Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-194465

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Offered |

Maximum Aggregate Offering Price |

Registration Fee(1) |

||

|---|---|---|---|---|

4.850% Senior Notes due 2026 |

$500,000,000 | $50,350 | ||

|

||||

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 10, 2014)

EnLink Midstream Partners, LP

$500,000,000 4.850% Senior Notes due 2026

We are offering $500,000,000 aggregate principal amount of our 4.850% Senior Notes due 2026, or the notes.

Interest on the notes will accrue from July 14, 2016 and will be payable semi-annually on January 15 and July 15 of each year, beginning on January 15, 2017. The notes will mature on July 15, 2026. We may redeem some or all of the notes at our option at any time and from time to time prior to their maturity at the applicable redemption prices set forth in this prospectus supplement, plus accrued and unpaid interest. Please read the section entitled "Description of Notes—Optional Redemption."

The notes will be our unsecured senior obligations. If we default, your right to payment under the notes will rank equally with the right to payment of the holders of our other current and future unsecured senior debt, including our existing senior notes and borrowings under our revolving credit facility, and senior in right of payment to all of our current and future subordinated debt. The notes will not initially be guaranteed by our subsidiaries.

Investing in the notes involves risks. See "Risk Factors" beginning on page S-10.

| |

Public Offering Price(1) |

Underwriting Discount |

Proceeds, Before Expenses, to us |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Per Note |

99.859 | % | 0.650 | % | 99.209 | % | ||||

Total |

$ | 499,295,000 | $ | 3,250,000 | $ | 496,045,000 | ||||

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the notes to purchasers on or about July 14, 2016 only in book-entry form through the facilities of The Depository Trust Company for the accounts of its participants.

Joint Book-Running Managers

| BofA Merrill Lynch | J.P. Morgan | SunTrust Robinson Humphrey | ||

BBVA |

BMO Capital Markets |

Mizuho Securities |

||

| MUFG | PNC Capital Markets LLC | US Bancorp |

Co-Manager

Comerica Securities

July 11, 2016

S-i

IMPORTANT INFORMATION IN THIS PROSPECTUS SUPPLEMENT

AND THE ACCOMPANYING BASE PROSPECTUS

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of notes. The second part is the accompanying base prospectus, which describes certain terms of the indenture under which the notes will be issued and gives more general information, some of which may not apply to this offering of notes. Generally, when we refer only to the "prospectus," we are referring to both parts combined. If the information varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Information Incorporated by Reference" in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by or on behalf of us relating to this offering of notes. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the underwriters are offering to sell the notes, and seeking offers to buy the notes, only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in these documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information included in this prospectus supplement and the documents we incorporate by reference herein contain "forward-looking" statements. All statements that are not statements of historical facts, including statements regarding our future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. You can typically identify forward-looking statements by the use of forward-looking words, such as "forecast," "may," "believe," "will," "should," "plan," "predict," "anticipate," "intend," "estimate," "expect" and other similar words. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus supplement, the accompanying base prospectus and the documents we have incorporated by reference.

These forward-looking statements are made based upon management's current plans, expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. Known material risks and uncertainties include the risks set forth under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, as well as the following risks and uncertainties:

S-ii

Before you invest, you should be aware that the occurrence of any of the events described under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 could substantially harm our business, results of operations and financial condition. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As generally used in the energy industry and in this prospectus supplement, the following terms have the following meanings:

S-iii

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information that you should consider before making an investment decision. You should read this entire prospectus supplement, the accompanying base prospectus and the documents incorporated herein by reference for a more complete understanding of this offering of notes. Please read "Risk Factors" beginning on page S-10 of this prospectus supplement and page 1 of the accompanying base prospectus for information regarding risks you should consider before investing in our notes.

Throughout this prospectus supplement, when we use the terms "we," "us," "our" or the "Partnership," we are referring either to EnLink Midstream Partners, LP in its individual capacity or to EnLink Midstream Partners, LP and its operating subsidiaries collectively, as the context requires. Our business activities are conducted through our subsidiary, EnLink Midstream Operating, LP and its subsidiaries. References in this prospectus supplement to our "general partner" refer to EnLink Midstream GP, LLC, an indirect wholly owned subsidiary of EnLink Midstream, LLC ("ENLC"). ENLC's managing member is an indirect wholly owned subsidiary of Devon.

Overview

EnLink Midstream Partners, LP is a publicly traded Delaware limited partnership formed in 2002. Our common units are traded on the New York Stock Exchange under the symbol "ENLK." We primarily focus on providing midstream energy services, including gathering, transmission, processing, fractionation and marketing, to producers of natural gas, NGLs, crude oil and condensate. We also provide crude oil, condensate and brine services to producers. Our midstream energy asset network includes approximately 10,000 miles of pipelines, 19 natural gas processing plants, seven fractionators, 3.2 million barrels of NGL cavern storage, 19.1 Bcf of natural gas storage, rail terminals, barge terminals, truck terminals and a fleet of approximately 150 trucks.

We connect the wells of natural gas producers in our market areas to our gathering systems, process natural gas for the removal of NGLs, fractionate NGLs into purity products and market those products for a fee, transport natural gas and ultimately provide natural gas to a variety of markets. We purchase natural gas from natural gas producers and other supply sources and sell that natural gas to utilities, industrial consumers, other marketers and pipelines. We operate processing plants that process gas transported to the plants by major interstate pipelines or from our own gathering systems under a variety of fee-based arrangements. We provide a variety of crude oil and condensate services, which include crude oil and condensate gathering via pipelines, barges, rail and trucks, condensate stabilization and brine disposal. Our gas gathering systems consist of networks of pipelines that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission. Our transmission pipelines primarily receive natural gas from our gathering systems and from third party gathering and transmission systems and deliver natural gas to industrial end-users, utilities and other pipelines. We also have transmission lines that transport NGLs from east Texas and from our south Louisiana processing plants to our fractionators in south Louisiana. Additionally, we own an economic interest in an NGL fractionator located at Mont Belvieu, Texas that receives raw mix NGLs from customers, fractionates such raw mix and redelivers the finished products to the customers for a fee. Devon is one of the largest customers of this fractionator. Our crude oil and condensate gathering and transmission systems consist of trucking facilities, pipelines, rail and barge facilities that, in exchange for a fee, transport oil from a producer site to an end user. Our processing plants remove NGLs and CO2 from a natural gas stream and our fractionators separate the NGLs into separate NGL products, including ethane, propane, iso-butane, normal butane and natural gasoline.

S-1

Our assets are comprised of systems and other assets in which our interest is held through our wholly-owned subsidiaries as well as systems and other assets owned by EnLink Oklahoma Gas Processing, LP (previously known as EnLink TOM Holdings, LP), in which we hold a 84% interest, and are included in five primary segments:

Our Business Strategies

Our primary business objective is to provide cash flow stability in our business while growing prudently and profitably. We intend to accomplish this objective by executing the following strategies:

S-2

existing infrastructure, operating expertise and customer relationships by constructing and expanding systems to meet new or increased demand for our services.

