Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 000-50067

CROSSTEX ENERGY, L.P.

(Exact name of registrant as specified in its charter)

| Delaware (State of organization) |

16-1616605 (I.R.S. Employer Identification No.) |

|

2501 CEDAR SPRINGS DALLAS, TEXAS (Address of principal executive offices) |

75201 (Zip Code) |

(Registrant's

telephone number, including area code)

(214) 953-9500

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Exchange on which Registered | |

|---|---|---|

| Common Units Representing Limited | The NASDAQ Global Select Market | |

| Partnership Interests |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None.

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the Common Units representing limited partner interests held by non-affiliates of the registrant was approximately $457,405,664 on June 30, 2011, based on $18.15 per unit, the closing price of the Common Units as reported on The NASDAQ Global Select Market on such date.

At February 14, 2012, there were 50,863,334 common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

2

General

Crosstex Energy, L.P. is a publicly traded Delaware limited partnership formed in 2002. Our common units are traded on The NASDAQ Global Select Market under the symbol "XTEX". Our business activities are conducted through our subsidiary, Crosstex Energy Services, L.P., a Delaware limited partnership (the "Operating Partnership") and the subsidiaries of the Operating Partnership. Our executive offices are located at 2501 Cedar Springs, Dallas, Texas 75201, and our telephone number is (214) 953-9500. Our Internet address is www.crosstexenergy.com. We post the following filings in the "Investors" section of our website as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission: our annual report on Form 10-K; our quarterly reports on Form 10-Q; our current reports on Form 8-K; and any amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings on our web-site are available free of charge. In this report, the terms "Partnership" and "Registrant," as well as the terms "our," "we," "us" and "its," are sometimes used as abbreviated references to Crosstex Energy, L.P. itself or Crosstex Energy, L.P. together with its consolidated subsidiaries, including the Operating Partnership.

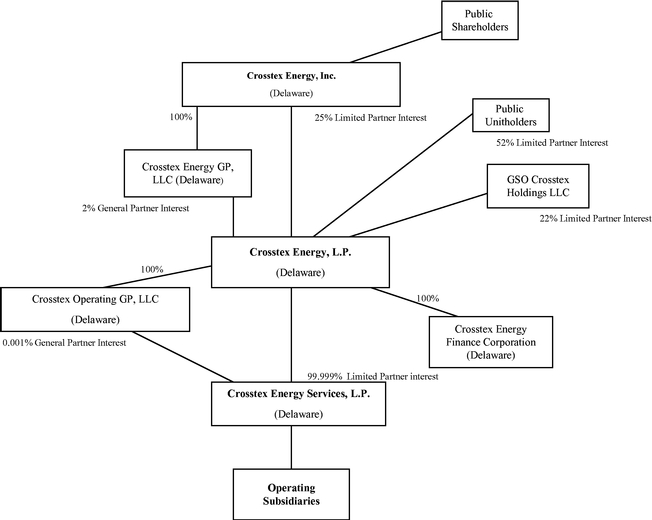

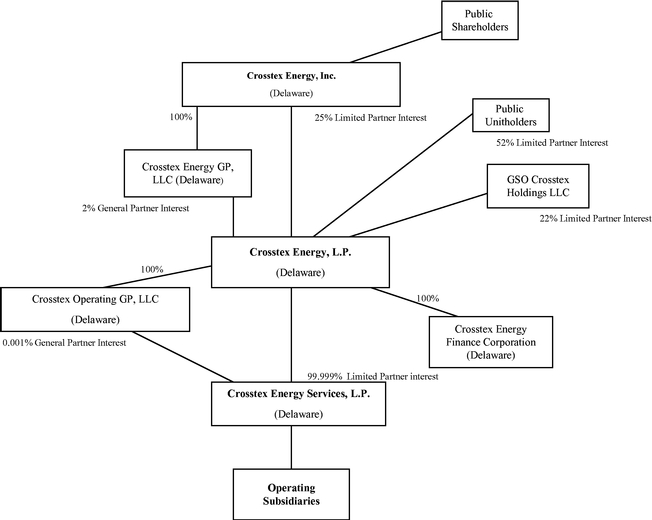

Crosstex Energy GP, LLC, a Delaware limited liability company, is our general partner. Crosstex Energy GP, LLC manages our operations and activities. Crosstex Energy GP, LLC is a wholly owned subsidiary of Crosstex Energy, Inc., or CEI. Crosstex Energy, Inc.'s shares are traded on The NASDAQ

3

Global Select Market under the symbol "XTXI." The following diagram depicts the organization and ownership of the Partnership as of December 31, 2011.

The following terms as defined generally are used in the energy industry and in this document:

/d =

per day

Bbls = barrels

Bcf = billion cubic feet

Btu = British thermal units

CO2= Carbon dioxide

Gal = gallon

Mcf = thousand cubic feet

MMBtu = million British thermal units

MMcf = million cubic feet

NGL = natural gas liquid and natural gas liquids

Capacity volumes for our facilities are measured based on physical volume and stated in cubic feet (Bcf, Mcf or MMcf). Throughput volumes are measured based on energy content and stated in British thermal units (Btu or MMBtu). A volume capacity of 100 MMcf generally correlates to volume capacity of 100,000 MMBtu. Fractionated volumes are measured based on physical volumes and stated in gallons (Gal).

4

Our Operations

Crosstex Energy, L.P. is an independent midstream energy company engaged in the gathering, transmission, processing and marketing of natural gas, natural gas liquids, or NGLs, and providing terminal services for crude oil. We connect the wells of natural gas producers in our market areas to our gathering systems, process natural gas for the removal of NGLs, fractionate NGLs into purity products and market those products for a fee, transport natural gas and ultimately provide natural gas to a variety of markets. We purchase natural gas from natural gas producers and other supply sources and sell that natural gas to utilities, industrial consumers, other marketers and pipelines. We operate processing plants that process gas transported to the plants by major interstate pipelines or from our own gathering systems under a variety of fee arrangements. In addition, we purchase natural gas from producers not connected to our gathering systems for resale and sell natural gas on behalf of producers for a fee.

We focus on the gathering, processing, transmission and marketing of natural gas and NGLs, which we manage as regional reporting segments. Our geographic focus is in the North Texas Barnett Shale (NTX) and in Louisiana, which has two reportable business segments (the Crosstex LIG system and the south Louisiana processing and NGL assets, or PNGL). Our combined midstream assets consist of over 3,300 miles of natural gas gathering and transmission and NGL pipelines, nine natural gas processing plants and three fractionators. Our gathering systems consist of a network of pipelines that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission. Our transmission pipelines primarily receive natural gas from our gathering systems and from third party gathering and transmission systems and deliver natural gas to industrial end-users, utilities and other pipelines. Our processing plants remove NGLs and CO2 from a natural gas stream and our fractionators separate the NGLs into separate NGL products, including ethane, propane, iso-butane and normal butanes and natural gasoline. See Note 14 to the consolidated financial statements for financial information about these operating segments.

Our assets include the following:

Our Business Strategy

Our business strategy consists of three overarching objectives which are to maximize earnings and growth of our existing businesses, to enhance the scale and diversification of our assets and to continue our focus on operational excellence. We believe we were successful in executing our business strategy during 2011, and we will continue to pursue these objectives in 2012.

