a rate of return on investment. We do not routinely obtain independent evaluations of reserves dedicated to our systems and assets due to the cost and relatively limited benefit of such evaluations. Accordingly, we do not have estimates of total reserves dedicated to our systems and assets or the anticipated life of such producing reserves.

Credit Risk and Significant Customers

We are diligent in attempting to ensure that we issue credit to only credit-worthy customers. However, our purchase and resale of oil, gas and other products exposes us to significant credit risk, as the margin on any sale is generally a very small percentage of the total sale price. Therefore, a credit loss can be very large relative to our overall profitability.

During the year ended December 31, 2013, we had only one customer, Dow, which represented greater than 10.0% of our revenue. While this customer represented 12.6% of consolidated revenues, the loss of this customer would not have a material impact on our results of operations because the gross operating margins received from transactions with this customer are not material to our total gross operating margin, and we believe the sales to this customer could be replaced with other buyers at comparable sales prices.

Regulation

Interstate Natural Gas Pipelines Regulation. We do not own any interstate natural gas pipelines, so the Federal Energy Regulatory Commission, or FERC, does not directly regulate our natural gas operations under the National Gas Act, or NGA. However, FERC's regulation of interstate natural gas pipelines influences certain aspects of our business and the market for our products. In general, FERC has authority over natural gas companies that provide natural gas pipeline transportation services in interstate commerce and its authority to regulate those services includes:

| |

• | the certification and construction of new facilities; |

| |

• | the extension or abandonment of services and facilities; |

| |

• | the maintenance of accounts and records; |

| |

• | the acquisition and disposition of facilities; |

| |

• | maximum rates payable for certain services; and |

| |

• | the initiation and discontinuation of services. |

While we do not own any interstate natural gas pipelines, we do transport gas in interstate commerce. The rates, terms and conditions of service under which we transport natural gas in our pipeline systems in interstate commerce are subject to FERC jurisdiction under Section 311 of the Natural Gas Policy Act, or NGPA. The maximum rates for services provided under Section 311 of the NGPA may not exceed a "fair and equitable rate," as defined in the NGPA. The rates are generally subject to review every three years by FERC or by an appropriate state agency. The inability to obtain approval of rates at acceptable levels could result in refund obligations, the inability to achieve adequate returns on investments in new facilities and the deterrence of future investment or growth of the regulated facilities.

Liquids Pipelines Regulation. We own liquids transportation, storage and other assets in the Ohio River Valley, including certain assets providing common carrier interstate service subject to regulation by FERC under the Interstate Commerce Act, or ICA, the Energy Policy Act of 1992 and related rules and orders. Our Cajun-Sibon NGL pipeline became subject to FERC regulation as a result of our Phase I expansion, which went into operation in November 2013. The expansion is subject to regulation by FERC as a common carrier under the ICA, the Energy Policy Act of 1992 and related rules and orders.

FERC regulation requires that interstate liquids pipeline rates and terms and conditions of service, including rates for transportation of crude oil and NGLs, be filed with FERC and that these rates and terms and conditions of service be "just and reasonable" and not unduly discriminatory or unduly preferential.

Rates of interstate liquids pipelines are currently regulated by FERC primarily through an annual indexing methodology, under which pipelines increase or decrease their rates in accordance with an index adjustment specified by FERC. For the five-year period beginning in 2010, FERC established an annual index adjustment equal to the change in the producer price index for finished goods plus 2.65%. This adjustment is subject to review every five years. Under FERC's regulations, liquids pipelines can request a rate increase that exceeds the rate obtained through application of the indexing methodology by using a cost-of-services approach, but only after the pipeline establishes that a substantial divergence exists between the actual costs experienced by the pipeline and the rates resulting from application of the indexing methodology.