Our Competitive Strengths

We believe that we are well-positioned to execute our business strategies and to achieve our business objectives due to the following competitive strengths:

S-3

the energy industry. We believe this team provides us with a strong foundation for evaluating growth opportunities and operating our assets in a safe, reliable and efficient manner.

Recent Developments

Tall Oak Acquisition

On January 7, 2016, we and ENLC acquired an 84% and 16% interest, respectively, in EnLink Oklahoma Gas Processing, LP (previously known as EnLink TOM Holdings, LP) and its consolidated subsidiaries ("TOM") for approximately $1.4 billion. The first installment of $1.02 billion for the acquisition was paid at closing. The final installment of $500.0 million is due no later than the first anniversary of the closing date with the option to defer $250.0 million of the final installment up to 24 months following the closing date. The installment payables are valued net of discount within the total purchase price.

The first installment consisted of approximately $1.02 billion and was funded by (a) approximately $783.9 million in cash paid by us, the majority of which was derived from the proceeds from our issuance of Preferred Units (as defined under "Issuance of Preferred Units" below), and (b) 15,564,009 common units representing limited liability company interests in ENLC issued directly by ENLC and approximately $22.0 million in cash paid by ENLC.

TOM's assets serve gathering and processing needs in the growing STACK and CNOW plays in Oklahoma and are supported by long-term, fixed-fee contracts with acreage dedications that have a remaining weighted-average term of approximately 15 years. TOM's assets are strategically located in the core areas of the STACK and CNOW plays and include:

Organic Growth

Greater Chickadee. In June 2016, we announced that one of our subsidiaries will construct a new crude oil gathering system, called the Greater Chickadee crude oil gathering project ("Greater Chickadee"), in Upton and Midland counties in the Permian Basin. Greater Chickadee will include over 150 miles of high- and low-pressure pipelines that will transport crude oil volumes to several major market outlets and other key hub centers in the Midland, Texas area. The project also includes the construction of multiple central tank batteries and pump, truck injection, and storage stations to maximize shipping and delivery options for EnLink's producer customers. The initial phase of Greater

S-4

Chickadee is expected to be operational in the second half of 2016 with full service expected in early 2017.

Lobo II Natural Gas Gathering and Processing Facility. In the first quarter of 2016, we commenced construction of a new cryogenic gas processing plant and a gas gathering system in the Delaware Basin. The plant will initially provide 60 MMcf/d of processing capacity (with a potential capacity of 120 MMcf/d) and will be tied to approximately 75 miles of new pipeline located in both in Texas and New Mexico that is also under construction. The plant and Texas portion of the pipeline are expected to be completed in the second half of 2016 with the remaining New Mexico pipeline to be completed in the first quarter of 2017. The Lobo II system is supported by a long-term contract with a producer with an investment grade credit rating.

Riptide Processing Plant. In April 2016, we completed construction of the Riptide processing plant in the Permian Basin. The Riptide plant was part of the Coronado Midstream acquisition that was completed in March 2015. The Riptide plant is integrated with EnLink's Midland Basin system, and key customers include Diamondback Energy, Inc., RSP Permian, Inc. and Reliance Energy, Inc.

Marathon Petroleum Joint Venture. We have entered into a series of agreements with a subsidiary of Marathon Petroleum Corporation ("Marathon Petroleum") to create a 50/50 joint venture named Ascension Pipeline Company, LLC. In the third quarter of 2016, the joint venture will commence construction of a new 30-mile NGL pipeline connecting our existing Riverside fractionation and terminal complex to Marathon Petroleum's Garyville refinery located on the Mississippi River. This bolt-on project to our Cajun-Sibon NGL system is supported by long-term, fee-based contracts with Marathon Petroleum. Under the arrangement, we will serve as the construction manager and operator of the pipeline project, which is expected to be operational in the first half of 2017.

HEP. During 2016, we plan to make contributions to Howard Energy Partners ("HEP"), primarily to fund our equity share of HEP's Nueva Era Pipeline. The Nueva Era Pipeline is a 50-50 joint venture between HEP and a Mexico-based energy and services firm called Grupo Clisa connecting HEP's existing Webb County Hub in South Texas directly to the Mexican National Pipeline System in Monterrey, Mexico. Mexico's Comisión Federal de Electricidad will be the foundation shipper on the approximately 200-mile, 30-inch pipeline and will transport 504 MMcf/d on the system for a 25-year term.

Issuance of Common Units

Equity Distribution Agreement. In November 2014, the Partnership entered into an equity distribution agreement (the "BMO EDA") with BMO Capital Markets Corp. and certain other sales agents to sell up to $350.0 million in aggregate gross sales of the Partnership's common units from time to time through an "at the market" equity offering program. The Partnership may also sell common units to any sales agent as principal for the sales agent's own account at a price agreed upon at the time of sale. The Partnership has no obligation to sell any of the common units under the BMO EDA and may at any time suspend solicitation and offers under the BMO EDA.

For the three months ended March 31, 2016, we sold an aggregate of 0.2 million common units under the BMO EDA, generating proceeds of approximately $2.1 million (net of approximately $0.1 million of commissions). We used the net proceeds for general partnership purposes. As of March 31, 2016, approximately $314.8 million remains available to be issued under the agreement.

Issuance of Preferred Units

On January 7, 2016, we issued an aggregate of 50,000,000 Series B Cumulative Convertible Preferred Units representing limited partner interests in our partnership (the "Preferred Units") to Enfield Holdings, L.P. ("Enfield") in a private placement (the "Private Placement") for a cash purchase

S-5

price of $15.00 per Preferred Unit (the "Issue Price"), resulting in net proceeds of approximately $724.5 million after fees and deductions. Proceeds from the Private Placement were used to partially fund our portion of the purchase price payable in connection with the Tall Oak acquisition. Affiliates of the Goldman Sachs Group, Inc. and affiliates of TPG Global, LLC own interests in the general partner of Enfield.

The Preferred Units are convertible into our common units on a one-for-one basis, subject to certain adjustments, at any time after the record date for the quarter ending June 30, 2017 (a) in full, at our option, if the volume weighted average price of a common unit over the 30-trading day period ending two trading days prior to the conversion date (the "Conversion VWAP") is greater than 150% of the Issue Price or (b) in full or in part, at Enfield's option. In addition, upon certain events involving a change of control of our general partner or the managing member of ENLC, all of the Preferred Units will automatically convert into a number of common units equal to the greater of (i) the number of common units into which the Preferred Units would then convert and (ii) the number of Preferred Units to be converted multiplied by an amount equal to (x) 140% of the Issue Price divided by (y) the Conversion VWAP.

Enfield receives a quarterly distribution, subject to certain adjustments, equal to (x) during the quarter ended March 31, 2016 through the quarter ending June 30, 2017, an annual rate of 8.5% on the Issue Price payable in-kind in the form of additional Preferred Units and (y) thereafter, at an annual rate of 7.5% on the Issue Price payable in cash (the "Cash Distribution Component") plus an in-kind distribution equal to the greater of (A) an annual rate of 1.0% of the Issue Price and (B) an amount equal to (i) the excess, if any, of the distribution that would have been payable had the Preferred Units converted into common units over the Cash Distribution Component, divided by (ii) the Issue Price. Income is allocated to the Preferred Units in an amount equal to the quarterly distribution with respect to the period earned.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 2501 Cedar Springs Rd., Dallas, Texas 75201 and our telephone number is (214) 953-9500. Our website is located at www.enlink.com. We make available our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, the "SEC" or the "Commission," free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the Commission. The information on our website is not part of this prospectus supplement or the accompanying base prospectus, and you should rely only on information contained or incorporated by reference in this prospectus supplement or the accompanying base prospectus when making a decision as to whether or not to invest in our notes.