Maximize earnings and growth of existing businesses. We intend to leverage our franchise position, infrastructure and customer relationships by expanding existing systems to meet new or increased demand for our gathering, transmission, processing and marketing services. For example, we completed two expansion projects in north Texas in the Barnett Shale natural gas play. We added compression and

5

gathering lines at two separate locations increasing capacity by approximately 50 MMcf/d at an aggregate cost of approximately $44.2 million which generated gross operating margin of $17.0 million in 2011 as discussed more fully under "Recent Growth Developments" below.

Enhance scale and diversification of our assets. We look to grow and diversify by acquiring and/or building assets in new areas to serve as a platform for growth with a focus on emerging shale play areas with NGL and crude oil exposure. We expanded our asset scale and diversification during 2011 through our joint investment with Apache Corporation in the Permian Basin, through our equity investment in Howard Energy Partners in the Eagle Ford Shale play in south Texas and by adding crude oil terminals at our south Louisiana facilities. During 2011, we also began work on a project to expand our NGL pipeline system and our fractionation facilities in south Louisiana with construction commencing in 2012 and a planned completion date in mid 2013. These projects and the potential growth from these projects will help to provide additional scale and geographic diversity. All of these projects are discussed more fully under "Recent Growth Developments."

Continue to focus on operational excellence as we execute our business strategy. We have a continued focus on operating our existing asset base to maximize cost efficiencies, provide flexibility for our customers and provide reliable capacity for our customers, while maintaining a high level of safety, environmental integrity, innovation and customer service. We have developed tools to monitor pressures across our systems providing the opportunity to adjust operating modes. This improves reliability, reduces fuel consumption and enhances customer service. We continue to optimize our processing plant performance to improve ethane recovery. We are also in the top quartile of safety performance in the midstream industry due to our systematic focus on safety across the organization.

Recent Growth Developments

North Texas Expansion Projects. We expanded our natural gas gathering system in north Texas with the construction of a $28.3 million, 15-mile pipeline extension to serve major Barnett Shale producers. The project, which is supported by volumetric commitments, commenced operation in March 2011 and provides customers in southwest Tarrant County with greater takeaway capacity to accommodate their transportation requirements. This expansion contributed $9.5 million to our gross operating margin in 2011. Gross operating margin is a non-GAAP financial measure and is discussed under "Item 6. Selected Financial Data-Non-GAAP Financial Measures."

We also entered into a 10-year firm gathering and compression agreement with a major Barnett Shale producer for an additional 50 MMcf/d on our north Texas gathering system. In March 2011, we completed construction of a compressor station at a cost of $15.9 million that increased capacity on an existing gathering line for this additional volume. This expansion contributed $7.5 million to our gross operating margin in 2011.

Permian Basin Apache Joint Investment. We and Apache Corporation jointly have committed to invest $85.0 million in a new-build natural gas processing facility in the Permian Basin in Glasscock County, which we refer to as our Deadwood Plant. Crosstex and Apache have funded the processing project equally and each holds a 50 percent undivided working interest in the assets. We installed a refrigeration plant with a capacity of 20 MMcf per day, and we commenced operation of this facility in February 2012. A cryogenic gas processing facility with a capacity of 50 MMcf/day is under construction and is expected to be operational in June 2012. We are managing the construction of and will operate the processing facilities. The project gives us a footprint for growth in the Permian Basin where we will pursue additional business opportunities.

We also purchased and upgraded a nearby rail terminal and fractionator (which we renamed the Mesquite Terminal) in Midland County to serve initially as a rail terminal for the Deadwood Plant NGL and third party raw-make NGLs. These NGLs will be transported to our Eunice fractionation

6

facility in south central Louisiana for fractionation and sales. We own 100 percent of the terminal and fractionator. The Mesquite Terminal began receiving rawmake NGLs in February 2012 from the Deadwood Plant when we commenced its operation and from another producer via existing NGL pipelines or trucks. We have invested $12.7 million in this project. This facility will provide NGL takeaway for the constrained Permian infrastructure until a long-term pipeline solution becomes available.

Cajun-Sibon NGL expansion. The Cajun-Sibon NGL pipeline expansion will be an extension of our existing 440-mile Cajun-Sibon NGL pipeline that is connected to our fractionation facilities in south central Louisiana. The approximately 130-mile, 12-inch-diameter extension will have an initial capacity of 70,000 Bbls/d of NGLs. It will originate from interconnections to major Mont Belvieu supply pipelines and will provide connectivity for NGLs from the Permian Basin, Mid-Continent, Barnett Shale, Eagle Ford, and Rocky Mountain areas to our NGL fractionation facilities and end-user petrochemical customers in Louisiana. The project also includes the expansion of our Eunice NGL fractionation facilities from 15,000 Bbls/d to 55,000 Bbls/d, which will increase our interconnected fractionation capacity in Louisiana to approximately 97,000 Bbls/d.

We executed a long-term ethane sales agreement with Williams Olefins, a subsidiary of the Williams Companies, which provides us a secure market for ethane generated by our Eunice fractionation facility, the key product in the project. On the supply side, we have equity supply from our Texas gas plants and have received sufficient long-term supply commitments to proceed with the construction of this project. We are negotiating additional long-term commitments for the remaining capacity.

The Cajun-Sibon project expands our strategic footprint of our PNGL assets so we can take advantage of the increasing demand for fractionation and NGL handling as producers pursue the development of liquids-rich natural gas shale plays. The current estimated capital for this project is $230.0 million. We expect the facilities will be operational in the first half of 2013.

Partnership with Howard Energy Partners. In June 2011, we made a strategic equity investment in Howard Energy which provides us with an important growth platform in the rapidly developing Eagle Ford Shale play in south Texas, a new geographic area for us. Howard Energy owns midstream assets and provides midstream and construction services to Eagle Ford Shale producers.

Crosstex and Quanta Services, a leading pipeline construction contractor in the energy industry, each provided an initial capital contribution of $35.0 million for an ownership interest of about 35.0 percent each in Howard Energy. Howard Energy's management team has extensive midstream experience and, together with our experience in large scale and emerging shale developments and Quanta's construction experience, provide the depth and overall ability to develop and execute additional midstream projects in the Eagle Ford.

Crude Oil Terminals. We have modified the rail, truck, pipeline and barge facilities at our Eunice and Riverside fractionators to serve as crude oil terminals, thereby expanding the functionality of these facilities. They are ready to receive 5,000 to 6,000 Bbls/d of crude oil and condensate in aggregate and began receiving deliveries in January 2012 as part of phase one of the project. We are currently in discussions with several potential customers to contract additional crude oil volumes, and these terminal facilities could be expanded. The additional expansion at our Riverside plant could add 8,000 barrels of capacity by the second half of 2012.

These projects enable us to take advantage of the crude pricing differentials in today's market by providing quick access to the premium Louisiana market. Regional infrastructure bottlenecks have created differentials to the markets of Louisiana Gulf Coast crude, Louisiana Light Sweet, which benefits our physical asset position. We earn a volume based fee for providing this terminal service.