The ICA permits interested persons to challenge proposed new or changed rates and authorizes FERC to suspend the effectiveness of such rates for up to seven months and investigate such rates. If, upon completion of an investigation, FERC finds that the new or changed rate is unlawful, it is authorized to require the pipeline to refund revenues collected in excess of the just and reasonable rate during the term of the investigation. FERC may also investigate, upon complaint or on its own motion, rates that are already in effect and may order a carrier to change its rates prospectively. Under certain circumstances, FERC could limit our ability to set rates based on our costs or could order us to reduce our rates and could require the payment of reparations to complaining shippers for up to two years prior to the date of the complaint. FERC also has the authority to change our terms and conditions of service if it determines that they are unjust and unreasonable or unduly discriminatory or preferential.

As we acquire, construct and operate new liquids assets and expand our liquids transportation business segment, the classification and regulation of our liquids transportation services are subject to ongoing assessment and change based on the services we provide and determinations by FERC and the courts. Such changes may subject additional services we provide to regulation by FERC.

Intrastate Natural Gas Pipeline Regulation. Our intrastate natural gas pipeline operations are subject to regulation by various agencies of the states in which they are located. Most states have agencies that possess the authority to review and authorize natural gas transportation transactions and the construction, acquisition, abandonment and interconnection of physical facilities. Some states also have state agencies that regulate transportation rates, service terms and conditions and contract pricing to ensure their reasonableness and to ensure that the intrastate pipeline companies that they regulate do not discriminate among similarly situated customers.

Intrastate NGL Pipeline Regulation. Intrastate NGL and other petroleum pipelines are not generally subject to rate regulation by FERC, but they are subject to regulation by various agencies in the respective states where they are located. While the regulatory regime varies from state to state, state agencies typically require intrastate petroleum pipelines to file their rates with the agencies and permit shippers to challenge existing rates or proposed rate increases.

Gathering Pipeline Regulation. Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of FERC under the NGA. We own a number of natural gas pipelines that we believe meet the traditional tests FERC has used to establish a pipeline's status as a gatherer not subject to FERC jurisdiction. State regulation of gathering facilities generally

includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements, and in some instances complaint-based rate regulation.

We are subject to some state ratable take and common purchaser statutes. The ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes generally require gatherers to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply.

Sales of Natural Gas and NGLs. The price at which we sell natural gas and NGLs currently are not subject to federal regulation and, for the most part, are not subject to state regulation. Our natural gas and NGL sales are affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation. FERC is continually proposing and implementing new rules and regulations affecting those segments of the natural gas and NGL industries, most notably interstate natural gas transmission companies and NGL pipeline companies that remain subject to FERC's jurisdiction. These initiatives also may affect the intrastate transportation of natural gas and NGLs under certain circumstances. We cannot predict the ultimate impact of these regulatory changes on our natural gas and NGL marketing operations, but we do not believe that we will be affected by any such FERC action in a manner that is materially different from the natural gas and NGL marketers with whom we compete.

Environmental Matters

General. Our operations involve processing and pipeline services for delivery of hydrocarbons (natural gas, NGLs, petroleum and fractionates) from point-of-origin at oil and gas wellheads operated by our suppliers to our end-use market customers. Our facilities include natural gas processing and fractionation plants, brine disposal wells, pipelines and associated facilities, fractionation and storage units for NGLs, and transportation and delivery of petroleum. As with all companies in our industrial sector, our operations are subject to stringent and complex federal, state and local laws and regulations relating to release of hazardous substances or solid wastes into the environment or otherwise relating to protection of the environment. Compliance with existing and anticipated environmental laws and regulations increases our overall costs of doing business, including costs of planning, constructing, and operating plants, pipelines, and other facilities, as well as capital cost items necessary to maintain or upgrade equipment and facilities. Similar costs are likely upon changes in laws or regulations and upon any future acquisition of operating assets.

Any failure to comply with applicable environmental laws and regulations, including those relating to equipment failures, and obtaining required governmental approvals, may result in the assessment of administrative, civil or criminal penalties, imposition of investigatory or remedial activities and, in less common circumstances, issuance of temporary or permanent injunctions or construction or operation bans or delays.