S-6

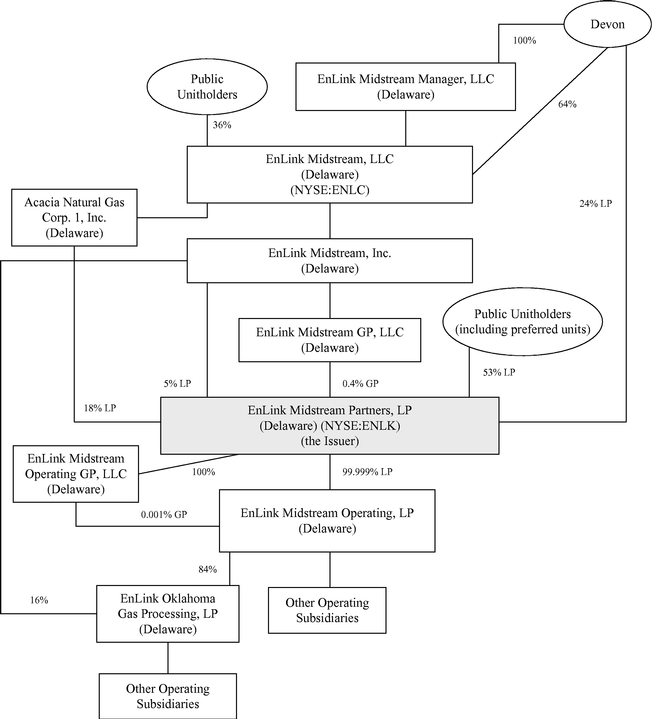

The diagram below depicts our organization and approximate ownership immediately prior to this offering.

Simplified Organizational Structure

S-7

We provide the following summary solely for your convenience. This summary is not a complete description of the notes. You should read the full text of, and more specific details contained elsewhere in, this prospectus supplement and the accompanying base prospectus. For a more detailed description of the notes, please read the section entitled "Description of Notes" in this prospectus supplement and the section entitled "Description of the Debt Securities" in the accompanying base prospectus.

| Issuer | EnLink Midstream Partners, LP | |

Notes Offered |

We are offering $500,000,000 aggregate principal amount of 4.850% Senior Notes due 2026. |

|

Maturity |

Unless redeemed prior to maturity as described below, the notes will mature on July 15, 2026. |

|

Interest Rate |

Interest on the notes will accrue at the per annum rate of 4.850%. |

|

Interest Payment Dates |

Interest on the notes will accrue from, and including, the issue date of the notes and be payable semi-annually on January 15 and July 15 of each year, beginning on January 15, 2017. |

|

Ranking |

The notes will be our unsecured senior obligations. The notes will rank equally with all of our other current and future unsecured senior debt, including our existing senior notes and borrowings under our revolving credit facility, senior to all of our current and future subordinated debt, and junior to the indebtedness and other obligations, including trade payables, of our subsidiaries. |

|

As of March 31, 2016, after giving effect to this offering of the notes and the application of the net proceeds therefrom as described in "Use of Proceeds," we, excluding our subsidiaries, would have had approximately $3.6 billion of indebtedness outstanding, all of which would have been unsecured senior indebtedness, and our subsidiaries would have had approximately $13.4 million of indebtedness outstanding, consisting of capital leases. Please read "Description of Notes—Ranking." |

||

Optional Redemption |

We may redeem the notes for cash, in whole or in part at any time and from time to time, at our option at the applicable redemption prices set forth under the heading "Description of Notes—Optional Redemption." |

|

Certain Covenants |

We will issue the notes under a supplement to an indenture with Wells Fargo Bank, National Association, as trustee. The covenants in the indenture supplement will include a limitation on liens and a restriction on sale-leaseback transactions. Each covenant is subject to a number of important exceptions, limitations and qualifications that are described in "Description of Notes—Certain Covenants." |

S-8

| Use of Proceeds | We intend to use the net proceeds from this offering to repay outstanding borrowings under our revolving credit facility and for general partnership purposes. See "Use of Proceeds." | |

Affiliates of each of the underwriters are lenders under our revolving credit facility that we expect to reduce using the proceeds of this offering, and, accordingly, such underwriters and affiliates will receive a portion of the proceeds from this offering. See "Underwriting." |

||

Further Issuances |

We may create and issue additional notes ranking equally and ratably with any series of notes offered by this prospectus supplement in all respects, except for the issue date, public offering price and in some cases, the first interest payment date, so that such additional notes will form a single series with the applicable series of notes offered by this prospectus supplement and will have substantially identical terms as such series, including with respect to ranking, redemption and otherwise. |

|

Risk Factors |

Investing in the notes involves risks. See "Risk Factors" beginning on page S-10 of this prospectus supplement and the risk factors set forth on page 1 of the accompanying base prospectus, and in our Annual Report on Form 10-K for the year ended December 31, 2015 and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, together with all of the other information included in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus before investing in the notes. |

|

Governing Law |

The indenture governing the notes and the notes will be governed by, and construed in accordance with, the laws of the State of New York. |

S-9

An investment in the notes involves risks. You should consider carefully the following risk factors and the risk factors set forth beginning on page 1 of the accompanying base prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2015 and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, together with all of the other information included in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus when evaluating an investment in the notes.

Risks Related to the Notes

Our significant indebtedness, and any future indebtedness, as well as the restrictions in our debt agreements may adversely affect our future financial and operating flexibility and our ability to service the notes.

As of March 31, 2016, after giving effect to this offering and the application of the net proceeds as described in "Use of Proceeds," our consolidated indebtedness would have been approximately $3.6 billion, and we would have been able to incur approximately $1.44 billion of additional indebtedness under our revolving credit facility. Our substantial indebtedness and the additional debt we may incur in the future for potential acquisitions or operating activities may adversely affect our liquidity and therefore our ability to make interest payments on the notes.

Among other things, our significant indebtedness may be viewed negatively by credit rating agencies, which could result in increased costs for us to access the capital markets. Any future downgrade of the debt issued by us or our subsidiaries could significantly increase our capital costs or adversely affect our ability to raise capital in the future.

Debt service obligations and restrictive covenants in our revolving credit facility and other indebtedness and the indenture governing the notes may adversely affect our ability to finance future operations, pursue acquisitions and fund other capital needs. In addition, this leverage may make our results of operations more susceptible to adverse economic or operating conditions by limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate and may place us at a competitive disadvantage as compared to our competitors that have less debt.

The indenture governing the notes will permit us to incur additional debt, which would be equal in right of payment to the notes. If we incur any additional indebtedness, including trade payables, that ranks equally with the notes, the holders of that debt would be entitled to share ratably with you in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding up of us. This may have the effect of reducing the amount of proceeds paid to you. If new debt is added to our current debt levels, the related risks that we now face could intensify.