7

Our Assets

North Texas Assets. Our gathering systems in north Texas, or NTG, consist of approximately 670 miles of gathering lines that had an average throughput of approximately 773,000 MMBtu/d for the year ended December 31, 2011. Our processing facilities in north Texas include three gas processing plants with total processing throughput that averaged 249,000 MMBtu/d for the year ended December 31, 2011. Our transmission asset, referred to as the North Texas Pipeline, or NTP, consists of a 140-mile pipeline from an area near Fort Worth, Texas to a point near Paris, Texas and related facilities. The NTP connects production from the Barnett Shale to markets in north Texas and to markets accessed by the Natural Gas Pipeline Company, or NGPL, Kinder Morgan, Houston Pipeline, or HPL, Atmos and Gulf Crossing. For the year ended December 31, 2011, the average throughput on the NTP was approximately 352,000 MMBtu/d.

Crosstex LIG Assets. The Crosstex LIG gathering and transmission pipeline system is comprised of a north and south system and had an average throughput of approximately 912,000 MMbtu/d for the year ended December 31, 2011. Our LIG system in the south has a capacity in excess of 1.5 Bcf/d and over 1,000 miles of transmission and gathering lines. The system also includes two operating, on-system processing plants, our Plaquemine and Gibson plants, with an average throughput of 247,000 MMBtu/d for the year ended December 31, 2011. The Plaquemine plant also has a fractionation capacity of 10,800 Bbls/d of liquid products which we plan to connect to our south Louisiana NGL system in 2012. Total volume for fractionated liquids at Plaquemine averaged 2,800 Bbls/d for the year ended December 31, 2011. The south system has access to both rich and lean gas supplies from onshore production in south central and southeast Louisiana. Crosstex LIG has a variety of transportation and industrial sales customers in the south, with the majority of its sales being made into the industrial Mississippi River corridor between Baton Rouge and New Orleans.

Our Crosstex LIG system in the north, comprised of 63 miles of 24" mainline and 9 miles of gathering lateral pipeline, serves the natural gas fields south of Shreveport, Louisiana and extends into the Haynesville Shale gas play in north Louisiana. The north Louisiana system has a capacity of 485 MMcf/d and interconnects with interstate pipelines of ANR Pipeline, Columbia Gulf Transmission, Texas Gas Transmission, Trunkline Gas and Tennessee Gas Pipeline. We have firm transportation agreements for 440 MMcf/d on the north system with weighted average lives of approximately five years. Our north Louisiana system is connected to our south Louisiana system and has the capacity to move approximately 145 MMcf/d of gas to our markets in the south.

PNGL Assets. Our south Louisiana natural gas processing and liquids assets include processing and fractionation capabilities, underground storage and approximately 440 miles of liquids transport lines. Total processing throughput averaged 829,000 MMBtu/d for the year ended December 31, 2011.

8

9

Transco. The plant processed approximately 61,000 MMBtu/d for the year ended December 31, 2011. Offshore volumes supplying this plant have been declining during 2010 and 2011. We are looking for additional offshore supply for this plant. See Note 3(c) of the Notes to Consolidated Financial Statements for further discussion on the Sabine plant.

Industry Overview

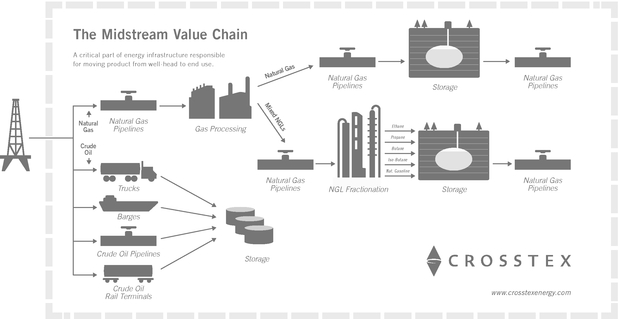

The following diagram illustrates the gathering, processing, fractionation and transmission process.

The midstream natural gas industry is the link between the exploration and production of natural gas and the delivery of its components to end-user markets. The midstream industry is generally characterized by regional competition based on the proximity of gathering systems and processing plants to natural gas producing wells.

Natural gas gathering. The natural gas gathering process follows the drilling of wells into gas-bearing rock formations. After a well has been completed, it is connected to a gathering system. Gathering systems typically consist of a network of small diameter pipelines and, if necessary, compression and treating systems that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission.

Compression. Gathering systems are operated at pressures that will maximize the total natural gas throughput from all connected wells. Because wells produce gas at progressively lower field pressures as they age, it becomes increasingly difficult to deliver the remaining production in the ground against the higher pressure that exists in the connected gathering system. Natural gas compression is a mechanical

10

process in which a volume of gas at an existing pressure is compressed to a desired higher pressure, allowing gas that no longer naturally flows into a higher-pressure downstream pipeline to be brought to market. Field compression is typically used to allow a gathering system to operate at a lower pressure or provide sufficient discharge pressure to deliver gas into a higher-pressure downstream pipeline. The remaining natural gas in the ground will not be produced if field compression is not installed because the gas will be unable to overcome the higher gathering system pressure. In contrast, a declining well can continue delivering natural gas if the field compression is installed.

Natural gas processing. The principal components of natural gas are methane and ethane, but most natural gas also contains varying amounts of heavier NGLs and contaminants, such as water and CO2, sulfur compounds, nitrogen or helium. Natural gas produced by a well may not be suitable for long-haul pipeline transportation or commercial use and may need to be processed to remove the heavier hydrocarbon components and contaminants. Natural gas in commercial distribution systems mostly consists of methane and ethane, and moisture and other contaminants have been removed so there are negligible amounts of them in the gas stream. Natural gas is processed to remove unwanted contaminants that would interfere with pipeline transportation or use of the natural gas and to separate those hydrocarbon liquids from the gas that have higher value as NGLs. The removal and separation of individual hydrocarbons through processing is possible due to differences in weight, boiling point, vapor pressure and other physical characteristics. Natural gas processing involves the separation of natural gas into pipeline-quality natural gas and a mixed NGL stream and the removal of contaminants.

NGL fractionation. NGLs are separated into individual, more valuable components during the fractionation process. NGL fractionation facilities separate mixed NGL streams into discrete NGL products: ethane, propane, isobutane, normal butane, natural gasoline and stabilized condensate. Ethane is primarily used in the petrochemical industry as feedstock for ethylene, one of the basic building blocks for a wide range of plastics and other chemical products. Propane is used as a petrochemical feedstock in the production of ethylene and propylene and as a heating fuel, an engine fuel and industrial fuel. Isobutane is used principally to enhance the octane content of motor gasoline. Normal butane is used as a petrochemical feedstock in the production of ethylene and butylene (a key ingredient in synthetic rubber), as a blend stock for motor gasoline and to derive isobutene through isomerization. Natural gasoline, a mixture of pentanes and heavier hydrocarbons, is used primarily as motor gasoline blend stock or petrochemical feedstock.

Natural gas transmission. Natural gas transmission pipelines receive natural gas from mainline transmission pipelines, processing plants, and gathering systems and deliver it to industrial end-users, utilities and to other pipelines.

Crude oil terminals. Crude oil rail terminals are an integral part of ensuring the movement of new crude oil production from the developing shale plays in the United States and Canada. In general, the crude oil rail unloading terminals are used to unload rail cars, store crude oil volumes for 3rd parties until the oil is re-delivered to premium markets via pipelines, trucks or rail to delivery points.