The continuing trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment, and thus there can be no assurance as to the amount or timing of future expenditures for environmental compliance or remediation, and actual future expenditures may be different from the amounts we currently anticipate. Moreover, risks of process upsets, accidental releases or spills are associated with possible future operations, and we cannot assure you that we will not incur significant costs and liabilities, including those relating to claims for damage to property and persons as a result of any such upsets, releases or spills. In the event of future increases in environmental costs, we may be unable to pass on those cost increases to our customers. A discharge of hazardous substances or solid wastes into the environment could, to the extent losses related to the event are not insured, subject us to substantial expense, including both the cost to comply with applicable laws and regulations and to pay fines or penalties that may be assessed and the cost related to claims made by neighboring landowners and other third parties for personal injury or damage to natural resources or property. We will attempt to anticipate future regulatory requirements that might be imposed and plan accordingly to comply with changing environmental laws and regulations and to minimize costs with respect to more stringent future laws and regulations or more rigorous enforcement of existing laws and regulations.

Hazardous Substances and Waste. Environmental laws and regulations that relate to the release of hazardous substances or solid wastes into soils, groundwater and surface water and/or include measures to prevent and control pollution may pose the highest potential cost to our industry sector. These laws and regulations generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous wastes and may require investigatory and corrective actions at facilities where such waste may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, also known as the federal "Superfund" law, and comparable state laws impose liability without regard to fault or the legality of the original conduct on certain classes of persons that contributed to a release of "hazardous substance" into the environment. Potentially liable persons include the owner or operator of the site where a release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several liability for the costs of cleaning up the hazardous substances that

have been released into the environment, for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the Environmental Protection Agency (EPA) and, in some cases, third parties to take actions in response to threats to the public health or the environment and to seek to recover from the potentially responsible classes of persons the costs they incur. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other wastes released into the environment. Although petroleum, natural gas and NGLs are excluded from CERCLA's definition of a "hazardous substance," in the course of ordinary operations, we may generate wastes that may fall within the definition of a "hazardous substance." In addition, there are other laws and regulations that can create liability for releases of petroleum, natural gas or NGLs. Moreover, we may be responsible under CERCLA or other laws for all or part of the costs required to clean up sites at which such wastes have been disposed. We have not received any notification that we may be potentially responsible for cleanup costs under CERCLA or any analogous federal or state law.

We also generate, and may in the future generate, both hazardous and nonhazardous solid wastes that are subject to requirements of the federal Resource Conservation and Recovery Act, or RCRA, and/or comparable state statutes. From time to time, the EPA and state regulatory agencies have considered the adoption of stricter disposal standards for nonhazardous wastes, including crude oil and natural gas wastes. Moreover, it is possible that some wastes generated by us that are currently considered nonhazardous may in the future be designated as "hazardous wastes," resulting in the wastes being subject to more rigorous and costly management and disposal requirements. Changes in applicable laws or regulations may result in an increase in our capital expenditures or plant operating expenses or otherwise impose limits or restrictions on our production and operations.

We currently own or lease, have in the past owned or leased, and in the future may own or lease, properties that have been used over the years for brine disposal operations, crude and condensate transportation, natural gas gathering, treating or processing and for NGL fractionation, transportation or storage. Solid waste disposal practices within the NGL industry and other oil and natural gas related industries have improved over the years with the passage and implementation of various environmental laws and regulations. Nevertheless, some hydrocarbons and other solid wastes may have been disposed of on or under various properties owned or leased by us during the operating history of those facilities. In addition, a number of these properties may have been operated by third parties over whose operations and hydrocarbon and waste management practices we had no control. These properties and wastes disposed thereon may be subject to the Safe Drinking Water Act, CERCLA, RCRA and analogous state laws. Under these laws, we could be required, alone or in participation with others, to remove or remediate previously disposed wastes or property contamination, if present, including groundwater contamination, or to take action to prevent future contamination.