The notes will be our senior unsecured obligations and as a result, the notes will be effectively junior to our future secured indebtedness, to the extent of the value of the collateral securing such indebtedness, and structurally subordinated to the indebtedness and other liabilities of our subsidiaries, other than subsidiaries that may guarantee the notes in the future.

The notes will be our senior unsecured obligations and will rank equally in right of payment with all of our other existing and future senior indebtedness, and will be structurally subordinated to the claims of all creditors, including trade creditors and tort claimants, of our subsidiaries, other than subsidiaries that may guarantee the notes in the future. In the event of the liquidation, dissolution, reorganization, bankruptcy or similar proceeding of the business of a subsidiary that is not a guarantor, creditors of that subsidiary, including trade creditors, would generally have the right to be paid in full before any distribution is made to us or the holders of the notes. Accordingly, there may not be sufficient funds remaining to pay amounts due on all or any of the notes. As of March 31, 2016, after

S-10

giving effect to this offering and the application of the net proceeds as described in "Use of Proceeds," our subsidiaries would have had approximately $13.4 million of indebtedness outstanding, consisting of capital leases. The indenture governing the notes will not prohibit such subsidiaries from incurring indebtedness in the future.

In addition, because the notes are, and any future guarantees of the notes will be, unsecured, holders of any secured indebtedness of ours or our subsidiaries would have claims with respect to the assets constituting collateral for such indebtedness that are senior to the claims of the holders of the notes. Currently, neither we nor any of our subsidiaries has any secured indebtedness. Although the indenture governing the notes will place some limitations on our ability to create liens securing indebtedness, there will be significant exceptions to these limitations that would allow us to secure significant amounts of indebtedness without equally and ratably securing the notes. If we or our subsidiaries incur secured indebtedness and such indebtedness is accelerated or we become subject to bankruptcy, liquidation or reorganization proceedings, our and our subsidiaries' assets would be used to satisfy obligations with respect to the indebtedness secured thereby before any payment could be made on the notes. Consequently, any such secured indebtedness would effectively be senior to the notes and any future guarantees of the notes, to the extent of the value of the collateral securing such secured indebtedness. In that event, you may not be able to recover all the principal or interest you are due under the notes.

Any future subsidiary guarantees could be deemed fraudulent conveyances under certain circumstances, and in such event a court may try to subordinate or void the subsidiary guarantees.

Initially, none of our subsidiaries will guarantee the notes, although in the future one or more of our subsidiaries may do so. Under the federal bankruptcy laws and comparable provisions of state fraudulent transfer laws, a subsidiary guarantee could be voided, or claims in respect of a subsidiary guarantee could be subordinated to all other debts of that subsidiary guarantor if, among other things, the subsidiary guarantor, at the time it incurred the indebtedness evidenced by its subsidiary guarantee received less than reasonably equivalent value or fair consideration for the incurrence of such subsidiary guarantee; and

In addition, any payment by that subsidiary guarantor pursuant to its subsidiary guarantee could be voided and required to be returned to the subsidiary guarantor, or to a fund for the benefit of the creditors of the subsidiary guarantor. The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a subsidiary guarantor would be considered insolvent if:

S-11

The indenture governing the notes will include only limited covenants and these limited covenants may not protect your investment.

The indenture governing the notes will not:

The indenture governing the notes will also permit us and our subsidiaries to incur additional indebtedness, including secured indebtedness, that could effectively rank senior to the notes, and to engage in leaseback arrangements, subject to certain limitations. Any of these actions could adversely affect our ability to make principal and interest payments on the notes.

We have a holding company structure in which our subsidiaries conduct our operations and own our operating assets.

We are a holding company, and our subsidiaries conduct all of our operations and own all of our operating assets. We do not have significant assets other than the equity in our subsidiaries. As a result, our ability to make required payments on the notes depends on the performance of our subsidiaries and their ability to distribute funds to us. The ability of our subsidiaries to make distributions to us may be restricted by, among other things, credit instruments and applicable state partnership laws and other laws and regulations. If our subsidiaries are prevented from distributing funds to us, we may be unable to pay all the principal and interest on the notes when due.

We do not have the same flexibility as other types of organizations to accumulate cash, which may limit cash available to service the notes or to repay them at maturity.

Unlike a corporation, we are required by our partnership agreement to distribute, on a quarterly basis, 100% of our available cash to our unitholders of record and our general partner. "Available cash" is defined in our partnership agreement, and it generally means, for each fiscal quarter:

S-12

As a result, we do not expect to accumulate significant amounts of cash. Depending on the timing and amount of our cash distributions, these distributions could significantly reduce the cash available to us in subsequent periods to make payments on the notes.

Your ability to transfer the notes at a time or price you desire may be limited by the absence of an active trading market, which may not develop.

Although we have registered the offer and sale of the notes under the Securities Act of 1933, as amended, we do not intend to apply for the listing of the notes on any securities exchange or for the quotation of the notes on any automated dealer quotation system. In addition, although the underwriters have informed us that they intend to make a market in the notes of each series, as permitted by applicable laws and regulations, they are not obligated to make markets in the notes, and they may discontinue their market-making activities at any time without notice. Active markets for the notes may not develop or, if developed, may not continue. In the absence of active trading markets, you may not be able to transfer the notes within the time or at the prices you desire.

We may not be able to generate sufficient cash to service all of our indebtedness, including the notes, our existing notes and our indebtedness under our revolving credit facility, and we may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness, including the notes. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and would permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, including our credit agreement, the indentures governing our existing notes and the indenture that will govern the notes. For example, our revolving credit facility contains restrictions on our ability to dispose of assets. We may not be able to consummate asset dispositions, and any proceeds may not be adequate to meet any debt service obligations then due. See "Description of Notes."

The credit and risk profile of our general partner and its owner could adversely affect our credit ratings and profile.

The credit and business risk profiles of our general partner and its indirect owner, Devon, may be factors in credit evaluations of us due to the control of our general partner, the significant business we conduct with Devon and the significant influence over our business activities, including our cash distributions, acquisition strategy and business risk profile. Another factor that may be considered is the financial condition of our general partner and Devon, including the degree of their financial leverage.

Our tax treatment will depend on our status as a partnership for U.S. federal income tax purposes, as well as our not being subject to entity-level taxation by individual states. If the Internal Revenue Service (the "IRS") treats us as a corporation for tax purposes or we become subject to additional entity-level taxation, it would reduce the amount of cash available for payment of principal and interest on the notes.

If we were classified as a corporation for U.S. federal income tax purposes, we would be required to pay U.S. federal income tax on our taxable income at the corporate tax rate, which is

S-13

currently a maximum of 35%, and would likely pay state income tax and franchise tax at varying rates. Treatment of us as a corporation would cause a material reduction in our anticipated cash flow, which could materially and adversely affect our ability to make payments on the notes.