Balancing Supply and Demand

When we purchase natural gas, we establish a margin normally by selling it for physical delivery to third-party users. We can also use over-the-counter derivative instruments or enter into future delivery obligations under futures contracts on the NYMEX. Through these transactions, we seek to maintain a position that is balanced between purchases, on the one hand, and sales or future delivery obligations, on the other hand. Our policy is not to acquire and hold natural gas futures contracts or derivative products for the purpose of speculating on price changes.

11

Competition

The business of providing gathering, transmission, processing and marketing services for natural gas and NGLs is highly competitive. We face strong competition in obtaining natural gas supplies and in the marketing and transportation of natural gas and NGLs. Our competitors include major integrated and independent E&P oil companies, natural gas producers, interstate and intrastate pipelines and other natural gas gatherers and processors. Competition for natural gas supplies is primarily based on geographic location of facilities in relation to production or markets, the reputation, efficiency and reliability of the gatherer and the pricing arrangements offered by the gatherer. Many of our competitors offer more services or have greater financial resources and access to larger natural gas supplies than we do. Our competition varies in different geographic areas.

In marketing natural gas and NGLs, we have numerous competitors, including marketing affiliates of interstate pipelines, major integrated oil and gas companies, and local and national natural gas producers, gatherers, brokers and marketers of widely varying sizes, financial resources and experience. Local utilities and distributors of natural gas are, in some cases, engaged directly, and through affiliates, in marketing activities that compete with our marketing operations.

We face strong competition for acquisitions and development of new projects from both established and start-up companies. Competition increases the cost to acquire existing facilities or businesses, and results in fewer commitments and lower returns for new pipelines or other development projects. Many of our competitors have greater financial resources or lower cost of capital, or are willing to accept lower returns or greater risks. Our competition differs by region and by the nature of the business or the project involved.

Natural Gas Supply

Our gathering and transmission pipelines have connections with major intrastate and interstate pipelines, which we believe have ample natural gas supplies in excess of the volumes required for the operation of these systems. We evaluate well and reservoir data that is either publicly available or furnished by producers or other service providers in connection with the construction and acquisition of our gathering systems to determine the availability of natural gas supply for the systems and/or obtain a minimum volume commitment from the producer that results in a rate of return on investment. Based on these facts, we believe that there should be adequate natural gas supply to recoup our investment with an adequate rate of return. We do not routinely obtain independent evaluations of reserves dedicated to our systems due to the cost and relatively limited benefit of such evaluations. Accordingly, we do not have estimates of total reserves dedicated to our systems or the anticipated life of such producing reserves.

Credit Risk and Significant Customers

We are diligent in attempting to ensure that we issue credit to only credit-worthy customers. However, our purchase and resale of gas exposes us to significant credit risk, as the margin on any sale is generally a very small percentage of the total sale price. Therefore, a credit loss can be very large relative to our overall profitability.

During the year ended December 31, 2011, we had only one customer, Dow Hydrocarbons & Resources LLC, that represented greater than 10.0% of our revenue. While this customer represented 12.3% of consolidated revenues, the loss of this customer would not have a material impact on our results of operations because the gross operating margins received from transactions with this customer are not material to our total gross operating margin, and we believe the sales to this customer could be replaced with other buyers at comparable sales prices.

12

Regulation

Regulation by FERC of Interstate Natural Gas Pipelines. We do not own any interstate natural gas pipelines, so the Federal Energy Regulatory Commission, or FERC, does not directly regulate our operations under the National Gas Act, or NGA. However, FERC's regulation of interstate natural gas pipelines influences certain aspects of our business and the market for our products. In general, FERC has authority over natural gas companies that provide natural gas pipeline transportation services in interstate commerce and its authority to regulate those services includes:

While we do not own any interstate pipelines, we do transport gas in interstate commerce. The rates, terms and conditions of service under which we transport natural gas in our pipeline systems in interstate commerce are subject to FERC jurisdiction under Section 311 of the Natural Gas Policy Act, or NGPA. In addition, FERC has adopted, or is in the process of adopting, various regulations concerning natural gas market transparency that will apply to some of our pipeline operations. The maximum rates for services provided under Section 311 of the NGPA may not exceed a "fair and equitable rate," as defined in the NGPA. The rates are generally subject to review every three years by FERC or by an appropriate state agency. The inability to obtain approval of rates at acceptable levels could result in refund obligations, the inability to achieve adequate returns on investments in new facilities and the deterrence of future investment or growth of the regulated facilities.

Regulation by FERC of Interstate NGL Pipelines. As of December 31, 2011, we did not own any interstate NGL pipelines. However, as discussed in "Recent Growth Developments," we intend to begin construction in 2012 of an expansion of the Cajun-Sibon NGL pipeline that is connected to our fractionation facilities in south central Louisiana. This expansion is scheduled to be operational in the first half of 2013. Once operational, the expansion will be subject to regulation by FERC as a common carrier under the Interstate Commerce Act, the Energy Policy Act of 1992 and related rules and orders. FERC regulation requires that interstate oil pipeline rates, including rates for transportation of NGLs, be filed with FERC and that these rates be "just and reasonable" and not unduly discriminatory.

Rates of interstate NGL pipelines are currently regulated by FERC primarily through an annual indexing methodology, under which pipelines increase or decrease their rates in accordance with an index adjustment specified by FERC. For the five-year period beginning in 2010, FERC established an annual index adjustment equal to the change in the producer price index for finished goods plus 2.65%. This adjustment is subject to review every five years. Under FERC's regulations, an NGL pipeline can request a rate increase that exceeds the rate obtained through application of the indexing methodology by using a cost-of-service approach, but only after the pipeline establishes that a substantial divergence exists between the actual costs experienced by the pipeline and the rates resulting from application of the indexing methodology.

The Interstate Commerce Act permits interested persons to challenge proposed new or changed rates and authorizes FERC to suspend the effectiveness of such rates for up to seven months and investigate such rates. If, upon completion of an investigation, FERC finds that the new or changed rate is unlawful, it is authorized to require the pipeline to refund revenues collected in excess of the just and reasonable rate during the term of the investigation. The just and reasonable rate used to calculate refunds cannot be lower than the last tariff rate approved as just and reasonable. FERC may

13

also investigate, upon complaint or on its own motion, rates that are already in effect and may order a carrier to change its rates prospectively. Upon an appropriate showing, a shipper may obtain reparations for charges in excess of a just and reasonable rate for a period of up to two years prior to the filing of a complaint.

Intrastate Pipeline Regulation. Our intrastate natural gas pipeline operations are subject to regulation by various agencies of the states in which they are located. Most states have agencies that possess the authority to review and authorize natural gas transportation transactions and the construction, acquisition, abandonment and interconnection of physical facilities. Some states also have state agencies that regulate transportation rates, service terms and conditions and contract pricing to ensure their reasonableness and to ensure that the intrastate pipeline companies that they regulate do not discriminate among similarly situated customers.

Gathering Pipeline Regulation. Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of FERC under the NGA. We own a number of natural gas pipelines that we believe meet the traditional tests FERC has used to establish a pipeline's status as a gatherer not subject to FERC jurisdiction. State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements, and in some instances complaint-based rate regulation.

We are subject to some state ratable take and common purchaser statutes. The ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes generally require gatherers to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply.