Air Emissions. Our current and future operations are subject to the federal Clean Air Act and comparable state laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including our facilities, and impose various controls together with monitoring and reporting requirements. Pursuant to these laws and regulations, we may be required to obtain environmental agency pre-approval for the construction or modification of certain projects or facilities expected to produce air emissions or result in an increase in existing air emissions, obtain and comply with the terms of air permits, which include various emission and operational limitations, or use specific emission control technologies to limit emissions. We likely will be required to incur certain capital expenditures in the future for air pollution control equipment in connection with maintaining or obtaining governmental approvals addressing air emission-related issues. Failure to comply with applicable air statutes or regulations may lead to the assessment of administrative, civil or criminal penalties and may result in the limitation or cessation of construction or operation of certain air emission sources. Although we can give no assurances, we believe such requirements will not have a material adverse effect on our financial condition or operating results, and the requirements are not expected to be more burdensome to us than to any similarly situated company.

On April 17, 2012, the EPA approved final rules under the Clean Air Act that establish new air emission controls for oil and natural gas production, pipelines and processing operations. These rules became effective on October 15, 2012. For new or reworked hydraulically-fractured gas wells, the rules require the control of emissions through flaring or reduced emission (or "green") completions until 2015, when the rules require the use of green completions by all such wells except wildcat (exploratory) and delineation gas wells and low reservoir pressure non-wildcat and non-delineation gas wells. The rules also establish specific new requirements regarding emissions from wet seal and reciprocating compressors at production facilities, gathering systems, boosting facilities and onshore natural gas processing plants, effective October 15, 2012, and from pneumatic controllers and storage vessels at production facilities, gathering systems, boosting facilities and onshore natural gas processing plants, effective October 15, 2013. In addition, the rules revise existing requirements for volatile organic compound emissions from equipment leaks at onshore natural gas processing plants by lowering the leak definition for valves from 10,000 parts per million to 500 parts per million and requiring the monitoring of connectors, pumps, pressure relief devices and open-ended lines, effective October 15, 2012. These rules may therefore require a number of modifications to our and our suppliers' and customers' operations, including the installation of new equipment to control emissions.

In October 2012, several challenges to the EPA's April 17, 2012 rules were filed by various parties, including environmental groups and industry associations. In a January 16, 2013 unopposed motion to hold this litigation in abeyance, the EPA indicated that it may reconsider some aspects of the rules. The case remains in abeyance. EPA issued a final rule revising certain aspects of the rules on August 5, 2013 and has indicated that it may reconsider other aspects of the rules. Depending on the outcome of such proceedings, the rules may be further modified or rescinded or the EPA may issue new rules. The costs of compliance with any modified or newly issued rules cannot be predicted. Additionally, on December 11, 2012, seven states submitted a notice of intent to sue the EPA to compel the agency to make a determination as to whether standards of performance limiting methane emissions from the oil and gas sector are appropriate, which was not addressed in the EPA rule that became effective on October 15, 2012. The notice of intent also requested that the EPA issue emission guidelines for the control of methane emissions from existing oil and gas sources. Depending on whether such rules are promulgated and the applicability and restrictions in any promulgated rule, compliance with such rules could result in additional costs, including increased capital expenditures and operating costs for us and for other companies in our industry. While we are not able at this time to estimate such additional costs, as is the case with similarly situated entities in the industry, they could be significant for us. Compliance with such rules, as well as any new state rules, may also make it more difficult for our suppliers and customers to operate, thereby reducing the volume of natural gas transported through our pipelines, which may adversely affect our business.

Climate Change. In response to concerns suggesting that emissions of certain gases, commonly referred to as "greenhouse gases" (including carbon dioxide and methane), may be contributing to warming of the earth's atmosphere, the EPA is taking steps that would result in the regulation of greenhouse gases as pollutants under the federal Clean Air Act.