Current law may change so as to cause us to be treated as a corporation for U.S. federal income tax purposes or otherwise subject us to entity-level taxation. For example, at the federal level, legislation previously has been proposed that would eliminate partnership tax treatment for certain publicly traded partnerships. Although such proposed legislation would not have applied to us as proposed, it is possible that modified versions of such legislation could be enacted which would apply to us. We are unable to predict whether any of these changes, or other proposals, will ultimately be enacted. Any such changes could materially and adversely affect our ability to make payments on the notes. At the state level, because of widespread state budget deficits and for other reasons, several states are evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise and other forms of taxation. For example, as a partnership operating in Texas we are currently required to pay franchise tax at a maximum effective rate of 0.525% of our gross income apportioned to Texas. If any other state were to impose a tax on us, the cash we have available to make payments on the notes could be materially reduced.

S-14

We expect to receive net proceeds from this offering of approximately $495.7 million after deducting the underwriting discounts and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering to repay outstanding borrowings under our revolving credit facility and for general partnership purposes.

As of July 8, 2016, we had $707.0 million in borrowings and $11.0 million in outstanding letters of credit under our $1.5 billion unsecured revolving credit facility (which includes a $500.0 million letter of credit subfacility) at a weighted average interest rate of 2.18%. Our revolving credit facility matures in March 2020, unless we request, and the requisite lenders agree, to extend it pursuant to its terms. Borrowings under our revolving credit facility were used for capital expenditures, acquisitions and general partnership purposes.

Affiliates of each of the underwriters are lenders under our revolving credit facility that we expect to reduce using the proceeds from this offering and, accordingly, such underwriters and affiliates will receive a portion of the proceeds from this offering. See "Underwriting."

S-15

The following table sets forth our cash and cash equivalents and our capitalization as of March 31, 2016:

You should read this table in conjunction with our financial statements and notes that are incorporated by reference into this prospectus supplement and the accompanying base prospectus for additional information about our capital structure.

| |

As of March 31, 2016 | ||||||

|---|---|---|---|---|---|---|---|

| |

Historical | As Adjusted | |||||

| |

(Dollars in millions) |

||||||

Cash and cash equivalents |

$ | 5.7 | $ | 5.7 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Long-term debt including current maturities: |

|||||||

Bank credit facility(1) |

$ | 543.0 | $ | 47.3 | |||

2.700% Senior Notes due 2019 (net of discount of $0.4 million) |

399.6 | 399.6 | |||||

7.125% Senior Notes due 2022 (including a premium of $18.2 million) |

180.7 | 180.7 | |||||

4.400% Senior Notes due 2024 (net of premium of $2.8 million) |

552.8 | 552.8 | |||||

4.150% Senior Notes due 2025 (net of discount of $1.2 million) |

748.8 | 748.8 | |||||

5.600% Senior Notes due 2044 (net of discount of $0.3 million) |

349.7 | 349.7 | |||||

5.050% Senior Notes due 2045 (net of discount of $6.8 million) |

443.2 | 443.2 | |||||

4.850% Senior Notes due 2026 offered hereby (net of discount of $0.7 million) |

— | 499.3 | |||||

Installment Payable (net of discount of $66.7 million) |

433.3 | 433.3 | |||||

Debt Issuance Cost |

(22.4 | ) | (26.0 | ) | |||

Other debt |

0.2 | 0.2 | |||||

| | | | | | | | |

Total long-term debt including current maturities |

3,628.9 | 3,628.9 | |||||

Partners' equity: |

|||||||

Common Units |

3,367.5 | 3,367.5 | |||||

Class C Common Units |

137.0 | 137.0 | |||||

Preferred Units |

736.3 | 736.3 | |||||

General Partner Interest |

210.4 | 210.4 | |||||

Non-Controlling Interest |

259.6 | 259.6 | |||||

| | | | | | | | |

Total partners' equity |

4,710.8 | 4,710.8 | |||||

| | | | | | | | |

Total capitalization |

$ | 8,339.7 | $ | 8,339.7 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

S-16

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratio of earnings to fixed charges for each of the periods indicated:

| |

|

Year Ended December 31, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months Ended March 31, 2016 |

||||||||||||||||||

| |

2015 | 2014 | 2013(2) | 2012(2) | 2011(2) | ||||||||||||||

Ratio of earnings to fixed charges(1) |

(3 | ) | (4 | ) | 6.5x | — | — | — | |||||||||||

S-17

We are currently a party to a base indenture between us and Wells Fargo Bank, National Association, as trustee, dated March 19, 2014, pursuant to which we may issue multiple series of debt securities from time to time. We will issue the notes under such base indenture, as supplemented by a supplemental indenture setting forth the specific terms of the notes. In this description, when we refer to the "indenture," we mean such base indenture as so amended and supplemented by the applicable supplemental indenture. This description is a summary of the material provisions of the notes and the indenture. This description does not restate those agreements and instruments in their entirety. You should refer to the notes and the indenture, forms of which are available as set forth below under "Available Information," for a complete description of our obligations and your rights.

The following description of the particular terms of the notes supplements the general description of the debt securities included in the accompanying base prospectus under the caption "Description of the Debt Securities." The notes offered hereby will be a series of senior debt securities issued by us as described herein and therein. You should review this "Description of Notes" together with the "Description of the Debt Securities" included in the accompanying base prospectus. To the extent that this "Description of Notes" is inconsistent with the "Description of the Debt Securities" in the accompanying base prospectus, this "Description of Notes" will control and replace the inconsistent "Description of the Debt Securities" in the accompanying base prospectus.

You can find the definitions of various terms used in this description under "—Certain Definitions" below. In this description, the terms "EnLink Midstream," "we," "us" and "our" refer only to EnLink Midstream Partners, LP and not to any of its Subsidiaries.

General

The notes:

The notes constitute a separate series of debt securities under the indenture. The indenture does not limit the amount of debt securities we may issue under the indenture from time to time in one or more series. We may in the future issue additional debt securities under the indenture in addition to the notes as described below under "—Further Issuances."

Interest

Interest on the notes will accrue from and including July 14, 2016 or from and including the most recent interest payment date to which interest has been paid or provided for. We will pay interest on the notes in cash semi-annually in arrears on January 15 and July 15 of each year, beginning January 15, 2017. We will make interest payments on the notes to the persons in whose names the notes are registered at the close of business on January 1 or July 1, as applicable, before the next interest payment date.

S-18

Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. If any interest payment date falls on a day that is not a business day, the payment will be made on the next business day, and no interest will accrue on the amount of interest due on that interest payment date for the period from and after the interest payment date to the date of payment.

Paying Agent and Registrar

The trustee will initially act as paying agent and registrar for the notes. We may change the paying agent or registrar without prior notice to the holders of the notes, and we or any of our Subsidiaries may act as paying agent or registrar; provided, however, that we will be required to maintain at all times an office or agency in The City of New York (which may be an office of the trustee or an affiliate of the trustee or the registrar or a co-registrar for the notes) where the notes may be presented for payment and where notes may be surrendered for registration of transfer or for exchange and where notices and demands to or upon us in respect of the notes and the indenture may be served. We may also from time to time designate one or more additional offices or agencies where the notes may be presented or surrendered for any or all such purposes and may from time to time rescind such designations.