Sales of Natural Gas. The price at which we sell natural gas currently is not subject to federal regulation and, for the most part, is not subject to state regulation. Our natural gas sales are affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation. FERC is continually proposing and implementing new rules and regulations affecting those segments of the natural gas industry, most notably interstate natural gas transmission companies that remain subject to FERC's jurisdiction. These initiatives also may affect the intrastate transportation of natural gas under certain circumstances. We cannot predict the ultimate impact of these regulatory changes on our natural gas marketing operations, but we do not believe that we will be affected by any such FERC action in a manner that is materially different from the natural gas marketers with whom we compete.

Environmental Matters

General. Our operation of processing and fractionation plants, pipelines and associated facilities in connection with the gathering and processing natural gas and the transportation, fractionation and storage of NGLs is subject to stringent and complex federal, state and local laws and regulations relating to release of hazardous substances or wastes into the environment or otherwise relating to protection of the environment. As with the industry generally, compliance with existing and anticipated environmental laws and regulations increases our overall costs of doing business, including costs of planning, constructing, and operating plants, pipelines, and other facilities. Included in our construction and operation costs are capital cost items necessary to maintain or upgrade equipment and facilities. Similar costs are likely upon changes in laws or regulations and upon any future acquisition of operating assets.

Any failure to comply with applicable environmental laws and regulations, including those relating to equipment failures and obtaining required governmental approvals, may result in the assessment of administrative, civil or criminal penalties, imposition of investigatory or remedial activities and, in less

14

common circumstances, issuance of injunctions or construction bans or delays. We believe that we currently hold all material governmental approvals required to operate our major facilities. As part of the regular evaluation of our operations, we routinely review and update governmental approvals as necessary. We believe that our operations and facilities are in substantial compliance with applicable environmental laws and regulations and that the cost of compliance with such laws and regulations currently in effect will not have a material adverse effect on our operating results or financial condition.

The clear trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment, and thus there can be no assurance as to the amount or timing of future expenditures for environmental compliance or remediation, and actual future expenditures may be different from the amounts we currently anticipate. Moreover, risks of process upsets, accidental releases or spills are associated with our possible future operations, and we cannot assure you that we will not incur significant costs and liabilities, including those relating to claims for damage to property and persons as a result of any such upsets, releases, or spills. In the event of future increases in environmental costs, we may be unable to pass on those cost increases to our customers. A discharge of hazardous substances or wastes into the environment could, to the extent losses related to the event are not insured, subject us to substantial expense, including both the cost to comply with applicable laws and regulations and to pay fines or penalties that may be assessed and the cost related to claims made by neighboring landowners and other third parties for personal injury or damage to natural resources or property. We will attempt to anticipate future regulatory requirements that might be imposed and plan accordingly to comply with changing environmental laws and regulations and to minimize costs with respect to more stringent future laws and regulations or more rigorous enforcement of existing laws and regulations.

Hazardous Substances and Waste. To a large extent, the environmental laws and regulations affecting our operations relate to the release of hazardous substances or solid wastes into soils, groundwater and surface water, and include measures to prevent and control pollution. These laws and regulations generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous wastes, and may require investigatory and corrective actions at facilities where such waste may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, also known as the "Superfund" law, and comparable state laws, impose liability without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to a release of "hazardous substance" into the environment. Potentially liable persons include the owner or operator of the site where a release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some cases, third parties to take actions in response to threats to the public health or the environment and to seek to recover from the potentially responsible classes of persons the costs they incur. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other wastes released into the environment. Although "petroleum" as well as natural gas and NGLs are excluded from CERCLA's definition of a "hazardous substance," in the course of ordinary operations, we may generate wastes that may fall within the definition of a "hazardous substance." In addition, there are other laws and regulations that can create liability for releases of petroleum, natural gas or NGLs. Moreover, we may be responsible under CERCLA or other laws for all or part of the costs required to clean up sites at which such wastes have been disposed. We have not received any notification that we may be potentially responsible for cleanup costs under CERCLA or any analogous federal or state laws.

We also generate, and may in the future generate, both hazardous and nonhazardous solid wastes that are subject to requirements of the federal Resource Conservation and Recovery Act, or RCRA,

15

and/or comparable state statutes. From time to time, the Environmental Protection Agency, or EPA, and state regulatory agencies have considered the adoption of stricter disposal standards for nonhazardous wastes, including crude oil and natural gas wastes. Moreover, it is possible that some wastes generated by us that are currently considered as nonhazardous may in the future be designated as "hazardous wastes," resulting in the wastes being subject to more rigorous and costly management and disposal requirements. Changes in applicable laws or regulations may result in an increase in our capital expenditures or plant operating expenses or otherwise impose limits or restrictions on our production and operations.

We currently own or lease, and have in the past owned or leased, and in the future we may own or lease, properties that have been used over the years for natural gas gathering, treating or processing and for NGL fractionation, transportation or storage. Solid waste disposal practices within the NGL industry and other oil and natural gas related industries have improved over the years with the passage and implementation of various environmental laws and regulations. Nevertheless, some hydrocarbons and other solid wastes have been disposed of on or under various properties owned or leased by us during the operating history of those facilities. In addition, a number of these properties may have been operated by third parties over whom we had no control as to such entities' handling of hydrocarbons or other wastes and the manner in which such substances may have been disposed of or released. These properties and wastes disposed thereon may be subject to CERCLA, RCRA, and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes or property contamination if present, including groundwater contamination, or to take action to prevent future contamination.

Air Emissions. Our current and future operations are subject to the federal Clean Air Act and comparable state laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including our facilities, and impose various controls together with monitoring and reporting requirements. Pursuant to these laws and regulations, we may be required to obtain environmental agency pre-approval for the construction or modification of certain projects or facilities expected to produce air emissions or result in an increase in existing air emissions, obtain and comply with the terms of air permits, which include various emission and operational limitations, or use specific emission control technologies to limit emissions. We likely will be required to incur certain capital expenditures in the future for air pollution control equipment in connection with maintaining or obtaining governmental approvals addressing air-emission related issues. Failure to comply with applicable air statutes or regulations may lead to the assessment of administrative, civil or criminal penalties, and may result in the limitation or cessation of construction or operation of certain air emission sources. Although we can give no assurances, we believe such requirements will not have a material adverse effect on our financial condition or operating results, and the requirements are not expected to be more burdensome to us than any similarly situated company.

Air emissions associated with operations in the Barnett Shale area have come under recent scrutiny. In 2010 and 2011, the Texas Commission on Environmental Quality (TCEQ) conducted comprehensive monitoring of air emissions in the Barnett Shale area, in response to public concerns about high concentrations of benzene and other potential emissions in the air near drilling sites and natural gas processing facilities. In addition, environmental groups have advocated increased regulation in the Barnett Shale area and these groups as well as at least one state representative further advocated a moratorium on permits for new gas wells until TCEQ completes its analysis. Also, the EPA entered into a settlement in 2010 that required it to reevaluate regulations for the control of air emissions from the oil and natural gas industry. As a result, the EPA proposed regulations in July 2011, which are currently pending adoption, that would establish new air pollution standards for the oil and natural gas industry, including new source performance standards for volatile organic compounds and sulfur dioxide and an air toxics standard for oil and natural gas production and for natural gas transmission and storage. Changes in laws or regulations imposing emission limitations, pollution

16

control technology requirements or other regulatory requirements or any restriction on permitting of natural gas production facilities in the Barnett Shale area could have an adverse effect on our business.