In October 2009, the EPA promulgated its Mandatory Reporting Rule for greenhouse gases, which requires the monitoring and reporting of greenhouse gas emissions on an annual basis. All of our facilities operating combustion sources, such as engines or natural gas fractionation facilities, are subject to the greenhouse gas reporting requirements included in the October 2009 final rule. The first annual greenhouse gas emissions inventory for our affected facilities was filed by us in September 2011 and we continue to file the required annual reports. In November 2010 and further in December 2011, the EPA expanded the scope of the Mandatory Reporting Rule to include petroleum and natural gas pipeline systems, which applies the Mandatory Reporting Rule's requirements to, among other sources, fugitive and vented methane emissions from the oil and gas sector, including natural gas transmission compression. Our transmission compression facilities as well as gathering compressor stations with large amine treating capacities are also required to report under this expanded rule. The first reports for these facilities were due in 2012. Although the Mandatory Reporting Rule does not control greenhouse gas emission levels from any facilities, it has still caused us to incur monitoring and reporting costs for emissions that are subject to the rule.

After a series of regulatory actions finalized by the EPA between December 2009 and May 2010, greenhouse gases became pollutants "subject to regulation" under the Clean Air Act's Prevention of Significant Deterioration (PSD) air quality permit program for stationary sources, which in turn triggered permitting requirements under the Clean Air Act's Title V permitting program. In the "Tailoring Rule," the EPA promulgated regulatory thresholds for greenhouse gases that make PSD permitting requirements applicable to only relatively large sources of greenhouse gas emissions. As a result, new and modified stationary sources that emit greenhouse gases over statutory thresholds and the Tailoring Rule's regulatory thresholds must obtain a PSD permit setting forth Best Available Control Technology (BACT) for those emissions. The current Tailoring Rule threshold levels act to limit PSD permitting for greenhouse gases to only relatively large sources of greenhouse gas emissions, but the EPA has indicated that it may tighten the Tailoring Rule thresholds in the future, subjecting additional sources to PSD permitting requirements for greenhouse gases. The EPA has also proposed to regulate greenhouse gas emissions from certain electric generating units through the Clean Air Act's New Source Performance Standards (NSPS) program, and may expand greenhouse gas NSPS requirements to additional source categories in the future. Any new requirements could in the future affect our operations and our ability to obtain air permits for new or modified facilities.

The U.S. Congress has considered but to date has not enacted legislation to mandate reductions of greenhouse gas emissions, and almost half of the states, either individually or through multi-state regional initiatives, have already taken legal measures intended to reduce greenhouse gas emissions, primarily through the planned development of greenhouse gas emission inventories and/or greenhouse gas cap and trade programs.

Because regulation of greenhouse gas emissions is relatively new, further regulatory, legislative and judicial developments are likely to occur. Such developments in greenhouse gas initiatives may affect us and other companies operating in the oil and gas industry. In addition to these developments, recent judicial decisions have allowed certain tort claims alleging property damage to proceed against greenhouse gas emissions sources, which may increase our litigation risk for such claims. Due to the uncertainties surrounding the regulation of and other risks associated with greenhouse gas emissions, we cannot predict the financial impact of related developments on us.

Federal or state legislative or regulatory initiatives that regulate or restrict emissions of greenhouse gases in areas in which we conduct business could adversely affect the availability of, or demand for, the products we store, transport and

process, and, depending on the particular program adopted, could increase the costs of our operations, including costs to operate and maintain our facilities, install new emission controls on our facilities, acquire allowances to authorize our greenhouse gas emissions, pay any taxes related to our greenhouse gas emissions and/or administer and manage a greenhouse gas emissions program. We may be unable to recover any such lost revenues or increased costs in the rates we charge our customers, and any such recovery may depend on events beyond our control, including the outcome of future rate proceedings before FERC or state regulatory agencies and the provisions of any final legislation or regulations. Reductions in our revenues or increases in our expenses as a result of climate control initiatives could have adverse effects on our business, financial position, results of operations and prospects.

Some scientific studies on climate change suggest that adverse weather events may become stronger or more frequent in the future in certain of the areas in which we operate, although the scientific studies are not unanimous. Due to their location, our operations along the Gulf Coast are vulnerable to operational and structural damages resulting from hurricanes and other severe weather systems, while inland operations include areas subject to tornadoes. Our insurance may not cover all associated losses. We are taking steps to mitigate physical risks from storms, but no assurance can be given that future storms will not have a material adverse effect on our business.