Further Issuances

We may from time to time, without notice to or the consent of the holders of the notes, create and issue additional notes having the same terms as any of the series of notes offered by this prospectus supplement and accompanying base prospectus, except for the issue date, public offering price and in some cases, the first interest payment date. Additional notes issued in this manner will form a single series with the previously issued and outstanding notes of such series.

Optional Redemption

Prior to April 15, 2026 (three months prior to the maturity date of the notes), the notes will be redeemable, at our option, at any time in whole, or from time to time in part, at a price equal to the greater of:

plus, in either case, accrued and unpaid interest to, but excluding, the redemption date.

At any time on or after April 15, 2026 (three months prior to the maturity date of the notes), the notes will be redeemable in whole or in part, at our option, at a redemption price equal to 100% of the principal amount of the notes to be redeemed plus accrued and unpaid interest thereon to, but excluding, the redemption date.

For purposes of determining the redemption price, the following definitions are applicable:

"Comparable Treasury Issue" means the United States Treasury security selected by the Quotation Agent as having a maturity comparable to the remaining term of the notes to be redeemed (calculated as if the maturity date of the notes was April 15, 2026 (three months prior to the maturity date of the notes)) that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the

S-19

remaining term of such notes (calculated as if the maturity date of the notes was April 15, 2026 (three months prior to the maturity date of the notes)).

"Comparable Treasury Price" means, with respect to any redemption date for notes, (1) the average of four Reference Treasury Dealer Quotations for such redemption date after excluding the highest and lowest of all of the Reference Treasury Dealer Quotations or (2) if the Quotation Agent obtains fewer than four such Reference Treasury Dealer Quotations, the average of all such quotations.

"Quotation Agent" means the Reference Treasury Dealer appointed by us.

"Primary Treasury Dealer" means a U.S. government securities dealer in the United States.

"Reference Treasury Dealer" means each of J.P. Morgan Securities LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated and their respective successors.

"Reference Treasury Dealer Quotation" means, with respect to each Reference Treasury Dealer and any redemption date, the average, as determined by the Quotation Agent, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount) quoted in writing to the Quotation Agent by such Reference Treasury Dealer at 5:00 p.m., New York City time, on the third business day preceding the redemption date.

"Treasury Rate" means, with respect to any redemption date, the rate per year equal to the semi-annual equivalent yield to maturity of the Comparable Treasury Issue, calculated using a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such redemption date. The Treasury Rate will be calculated on the third business day preceding any redemption date.

Redemption Procedures

If fewer than all of the notes of a series are to be redeemed at any time, such notes will be selected for redemption not more than 60 days prior to the redemption date and such selection will be made by the trustee on a pro rata basis, by lot or by such other method as the trustee deems appropriate (or, in the case of notes represented by a note in global form, by such method as The Depository Trust Company ("DTC") may require); provided, that no partial redemption of any note will occur if such redemption would reduce the principal amount of such note to less than $2,000. Notices of redemption with respect to the notes will be sent at least 30 but not more than 60 days before the redemption date to each holder of notes to be redeemed.

If any note is to be redeemed in part only, the notice of redemption that relates to such note will state the portion of the principal amount thereof to be redeemed. A new note in principal amount equal to the unredeemed portion thereof will be issued in the name of the holder thereof upon cancellation of the original note. Notes called for redemption will become due on the date fixed for redemption. Unless we default in payment of the redemption price, on and after the redemption date, interest will cease to accrue on the notes or portions of the notes called for redemption.

Future Subsidiary Guarantees

The notes initially will not be guaranteed by any of our Subsidiaries. However, if at any time following the issuance of the notes, any Subsidiary of EnLink Midstream becomes a guarantor or co-obligor of our Credit Agreement, then EnLink Midstream will cause such Subsidiary to promptly execute and deliver to the trustee a supplemental indenture in a form satisfactory to the trustee pursuant to which such Subsidiary guarantees EnLink Midstream's obligations with respect to the notes on the terms provided for in the indenture.

The guarantee of any Subsidiary Guarantor may be released under certain circumstances. If we exercise our legal or covenant defeasance option with respect to the notes as described below under

S-20

"—Defeasance and Discharge," then any Subsidiary Guarantor will be released. Further, if no default has occurred and is continuing under the indenture, and to the extent not otherwise prohibited by the indenture, a Subsidiary Guarantor will be unconditionally released and discharged from its guarantee:

If at any time following any release of a Subsidiary Guarantor from its guarantee of the notes pursuant to the third bullet point in the preceding paragraph, the Subsidiary Guarantor again becomes a guarantor or co-obligor of our Credit Agreement, then EnLink Midstream will cause the Subsidiary Guarantor to again guarantee the notes in accordance with the indenture.

Ranking

The notes will be unsecured, unless we are required to secure them pursuant to the limitations on liens covenant described below under "—Certain Covenants—Limitations on Liens." The notes will also be the unsubordinated obligations of EnLink Midstream and will rank equally with all other existing and future unsubordinated indebtedness of EnLink Midstream. Each guarantee, if any, of the notes will be an unsecured and unsubordinated obligation of the Subsidiary Guarantor and will rank equally with all other existing and future unsubordinated indebtedness of the Subsidiary Guarantor. The notes and each guarantee, if any, will effectively rank junior to any future indebtedness of EnLink Midstream and any Subsidiary Guarantor that is both secured and unsubordinated to the extent of the value of the assets securing such indebtedness, and the notes will structurally rank junior to all indebtedness and other liabilities of EnLink Midstream's existing and future Subsidiaries that are not Subsidiary Guarantors.

As of March 31, 2016, after giving effect to this offering of the notes and the application of the net proceeds therefrom as described in "Use of Proceeds," EnLink Midstream, excluding its Subsidiaries, would have had approximately $3.6 billion of indebtedness outstanding, all of which would have been unsecured, unsubordinated indebtedness, consisting entirely of the notes and our existing senior unsecured notes. Initially, none of EnLink Midstream's Subsidiaries will guarantee the notes. As of March 31, 2016, after giving effect to this offering of the notes and the application of the net proceeds therefrom as described in "Use of Proceeds," these Subsidiaries would have had approximately $13.4 million of indebtedness outstanding, consisting of capital leases.

Open Market Purchases; No Mandatory Redemption or Sinking Fund

We may at any time and from time to time repurchase notes in the open market or otherwise, in each case without any restriction under the indenture. We are not required to make any mandatory redemption or sinking fund payments with respect to the notes.

Certain Covenants

Except as set forth below, neither EnLink Midstream nor any of its Subsidiaries is restricted by the indenture from incurring any type of indebtedness or other obligation, from paying dividends or making distributions on its partnership or other equity interests or from purchasing or redeeming its partnership or other equity interests. The indenture does not require the maintenance of any financial

S-21

ratios or specified levels of net worth or liquidity. In addition, the indenture does not contain any provisions that would require EnLink Midstream to repurchase or redeem or otherwise modify the terms of the notes upon a change in control or other events involving EnLink Midstream that could adversely affect the creditworthiness of EnLink Midstream.