Climate Change. In response to concerns suggesting that emissions of certain gases, commonly referred to as "greenhouse gases" (including carbon dioxide and methane), may be contributing to warming of the earth's atmosphere, EPA is taking steps that would result in the regulation of greenhouse gases as pollutants under the federal Clean Air Act.

In October 2009, EPA promulgated its Mandatory Reporting Rule for greenhouse gases, which requires the monitoring and reporting of greenhouse gas emissions on an annual basis. All of our facilities operating combustion sources, such as engines, or natural gas fractionation facilities are subject to the greenhouse gas reporting requirements included in the October 2009 final rule. The first annual greenhouse gas emissions inventory for Crosstex affected facilities was filed by Crosstex in September 2011. In November 2010 and further in December 2011, EPA expanded the scope of the Mandatory Reporting Rule to include petroleum and natural gas pipeline systems, which applies the Mandatory Reporting Rule's requirements to, among other sources, fugitive and vented methane emissions from the oil and gas sector, including natural gas transmission compression. Our transmission compression facilities as well as gathering compressor stations with large amine treating capacities are now required to report under this expanded rule, with the first report due to the EPA on September 28, 2012. Although the Mandatory Reporting Rule does not control greenhouse gas emission levels from any facilities, it has still caused us to incur monitoring and reporting costs for emissions that are subject to the rule. Further, the rule's new requirements for reporting of fugitive and vented methane emissions from the oil and gas industry can be expected to increase our monitoring and reporting costs from here on forward.

After a series of regulatory actions finalized by EPA between December 2009 and May 2010, greenhouse gases became pollutants "subject to regulation" under the Clean Air Act's Prevention of Significant Deterioration (PSD) air quality permit program for stationary sources, and the largest of these sources have also become subject to permitting requirements under the Clean Air Act's Title V permitting program. As a result, new major stationary sources of greenhouse gas emissions, and modifications of existing major stationary sources that significantly increase their greenhouse gas emissions will require a permit setting forth Best Available Control Technology (BACT) for those emissions. EPA has, through its "Tailoring Rule," acted to limit these permitting requirements to only the largest sources of greenhouse gas emissions initially, but these new requirements could in the future affect our operations and our ability to obtain air permits for new or modified facilities.

The U.S. Congress has also considered legislation to mandate reductions of greenhouse gas emissions, and almost half of the states, either individually or through multi-state regional initiatives, have already taken legal measures intended to reduce greenhouse gas emissions, primarily through the planned development of greenhouse gas emission inventories and/or greenhouse gas cap and trade programs.

Because regulation of Green House Gas ("GHG") emissions is relatively new, further regulatory, legislative and judicial developments are likely to occur. Such developments may affect how these GHG initiatives will impact us. In addition to these regulatory developments, recent judicial decisions have allowed certain tort claims alleging property damage to proceed against GHG emissions sources may increase our litigation risk for such claims. Due to the uncertainties surrounding the regulation of and other risks associated with GHG emissions, we cannot predict the financial impact of related developments on us.

Federal or state legislative or regulatory initiatives that regulate or restrict emissions of greenhouse gases in areas in which we conduct business could adversely affect the demand for the products we store, transport, and process, and depending on the particular program adopted could increase the costs of our operations, including costs to operate and maintain our facilities, install new emission controls on our facilities, acquire allowances to authorize our greenhouse gas emissions, pay any taxes

17

related to our greenhouse gas emissions and/or administer and manage a greenhouse gas emissions program. We may be unable to recover any such lost revenues or increased costs in the rates we charge our customers, and any such recovery may depend on events beyond our control, including the outcome of future rate proceedings before the FERC or state regulatory agencies and the provisions of any final legislation or regulations. Reductions in our revenues or increases in our expenses as a result of climate control initiatives could have adverse effects on our business, financial position, results of operations and prospects.

Certain scientific studies on climate change suggest that stronger storms may occur in the future in certain of the areas in which we operate, although the scientific studies are not unanimous. Due to their location, our operations along the Gulf Coast are vulnerable to operational and structural damages resulting from hurricanes and other severe weather systems and our insurance may not cover all associated losses. We are taking steps to mitigate physical risks from storms, but no assurance can be given that future storms will not have a material adverse effect on our business.

Clean Water Act. The Federal Water Pollution Control Act, also known as the Clean Water Act, and comparable state laws impose restrictions and strict controls regarding the discharge of pollutants, including natural gas liquid related wastes, into state waters or waters of the United States. Regulations promulgated pursuant to these laws require that entities that discharge into federal and state waters obtain National Pollutant Discharge Elimination System, or NPDES, and/or state permits authorizing these discharges. The Clean Water Act and analogous state laws assess administrative, civil and criminal penalties for discharges of unauthorized pollutants into the water and impose substantial liability for the costs of removing spills from such waters. In addition, the Clean Water Act and analogous state laws require that individual permits or coverage under general permits be obtained by covered facilities for discharges of storm water runoff. We believe that we are in substantial compliance with Clean Water Act permitting requirements as well as the conditions imposed thereunder, and that continued compliance with such existing permit conditions will not have a material effect on our results of operations.

It is customary to recover natural gas from deep shale formations through the use of hydraulic fracturing, combined with sophisticated horizontal drilling. Hydraulic fracturing is an important and commonly used process in the completion of wells by our customers. Hydraulic fracturing involves the injection of water, sand and chemical additives under pressure into rock formations to stimulate gas production. Due to public concerns raised regarding potential impacts of hydraulic fracturing on groundwater quality, legislative and regulatory efforts at the federal level and in some states have been initiated to require or make more stringent the permitting and other regulatory requirements for hydraulic fracturing operations. At the federal level, the U.S. Congress has introduced legislation that would amend the federal Safe Drinking Water Act to subject hydraulic fracturing operations to regulation under that Act and to require the disclosure of chemicals used by the oil and gas industry in the hydraulic fracturing process. As support for the chemical disclosure requirements included in the legislation, sponsors of the legislation asserted that chemicals used in the fracturing process could adversely affect drinking water supplies. Disclosure of chemicals used in the fracturing process could make it easier for third parties opposing hydraulic fracturing to initiate legal proceedings against producers and service providers based on allegations that specific chemicals used in the fracturing process could adversely affect groundwater. If adopted, this or other similar legislation could establish an additional level of regulation and permitting of hydraulic fracturing operations at the federal level, which could lead to operational delays, increased operating costs and additional regulatory burdens that could make it more difficult for our customers to perform hydraulic fracturing. In addition, during the first quarter of 2010, the EPA initiated a detailed scientific study of hydraulic fracturing and its potential impacts on surface and ground waters. The initial study results are expected to be available in late 2012. In early 2010, EPA also indicated in a website posting that it intended to regulate hydraulic fracturing under the Safe Drinking Water Act and require permitting for any well where hydraulic fracturing was conducted with the use of diesel as an additive. While industry groups have challenged

18

EPA's website posting as improper rulemaking, the Agency's position, if upheld could require additional permitting and could lead to operations delays, increased costs and regulatory burdens that could make it more difficult for our customers to perform hydraulic fracturing. State and local governments have also considered proposed regulations addressing public concerns related to hydraulic fracturing operations. Some state and local governments in regions where shale development is underway have considered or imposed moratoriums on drilling operations using hydraulic fracturing until further study of the potential environmental and human health impacts by EPA or the relative state agencies are completed. Any increased federal, state or local regulation could reduce the volumes of natural gas that our customers move through our gathering systems which would materially adversely affect our revenues and results of operations.