Hydraulic Fracturing and Wastewater. The Federal Water Pollution Control Act, also known as the Clean Water Act, and comparable state laws impose restrictions and strict controls regarding the discharge of pollutants, including NGL related wastes, into state waters or waters of the United States. Regulations promulgated pursuant to these laws require that entities that discharge into federal and state waters obtain National Pollutant Discharge Elimination System, or NPDES, and/or state permits authorizing these discharges. The Clean Water Act and analogous state laws assess administrative, civil and criminal penalties for discharges of unauthorized pollutants into the water and impose substantial liability for the costs of removing spills from such waters. In addition, the Clean Water Act and analogous state laws require that individual permits or coverage under general permits be obtained by covered facilities for discharges of storm water runoff. We believe that we are in substantial compliance with Clean Water Act permitting requirements as well as the conditions imposed thereunder and that continued compliance with such existing permit conditions will not have a material effect on our results of operations.

We operate brine disposal wells that are regulated as Class II wells under the federal Safe Drinking Water Act (SDWA). The SDWA imposes requirements on owners and operators of Class II wells through the EPA's Underground Injection Control program, including construction, operating, monitoring and testing, reporting and closure requirements. Our brine disposal wells are also subject to comparable state laws and regulations, which in some cases are more stringent than requirements under the federal SDWA. Compliance with current and future laws and regulations regarding our brine disposal wells may impose substantial costs and restrictions on our brine disposal operations, as well as adversely affect demand for our brine disposal services. State and federal regulatory agencies recently have focused on a possible connection between the operation of injection wells used for oil and gas waste waters and an observed increase in minor seismic activity and tremors. When caused by human activity, such events are called induced seismicity. In a few instances, operators of injection wells in the vicinity of minor seismic events have reduced injection volumes or suspended operations, often voluntarily. A 2012 report published by the National Academy of Sciences concluded that only a very small fraction of the tens of thousands of injection wells have been suspected to be, or have been, the likely cause of induced seismicity. Regulatory agencies are continuing to study possible linkage between injection activity and induced seismicity. To the extent these studies result in additional regulation of injection wells, such regulations could impose additional regulations, costs and restrictions on our brine disposal operations.

It is common for our customers or suppliers to recover natural gas from deep shale formations through the use of hydraulic fracturing, combined with sophisticated horizontal drilling. Hydraulic fracturing is an important and commonly used process in the completion of wells by oil and gas producers. Hydraulic fracturing involves the injection of water, sand and chemical additives under pressure into rock formations to stimulate gas production. Due to public concerns raised regarding potential impacts of hydraulic fracturing on groundwater quality, legislative and regulatory efforts at the federal level and in some states and localities have been initiated to require or make more stringent the permitting and other regulatory requirements for hydraulic fracturing operations. There are certain governmental reviews either underway or being proposed that focus on environmental aspects of hydraulic fracturing practices. The White House Council on Environmental Quality is coordinating an administration-wide review of hydraulic fracturing practices, and a committee of the United States House of Representatives has conducted an investigation of hydraulic fracturing practices. In addition, the EPA is conducting a study of the potential environmental effects of hydraulic fracturing on drinking water and groundwater and has initiated plans to promulgate regulations controlling wastewater disposal associated with hydraulic fracturing and shale gas development. These ongoing or proposed studies, depending on their degree of pursuit and any meaningful results obtained, could spur initiatives to further regulate hydraulic fracturing. Additional regulatory burdens in the future, whether federal, state or local, could increase the cost of or restrict the ability of our customers or suppliers to perform hydraulic fracturing. As a result, any increased federal, state or local regulation could reduce the volumes of natural gas that our customers move through our gathering systems which would materially adversely affect our revenues and results of operations.

Employee Safety. We are subject to the requirements of the Occupational Safety and Health Act, referred to as OSHA, and comparable state laws that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We believe that our operations are in substantial compliance with the OSHA requirements including general industry standards, record keeping requirements, and monitoring of occupational exposure to regulated substances.