Limitations on Liens. EnLink Midstream will not, nor will it permit any of its Principal Subsidiaries to, create, assume, incur or suffer to exist any mortgage, lien, security interest, pledge, charge or other encumbrance ("liens") upon any Principal Property or upon any capital stock of any Principal Subsidiary, whether owned on the date of the supplemental indenture creating the notes or thereafter acquired, to secure any Indebtedness of EnLink Midstream or any other Person (other than the notes), without in any such case making effective provisions whereby all of the outstanding notes are secured equally and ratably with, or prior to, such Indebtedness so long as such Indebtedness is so secured.

Notwithstanding the foregoing, under the indenture, EnLink Midstream may, and may permit any of its Principal Subsidiaries to, create, assume, incur, or suffer to exist without securing the notes (a) any Permitted Lien, (b) any lien upon any Principal Property or capital stock of a Principal Subsidiary to secure Indebtedness of EnLink Midstream or any other Person, provided that the aggregate principal amount of all Indebtedness then outstanding secured by such lien and all similar liens under this clause (b), together with all Attributable Indebtedness from Sale-Leaseback Transactions (excluding Sale-Leaseback Transactions permitted by clauses (1) through (4), inclusive, of the first paragraph of the restriction on sale-leasebacks covenant described below), does not exceed 15% of Consolidated Net Tangible Assets or (c) any lien upon (i) any Principal Property that was not owned by EnLink Midstream or any of its Subsidiaries on the date of the supplemental indenture creating the notes or (ii) the capital stock of any Principal Subsidiary that owns no Principal Property that was owned by EnLink Midstream or any of its Subsidiaries on the date of the supplemental indenture creating the notes, in each case owned by a Subsidiary of EnLink Midstream (an "Excluded Subsidiary") that (A) is not, and is not required to be, a Subsidiary Guarantor and (B) has not granted any liens on any of its property securing Indebtedness with recourse to EnLink Midstream or any Subsidiary of EnLink Midstream other than such Excluded Subsidiary or any other Excluded Subsidiary.

Restriction on Sale-Leasebacks. EnLink Midstream will not, and will not permit any Principal Subsidiary to, engage in the sale or transfer by EnLink Midstream or any of its Principal Subsidiaries of any Principal Property to a Person (other than EnLink Midstream or a Principal Subsidiary) and the taking back by EnLink Midstream or any Principal Subsidiary, as the case may be, of a lease of such Principal Property (a "Sale-Leaseback Transaction"), unless:

S-22

prepayment, repayment, redemption, reduction or retirement of any Indebtedness of EnLink Midstream or any of its Subsidiaries that is not subordinated to the notes or any guarantee, or (b) the expenditure or expenditures for Principal Property used or to be used in the ordinary course of business of EnLink Midstream or its Subsidiaries.

Notwithstanding the foregoing, EnLink Midstream may, and may permit any Principal Subsidiary to, effect any Sale-Leaseback Transaction that is not excepted by clauses (1) through (4), inclusive, of the preceding paragraph provided that the Attributable Indebtedness from such Sale-Leaseback Transaction, together with the aggregate principal amount of outstanding Indebtedness (other than the notes) secured by liens other than Permitted Liens upon Principal Properties, does not exceed 15% of Consolidated Net Tangible Assets.

Merger, Consolidation or Sale of Assets. EnLink Midstream shall not consolidate with or merge into any Person or sell, lease, convey, transfer or otherwise dispose of all or substantially all of its assets to any Person unless:

The successor will be substituted for EnLink Midstream in the indenture with the same effect as if it had been an original party to the indenture. Thereafter, the successor may exercise the rights and powers of EnLink Midstream under the indenture. If EnLink Midstream conveys or transfers all or substantially all of its assets, it will be released from all liabilities and obligations under the indenture and under the notes except that no such release will occur in the case of a lease of all or substantially all of its assets.

Defeasance and Discharge

The indenture provides that we may be:

The defeasance provisions of the indenture described in the accompanying base prospectus will apply to the notes. See "Description of the Debt Securities—Defeasance" in the accompanying base prospectus.

The indenture is also subject to discharge with respect to the notes as described in the accompanying base prospectus under "Description of the Debt Securities—Satisfaction and Discharge."

S-23

Concerning the Trustee

The indenture contains certain limitations on the right of the trustee, should it become our creditor, to obtain payment of claims in certain cases, or to realize for its own account on certain property received in respect of any such claim as security or otherwise. The trustee is permitted to engage in certain other transactions. However, if it acquires any conflicting interest within the meaning of the Trust Indenture Act after a default has occurred and is continuing, it must eliminate the conflict within 90 days, apply to the SEC for permission to continue as trustee or resign.

If an Event of Default occurs and is not cured or waived, the trustee is required to exercise such of the rights and powers vested in it by the indenture and use the same degree of care and skill in their exercise as a prudent man would exercise or use under the circumstances in the conduct of his own affairs. Subject to such provisions, the trustee will not be under any obligation to exercise any of its rights or powers under the indenture at the request of any of the holders of notes unless they have offered to the trustee reasonable security or indemnity against the costs, expenses and liabilities it may incur.

Wells Fargo Bank, National Association is the trustee under the indenture and the registrar and paying agent with regard to the notes. The trustee and its affiliates maintain commercial banking and other relationships with EnLink Midstream.

Governing Law

The indenture and the notes will be governed by, and will be construed in accordance with, the laws of the State of New York.

Book-Entry System

We have obtained the information in this section concerning The Depository Trust Company ("DTC") and its book-entry systems and procedures from DTC, and we take no responsibility for the accuracy of this information. In addition, the description in this section reflects our understanding of the rules and procedures of DTC as they are currently in effect. DTC could change its rules and procedures at any time.

The notes will initially be represented by one or more fully registered global notes. Each such global note will be deposited with, or on behalf of, DTC or any successor thereto and registered in the name of Cede & Co. (DTC's nominee). You may hold your interests in the global notes through DTC either as a participant in DTC or indirectly through organizations that are participants in DTC.

So long as DTC or its nominee is the registered owner of the global securities representing the notes, DTC or such nominee will be considered the sole owner and holder of the notes for all purposes of the notes and the indenture. Except as provided below, owners of beneficial interests in the notes will not be entitled to have the notes registered in their names, will not receive or be entitled to receive physical delivery of the notes in definitive form and will not be considered the owners or holders of the notes under the indenture, including for purposes of receiving any reports delivered by us or the trustee pursuant to the indenture. Accordingly, each person owning a beneficial interest in a note must rely on the procedures of DTC or its nominee and, if such person is not a participant, on the procedures of the participant through which such person owns its interest, in order to exercise any rights of a holder of notes.

The Depository Trust Company. DTC will act as securities depositary for the notes. The notes will be issued as fully registered notes registered in the name of Cede & Co. DTC has advised us as follows: DTC is

S-24

DTC holds securities that its direct participants deposit with DTC. DTC facilitates the settlement among direct participants of securities transactions, such as transfers and pledges, in deposited securities through electronic computerized book-entry changes in direct participants' accounts, thereby eliminating the need for physical movement of securities certificates.

Direct participants of DTC include securities brokers and dealers (including the underwriters), banks, trust companies, clearing corporations, and certain other organizations. DTC is owned by a number of its direct participants. Access to the DTC system is also available to securities brokers and dealers, banks and trust companies that clear through or maintain a custodial relationship with a direct participant, either directly or indirectly.