Employee Safety. We are subject to the requirements of the Occupational Safety and Health Act, referred to as OSHA, and comparable state laws that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We believe that our operations are in substantial compliance with the OSHA requirements, including general industry standards, record keeping requirements, and monitoring of occupational exposure to regulated substances.

DOT Safety Regulations. Our pipelines are subject to regulation by the U.S. Department of Transportation (DOT). DOT's Pipeline Hazardous Material Safety Administration (PHMSA), acting through the Office of Pipeline Safety (OPS), administers the national regulatory program to assure the safe transportation of natural gas, petroleum, and other hazardous materials by pipeline. OPS develops regulations and other approaches to risk management to assure safety in design, construction, testing, operation, maintenance, and emergency response of pipeline facilities. These safety regulations are listed under 49 CFR, Parts 192 and 195. Pipelines that transport natural gas are governed under 49 CFR 192. Pipelines that transport crude oil, carbon dioxide, NGL and petroleum products are governed under 49 CFR 195. PHMSA requires any entity which owns or operates pipeline facilities to comply with the regulations under these and referenced regulations, regarding access to and allow copying of records, and to make certain reports and provide information as required by the Secretary of Transportation. The Pipeline Integrity Management in High Consequence Areas, amendments to 49 CFR Part 192 and 195 (PIM) requires operators of transmission pipelines to ensure the integrity of their pipelines through hydrostatic pressure testing, the use of in-line inspection tools or through risk-based direct assessment techniques. On December 13, 2011, the Senate passed, and on January 3, 2012, the President signed into law, H.R. 2845, "Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011," which increases potential penalties for pipeline safety violations, gives new rulemaking authority to the DOT with respect to shut-off valves on transmission pipeline facilities constructed or entirely replaced after the rule is promulgated, requires DOT to revise incident notification guidance, and imposes new records requirements on pipeline owners and operators. The new legislation also requires the DOT to study and report to Congress on other areas of pipeline safety, including expanding the reach of the integrity management regulations beyond high consequences areas, but restricts DOT from promulgating expanded integrity management rules during the review period and for a period following submittal of its report to Congress unless the rulemaking is needed to address a present condition that poses a risk to public safety, property, or the environment. In addition to federal regulations, the Railroad Commission of Texas, or TRRC, regulates our pipelines in Texas under its own pipeline safety regulations, including integrity management rules. We believe that our pipeline operations are in substantial compliance with applicable PHMSA and TRRC requirements; however, due to the possibility of new or amended laws and regulations or reinterpretation of existing laws and regulations, there can be no assurance that future compliance with the PHMSA or TRRC requirements will not have a material adverse effect on our results of operations or financial positions.

19

Office Facilities

We occupy approximately 95,400 square feet of space at our executive offices in Dallas, Texas under a lease expiring in June 2014, and approximately 25,100 square feet of office space for our Louisiana operations in Houston, Texas with lease terms expiring in April 2023. We have approximately 17,000 square feet of office space in Fort Worth, Texas with lease terms expiring in April 2013 and currently have this space sub-leased to other tenants.

Employees

As of December 31, 2011, we (through our subsidiaries) employed approximately 494 full-time employees. Approximately 179 of our employees were general and administrative, engineering, accounting and commercial personnel and the remainder were operational employees. We are not party to any collective bargaining agreements, and we have not had any significant labor disputes in the past. We believe that we have good relations with our employees.

The following risk factors and all other information contained in this report should be considered carefully when evaluating us. These risk factors could affect our actual results. Other risks and uncertainties, in addition to those that are described below, may also impair our business operations. If any of the following risks occur, our business, financial condition or results of operations could be affected materially and adversely. In that case, we may be unable to make distributions to our unitholders and the trading price of our common unit could decline. These risk factors should be read in conjunction with the other detailed information concerning us set forth in our accompanying financial statements and notes and contained in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" included herein.

Risks Inherent In Our Business

Our profitability is dependent upon prices and market demand for natural gas and NGLs, which are beyond our control and have been volatile.

We are subject to significant risks due to fluctuations in commodity prices. We are directly exposed to these risks primarily in the gas processing component of our business. For the year ended December 31, 2011 approximately 10.7% of our total gross operating margin was generated under percent of liquids (POL) contracts. Under these contracts we receive a fee in the form of a percentage of the liquids recovered and the producer bears all the cost of the natural gas shrink. Accordingly, our revenues under these contracts are directly impacted by the market price of NGLs.

We also realize processing gross operating margins under processing margin (margin) contracts. For the year ended December 31, 2011 approximately 19.3% of our total gross operating margin was generated under processing margin contracts. We have a number of processing margin contracts with our Plaquemine, Gibson, Eunice, Bluewater, and Pelican processing plants. Under this type of contract, we pay the producer for the full amount of inlet gas to the plant, and we make a margin based on the difference between the value of liquids recovered from the processed natural gas as compared to the value of the natural gas volumes lost ("shrink") and the cost of fuel used in processing. The shrink and fuel losses are referred to as plant thermal reduction or PTR. Our margins from these contracts can be greatly reduced or eliminated during periods of high natural gas prices relative to liquids prices.

We are also indirectly exposed to commodity prices due to the negative impacts on production and the development of production of natural gas and NGLs connected to or near our assets and on our margins for transportation between certain market centers. Low prices for these products will reduce the demand for our services and volumes on our systems.

20

In the past, the prices of natural gas and NGLs have been extremely volatile and we expect this volatility to continue. For example, prices of natural gas in 2011 were below the market price realized throughout most of 2010 while prices for oil and NGLs were higher than 2010 market prices. Crude oil prices (based on the New York Mercantile Exchange (the "NYMEX") futures daily close prices for the prompt month) in 2011 ranged from a low of $75.67 per Bbl in October 2011 to a high of $113.93 per Bbl in April 2011. Weighted average NGL prices in 2011 (based on the Oil Price Information Service (OPIS) Napoleonville daily average spot liquids prices) ranged from a low of $0.99 per gallon in February 2011 to a high of $1.35 per gallon in May 2011. Natural gas prices (based on Gas Daily Henry Hub closing prices) during 2011 ranged from a high of $4.92 per MMBtu in June 2011 to a low of $2.79 per MMBtu in November 2011.

The markets and prices for natural gas and NGLs depend upon factors beyond our control. These factors include the supply and demand for oil, natural gas and NGLs, which fluctuate with changes in market and economic conditions and other factors, including:

Changes in commodity prices may also indirectly impact our profitability by influencing drilling activity and well operations, and thus the volume of gas we gather and process. The volatility in commodity prices may cause our gross operating margin and cash flows to vary widely from period to period. Our hedging strategies may not be sufficient to offset price volatility risk and, in any event, do not cover all of our throughput volumes. Moreover, hedges are subject to inherent risks, which we describe in "Item 7A. Quantitative and Qualitative Disclosure about Market Risk." Our use of derivative financial instruments does not eliminate our exposure to fluctuations in commodity prices and interest rates and has in the past and could in the future result in financial losses or reduce our income. For a discussion of our risk management activities, please read "Item 7A. Quantitative and Qualitative Disclosure about Market Risk."

Our substantial indebtedness could limit our flexibility and adversely affect our financial health.

We have a substantial amount of indebtedness. As of December 31, 2011, we had approximately $713.4 million of indebtedness outstanding primarily comprised of $725.0 million (including $11.6 million of original issue discount) of senior unsecured notes. As of December 31, 2011, there was $85.0 million of borrowing and $69.0 million in outstanding letters of credit, under the bank credit

21

facility leaving approximately $331.0 million available for future borrowing based on a borrowing capacity of $485.0 million. Based on the January amendment to increase the credit facility borrowing capacity to $635.0 million and borrowings outstanding as of December 31, 2011, the Partnership's available borrowing would be $481.0 million.

Our substantial indebtedness could limit our flexibility and adversely affect our financial health. For example, it could:

In addition, our ability to make scheduled payments or to refinance our obligations depends on our successful financial and operating performance. We cannot assure you that our operating performance will generate sufficient cash flow or that our capital resources will be sufficient for payment of our debt obligations in the future. Our financial and operating performance, cash flow and capital resources depend upon prevailing economic conditions and certain financial, business and other factors, many of which are beyond our control.

If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to sell material assets or operations, obtain additional capital or restructure our debt. In the event that we are required to dispose of material assets or operations or restructure our debt to meet our debt service and other obligations, we cannot assure you as to the terms of any such transaction or how quickly any such transaction could be completed, if at all.

We may not be able to access new capital to fund our acquisition and growth strategies which could impair our ability to fund future capital needs and to grow.

Global financial markets and economic conditions have been disrupted and volatile over the past several years. These conditions and current weak world economic conditions have made, and could in the future make, it difficult to obtain funding for our capital needs. As a result, the cost of raising money in the debt and equity capital markets could increase substantially while the availability of funds from those markets could diminish significantly. Due to these factors, we cannot be certain that new debt or equity financing will be available to us on acceptable terms or at all. Without adequate funding, we may be unable to execute our growth strategy, complete future acquisitions or future construction projects or other capital expenditures, take advantage of other business opportunities or respond to competitive pressures, any of which could have a material adverse effect on our revenues and results of operations. Further, our customers may increase collateral requirements from us, including letters of credit which reduce available borrowing capacity, or reduce the business they transact with us to reduce their credit exposure to us.

Due to our lack of asset diversification, adverse developments in our gathering, transmission, processing and NGL services businesses would materially impact our financial condition.

We rely exclusively on the revenues generated from our gathering, transmission, processing, crude terminal and NGL services businesses and as a result our financial condition depends upon prices of, and continued demand for, natural gas and NGLs. Due to our lack of asset diversification, an adverse

22

development in one of these businesses would have a significantly greater impact on our financial condition and results of operations than if we maintained more diverse assets.

We may not be successful in balancing our purchases and sales.

We are a party to certain long-term gas sales commitments that we satisfy through supplies purchased under long-term gas purchase agreements. When we enter into those arrangements, our sales obligations generally match our purchase obligations. However, over time the supplies that we have under contract may decline due to reduced drilling or other causes and we may be required to satisfy the sales obligations by buying additional gas at prices that may exceed the prices received under the sales commitments. In addition, a producer could fail to deliver contracted volumes or deliver in excess of contracted volumes, or a consumer could purchase more or less than contracted volumes. Any of these actions could cause our purchases and sales not to be balanced. If our purchases and sales are not balanced, we will face increased exposure to commodity price risks and could have increased volatility in our operating income.

We have made commitments to purchase natural gas in production areas based on production-area indices and to sell the natural gas into market areas based on market-area indices, pay the costs to transport the natural gas between the two points and capture the difference between the indices as margin. Changes in the index prices relative to each other (also referred to as basis spread) can significantly affect our margins or even result in losses. For example, we are a party to one contract with a term to 2019 to supply approximately 150,000 MMBtu/day of gas. We buy gas for this contract on several different production-area indices on our NTP and sell the gas into a different market area index. For the year ended December 31, 2011 we have recorded a loss of approximately $13.3 million on this contract, and we currently expect that we will record a loss of approximately $13.0 million to $17.0 million on this contract in 2012. Reduced supplies and narrower basis spreads in recent periods have increased the losses on this contract, and greater losses on this contract could occur in future periods if these conditions persist or become worse. For additional information on this contract, please see "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Overview."

We must continually compete for natural gas supplies, and any decrease in our supplies of natural gas could adversely affect our financial condition and results of operations.

Our gathering systems are connected to natural gas wells from which production will naturally decline over time, which means that its cash flows associated with these sources of natural gas will likely also decline over time. In order to maintain or increase throughput levels in our natural gas gathering systems and asset utilization rates at our processing plants and to fulfill our current sales commitments, we must continually contract for new natural gas supplies. We may not be able to obtain additional contracts for natural gas supplies. The primary factors affecting our ability to connect new wells to our gathering facilities include our success in contracting for existing natural gas supplies that are not committed to other systems and the level of drilling activity near our gathering systems. If we are unable to maintain or increase the throughput on our systems by accessing new natural gas supplies to offset the natural decline in reserves, our business and financial results could be materially, adversely affected. In addition, our future growth will depend in part upon whether we can contract for additional supplies at a greater rate than the rate of natural decline in our currently connected supplies.

Fluctuations in energy prices can greatly affect production rates and investments by third parties in the development of new oil and natural gas reserves. Natural gas prices were relatively low in 2011 and continue to be depressed. Prolonged periods of low natural gas prices may put downward pressure on future drilling activity which may result in lower volumes. Tax policy changes or additional regulatory restrictions on development could also have a negative impact on drilling activity, reducing supplies of

23

natural gas available to our systems. Additional governmental regulation of, or delays in issuance of permits for, the offshore exploration and production industry may negatively impact current and future volumes from offshore pipelines supplying our processing plants. We have no control over producers and depend on them to maintain sufficient levels of drilling activity. A material decrease in natural gas production or in the level of drilling activity in our principal geographic areas for a prolonged period, as a result of depressed commodity prices or otherwise, likely would have a material adverse effect on our results of operations and financial position.

A substantial portion of our assets is connected to natural gas reserves that will decline over time, and the cash flows associated with those assets will decline accordingly.

A substantial portion of our assets, including our gathering systems, is dedicated to certain natural gas reserves and wells for which the production will naturally decline over time. Accordingly, our cash flows associated with these assets will also decline. If we are unable to access new supplies of natural gas either by connecting additional reserves to our existing assets or by constructing or acquiring new assets that have access to additional natural gas reserves, our cash flows may decline.

We are vulnerable to operational, regulatory and other risks due to our concentration of assets in south Louisiana and the Gulf of Mexico, including the effects of adverse weather conditions such as hurricanes.

Our operations and revenues will be significantly impacted by conditions in south Louisiana and the Gulf of Mexico because we have a significant portion of our assets located in these two areas. Our concentration of activity in Louisiana and the Gulf of Mexico makes us more vulnerable than many of our competitors to the risks associated with these areas, including:

Because a significant portion of our operations could experience the same condition at the same time, these conditions could have a relatively greater impact on our results of operations than they might have on other midstream companies who have operations in more diversified geographic areas.

Our use of derivative financial instruments does not eliminate our exposure to fluctuations in commodity prices and interest rates and has in the past and could in the future result in financial losses or reduce our income.