If you are not a direct participant or an indirect participant and you wish to purchase, sell or otherwise transfer ownership of, or other interests in, notes, you must do so through a direct participant or an indirect participant. DTC agrees with and represents to DTC participants that it will administer its book-entry system in accordance with its rules and by-laws and requirements of law. The SEC has on file a set of the rules applicable to DTC and its direct participants.

Purchases of notes under DTC's system must be made by or through direct participants, who will receive a credit for the notes on DTC's records. The ownership interest of each beneficial owner is in turn to be recorded on the records of direct participants and indirect participants. Beneficial owners will not receive written confirmation from DTC of their purchase, but beneficial owners are expected to receive written confirmations providing details of the transaction, as well as periodic statements of their holdings, from the direct participants or indirect participants through which such beneficial owners entered into the transaction. Transfers of ownership interests in the notes are to be accomplished by entries made on the books of participants acting on behalf of beneficial owners. Beneficial owners will not receive certificates representing their ownership interests in the notes, except in the event that use of the book-entry system for the notes is discontinued.

To facilitate subsequent transfers, all notes deposited by direct participants with DTC are registered in the name of DTC's nominee, Cede & Co., or such other name as may be requested by an authorized representative of DTC. The deposit of notes with DTC and their registration in the name of Cede & Co. do not effect any change in beneficial ownership. DTC has no knowledge of the actual beneficial owners of the notes. DTC's records reflect only the identity of the direct participants to whose accounts such notes are credited, which may or may not be the beneficial owners. The participants will remain responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by DTC to direct participants, by direct participants to indirect participants and by direct participants and indirect participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Book-Entry Format. Under the book-entry format, the trustee will pay interest or principal payments to Cede & Co., as nominee of DTC. DTC will forward the payment to the direct participants, who will then forward the payment to the indirect participants or to you as the beneficial owner. You may experience some delay in receiving your payments under this system. Neither we, the

S-25

trustee under the indenture nor any paying agent has any direct responsibility or liability for the payment of principal or interest on the notes to owners of beneficial interests in the notes.

DTC is required to make book-entry transfers on behalf of its direct participants and is required to receive and transmit payments of principal, premium, if any, and interest on the notes. Any direct participant or indirect participant with which you have an account is similarly required to make book-entry transfers and to receive and transmit payments with respect to the notes on your behalf. We, the underwriters and the trustee under the indenture have no responsibility for any aspect of the actions of DTC or any of its direct or indirect participants. We, the underwriters and the trustee under the indenture have no responsibility or liability for any aspect of the records kept by DTC or any of its direct or indirect participants relating to, or payments made on account of, beneficial ownership interests in the notes or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests. We also do not supervise these systems in any way.

The trustee will not recognize you as a holder under the indenture, and you can only exercise the rights of a holder indirectly through DTC and its direct participants. DTC has advised us that it will only take action regarding a note if one or more of the direct participants to whom the note is credited directs DTC to take such action and only in respect of the portion of the aggregate principal amount of the notes as to which that participant or participants has or have given that direction. DTC can only act on behalf of its direct participants. Your ability to pledge notes to non-direct participants, and to take other actions, may be limited because you will not possess a physical certificate that represents your notes.

Neither DTC nor Cede & Co. (nor such other DTC nominee) will consent or vote with respect to the notes unless authorized by a direct participant in accordance with DTC's procedures. Under its usual procedures, DTC will mail an omnibus proxy to us as soon as possible after the record date. The omnibus proxy assigns Cede & Co.'s consenting or voting rights to those direct participants to whose accounts the notes are credited on the record date (identified in a listing attached to the omnibus proxy).

DTC has agreed to the foregoing procedures in order to facilitate transfers of the notes among its participants. However, DTC is under no obligation to perform or continue to perform those procedures, and may discontinue those procedures at any time.

Certain Definitions

"Attributable Indebtedness," when used with respect to any Sale-Leaseback Transaction, means, as at the time of determination, the present value (discounted at the rate set forth or implicit in the terms of the lease included in such transaction) of the total obligations of the lessee for rental payments (other than amounts required to be paid on account of property taxes, maintenance, repairs, insurance, assessments, utilities, operating and labor costs and other items that do not constitute payments for property rights) during the remaining term of the lease included in such Sale-Leaseback Transaction (including any period for which such lease has been extended). In the case of any lease that is terminable by the lessee upon the payment of a penalty or other termination payment, such amount shall be the lesser of the amount determined assuming termination upon the first date such lease may be terminated (in which case the amount shall also include the amount of the penalty or termination payment, but no rent shall be considered as required to be paid under such lease subsequent to the first date upon which it may be so terminated) or the amount determined assuming no such termination.

S-26

"Consolidated Net Tangible Assets" means, at any date of determination, the total amount of assets of EnLink Midstream and its consolidated Subsidiaries after deducting therefrom:

all as set forth, or on a pro forma basis would be set forth, on the consolidated balance sheet of EnLink Midstream and its consolidated Subsidiaries for EnLink Midstream's most recently completed fiscal quarter for which financial statements have been filed with the SEC, prepared in accordance with generally accepted accounting principles.

"Credit Agreement" means the Credit Agreement, dated as of February 20, 2014, among EnLink Midstream, Bank of America, N.A., as Administrative Agent, and the other agents and lenders party thereto, and as further amended, restated, refinanced, replaced or refunded from time to time.

"Exchange Act" means the Securities Exchange Act of 1934, as amended, and any successor statute.

"General Partner" means EnLink Midstream GP, LLC, a Delaware limited liability company, and its successors as general partner of EnLink Midstream.

"Indebtedness" of any Person at any date means any obligation created or assumed by such Person for the repayment of borrowed money or any guaranty thereof.

"Permitted Liens" means:

S-27

S-28

"Person" means any individual, corporation, partnership, limited liability company, joint venture, incorporated or unincorporated association, joint-stock company, trust, unincorporated organization, government or any agency or political subdivision thereof or any other entity.

"Principal Property" means, whether owned or leased on the date of the initial issuance of the notes or thereafter acquired:

"Principal Subsidiary" means any Subsidiary owning or leasing, directly or indirectly through ownership in another Subsidiary, any Principal Property.

"Subsidiary" means, as to any Person, (1) any corporation, association or other business entity (other than a partnership or limited liability company) of which more than 50% of the outstanding capital stock having ordinary voting power is at the time owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person or (2) any general or limited partnership or limited liability company, (a) the sole general partner or member of which is the Person or a Subsidiary of the Person or (b) if there is more than one general partner or member, either (i) the only managing general partners or managing members of such partnership or limited liability company are such Person or Subsidiaries of such Person or (ii) such Person owns or controls, directly or

S-29

indirectly, a majority of the outstanding general partner interests, member interests or other voting equities of such partnership or limited liability company, respectively.

"Subsidiary Guarantor" means each Subsidiary of EnLink Midstream that guarantees the notes pursuant to the terms of the indenture but only so long as such Subsidiary is a guarantor with respect to the notes on the terms provided for in the indenture.

S-30

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS